CNB Bitcoin Test Portfolio November 2025: Smart Money’s Crypto Moves Revealed

Wall Street's playing catch-up—again. While traditional finance debates Bitcoin's 'store of value' narrative, CNB's test portfolio shows traders stacking sats like there's no tomorrow.

Here's what's hot in the whale wallets:

• MicroStrategy 2.0 plays: Institutions quietly replicating the HODL playbook

• DeFi bluechips: Ethereum killers aren't killing ETH—liquidity stays put

• Miner capitulation buys: Vultures circling at $40K BTC

Funny how the same banks questioning crypto's volatility are first in line for the OTC desk. Just don't call it FOMO when their quarterly reports show 'digital asset exposure.'

The Where’s and Why’s of the Czech Bitcoin Portfolio

The CNB listed four Core reasons for creating the $1M test portfolio:

- Gain practical, hands-on experience with purchasing, holding, settling, accounting for, auditing, and securing blockchain-based assets, including key management, multi-level approvals, crisis drills, and AML/KYC checks.

- Evaluate Bitcoin specifically from a central bank perspective and assess its potential role in future reserve diversification, while keeping the pilot ring-fenced from official reserves.

- Explore the future of payments and asset tokenization by comparing BTC, a USD stablecoin, and a tokenized deposit, and test how these instruments can be used and settled in operations.

- Build and transfer internal expertise across teams and publish learnings over 2–3 years, without increasing the portfolio size beyond the initial $1M during the pilot period.

What Traders Are Buying as Crypto Treasuries Arrive in Europe

As governments build their treasuries with leading cryptos, retail traders also have a variety of options to choose from. A micro-scale wallet can also be profitable if you choose wisely. So what are today’s picks for an investor’s portfolio? Let’s start with something close to Bitcoin, and then diversify.

Bitcoin Hyper: L2 That Goes With a Bang

is a Layer-2 solution for Bitcoin, and as such, is related to the major crypto. While it won’t appeal to authorities, it certainly has its merits for developers and minor traders. It opens the way to dApps, memecoins, faster and cheaper transactions, and all this with Bitcoin-like security level.

And it’s not only retail investors who come to realize this. $HYPER is attracting whale buys to a surprising extent: the last 12 hours saw a major buy of almost $500,000, as evidenced on Etherscan. That said, the BTC Hyper presale has surpassed $27.5M and counting, but there’s still a chance to jump on that bandwagon – good news for those who have just discovered they want to buy bitcoin Hyper after all..

Hedera’s Liquidity Lift: WBTC Live, USDC Rising, EU Ramps Opening

Today’s bull case for Hedera centers on fresh utility catalysts, enterprise-grade economics, and improving fiat/stablecoin rails that can translate into sustained on-chain demand.

Wrapped Bitcoin (WBTC) just launched on Hedera, piping BTC liquidity into Hedera DeFi and widening collateral options for lending, trading, and yield – an immediate TVL and activity tailwind if integrations stick.

Secondly, stablecoin momentum is accelerating: USDC supply on Hedera has surged in recent months, and payments/on-ramp tooling keeps improving, which historically correlates with higher transaction counts and stickier liquidity.

With reference to the above, MiCA’s rulebook plus ESMA centralization are accelerating compliant ramps (Aave, Revolut) and shifting activity toward regulated issuers and venues, making stablecoins a more credible payments and settlement rail in the EU. As the stablecoin landscape is becoming more favourable, Hedera, with its price of $0.1545, sounds like a viable option for retail traders.

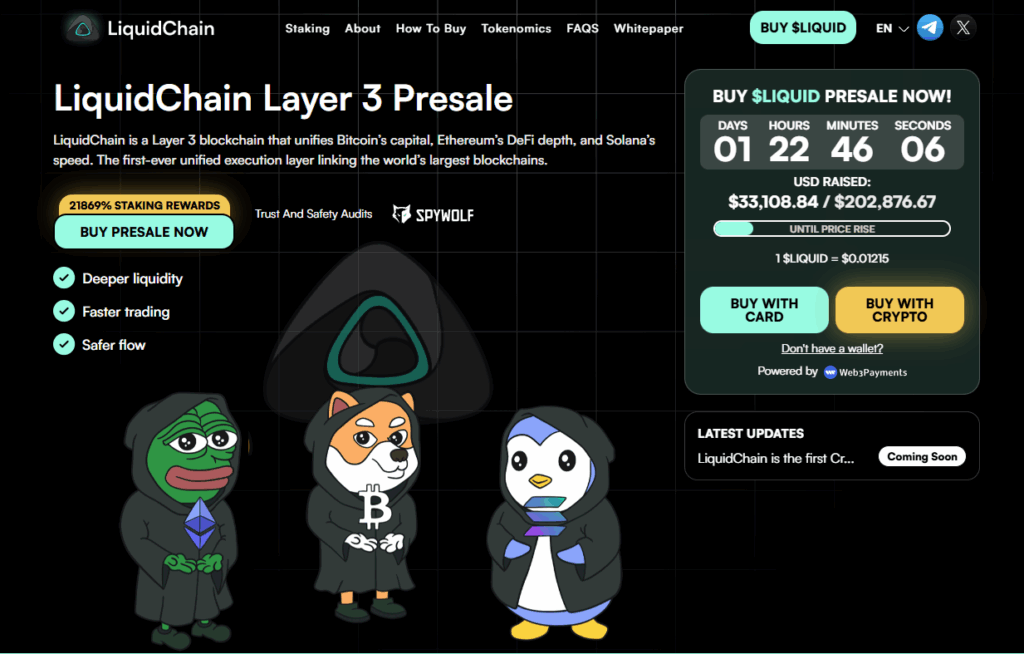

LiquidChain: When Layer 2 Is Not Enough, Enter Layer 3

Layer-2 solutions have hardly made their way to the crypto market, when Layer 3 is already on the go.offers even faster and cheaper transactions – it poses as a unifying layer that connects major chains and their liquidity.

As such, it is bridging Bitcoin, Ethereum, and solana so assets and apps can interact across what are currently siloed ecosystems. It promises immediate access to combined liquidity pools from multiple chains to enable deeper liquidity, faster execution, and better pricing for trades and DeFi activity.

Since this is a baby token – the presale has recently gone live – we are yet to discover its full potential. As it is, our three contenders for today share a similar profile: all of them aim at improving user experience.

Bitcoin Hyper’s whale-fueled presale momentum, Hedera’s growing liquidity from WBTC and stablecoin rails, and LiquidChain’s cross-chain liquidity vision together signal how retail, enterprise, and interoperability narratives are converging, just as the Czech National Bank’s $1M Bitcoin pilot underscores the shift from theory to institutional experimentation.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()