Political Stability Fuels Crypto Rally: Markets Surge as Washington Finds Its Footing

Bitcoin leads charge as digital assets rebound on renewed institutional confidence.

After weeks of regulatory uncertainty, crypto markets breathe easy—proving once again that decentralization thrives on centralized stability. Traders pile in as Washington gridlock breaks, with altcoins posting double-digit gains.

Ethereum outperforms, climbing 18% as DeFi protocols react faster than Congress ever could. Memecoins—ever the contrarian indicators—lag behind, suggesting this rally might actually have legs.

Wall Street analysts scramble to revise Q4 forecasts, because nothing says 'serious investment thesis' like changing your mind every time a politician blinks.

Crypto Rebounds on Renewed Stability

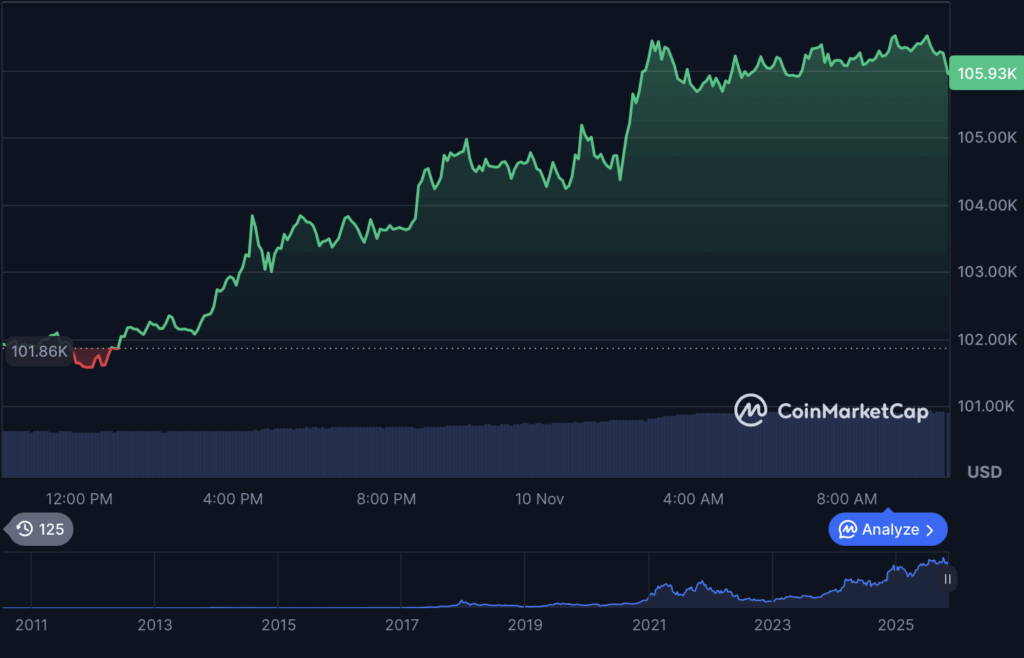

The resolution quickly rippled through financial markets. Bitcoin (BTC) jumped 4% to $106,000, reclaiming momentum after dipping below $104,000 earlier in the week. ethereum (ETH) followed with a 5.2% rise to $3,600, while XRP led the large-cap rally, surging 8.4% to $2.47 amid a broader rotation into altcoins.

Other major gainers included Solana (SOL), up 4.5% to $166, chainlink (LINK) climbing 6% to $16.25, and Cardano (ADA) rising 4% to $0.59. The day’s standout performer was Zcash (ZEC), which soared nearly 16%, extending its impressive week-long rally to more than 70%.

READ MORE:

Sentiment Turns Risk-On Again

Market strategists say the rebound reflects renewed liquidity confidence as political uncertainty eases. The shutdown resolution removes one of the major macro overhangs that had weighed on investor sentiment throughout October and early November.

Analysts note that while the deal is temporary, it provides a critical window of stability ahead of upcoming U.S. inflation data (CPI and PPI), which could further shape risk appetite in mid-November.

If inflation trends softer and the funding agreement holds, traders expect the crypto market’s risk-on momentum to continue – potentially paving the way for a stronger finish to the fourth quarter.

![]()