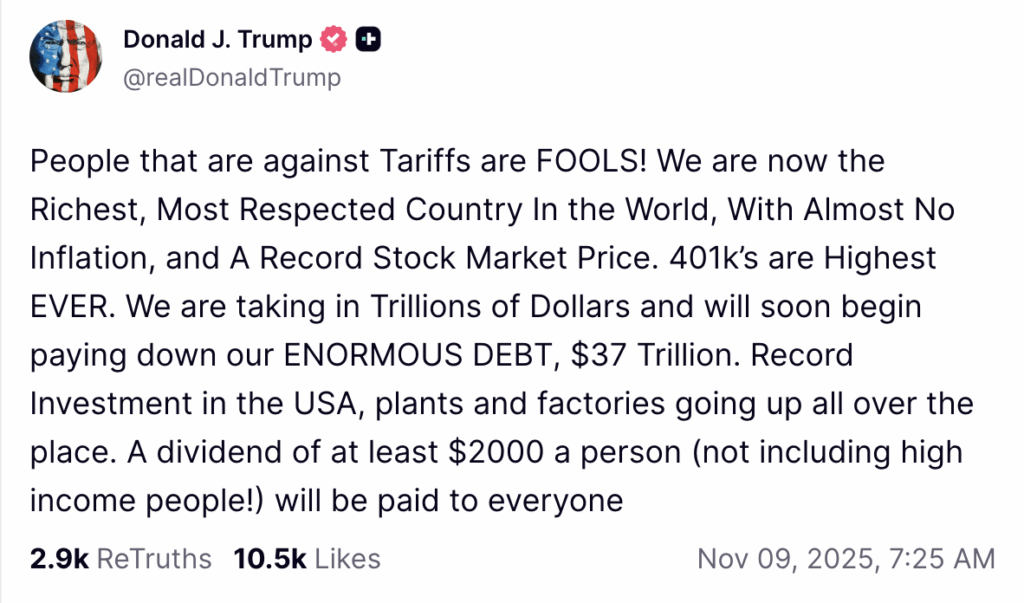

Trump’s $2,000 Tariff Dividend Sparks Inflation Fears—Analysts Sound the Alarm

Economists brace for price surges as Trump’s tariff plan threatens to destabilize markets.

Here’s why Wall Street’s sweating—and Main Street should too.

Another day, another policy that’ll make your latte cost more while hedge funds short the fallout.

Prediction markets suggest skepticism about the plan’s legal survival – Kalshi traders assign just 23% odds that the Supreme Court will uphold the tariffs, while Polymarket participants place the probability at 21%.

READ MORE:

Despite the legal uncertainty, investors and analysts largely see the proposed payments as a short-term economic boost, potentially driving up cryptocurrency and stock prices as fresh capital enters the markets.The Kobeissi Letter estimated that around 85% of U.S. adults could qualify for the payments, mirroring the distribution pattern of the 2020 COVID stimulus checks. However, analysts warned that the long-term effects could be less favorable. Increased federal spending and consumer liquidity, they cautioned, would likely raise inflation, weaken the dollar, and expand national debt.

Bitcoin advocate Simon Dixon noted that unless recipients invest their checks in assets, the money will “be inflated away.” Meanwhile, Anthony Pompliano commented that “stocks and Bitcoin only know to go higher in response to stimulus,” suggesting markets may rally regardless of fiscal consequences.

As the Supreme Court deliberates and Washington braces for the policy’s political fallout, the proposed “tariff dividend” has become a flashpoint – a populist MOVE with potentially far-reaching implications for both the economy and digital asset markets.

![]()