Wintermute’s Warning: Crypto Liquidity Is Running on Fumes

Crypto's lifeblood—liquidity—is drying up. Fast.

Market makers like Wintermute are flashing warning signs as spreads widen and slippage creeps into once-fluid markets. The engine that kept digital assets humming? It's sputtering.

When the so-called 'smart money' starts hoarding cash instead of providing price stability, even degenerate traders should pay attention. But hey—at least the yield farmers can still pretend their 0.2% APY is 'risk-adjusted returns.'

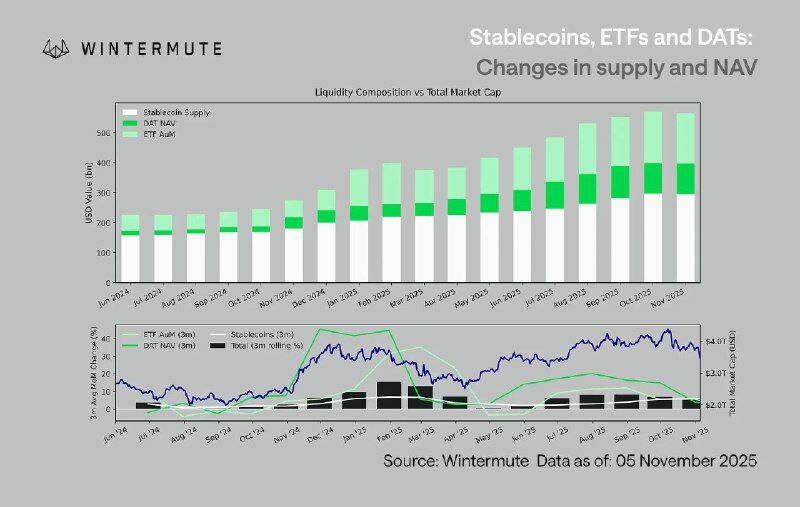

But that furious pace of growth has cooled in recent months. Since August 2025, Wintermute notes, ETF inflows have flattened, stablecoin minting has slowed, and digital trust products have seen more modest expansion. Analysts LINK the slowdown to a shift toward tighter monetary conditions, widespread profit-taking, and a pause in investor risk appetite after months of bullish sentiment. The leveling of key liquidity metrics suggests that the market may have already reached a short-term peak before its next cycle.

READ MORE:

The big question now is where the next wave of capital will emerge. Some observers expect tokenized U.S. Treasuries and real-world-asset ETFs to lead the next phase of growth, while others see opportunities in layer-2 settlement tokens and cross-chain stablecoin protocols.

Even with the recent cooldown, Wintermute’s data points to a stronger foundation than in previous cycles. Stablecoins remain deeply embedded in market infrastructure, ETF products continue attracting institutional demand, and tokenized assets are steadily reshaping the link between crypto and traditional finance. If 2024 and 2025 were about building liquidity, the next stage may determine how effectively that liquidity fuels real-world utility and long-term market resilience.

![]()