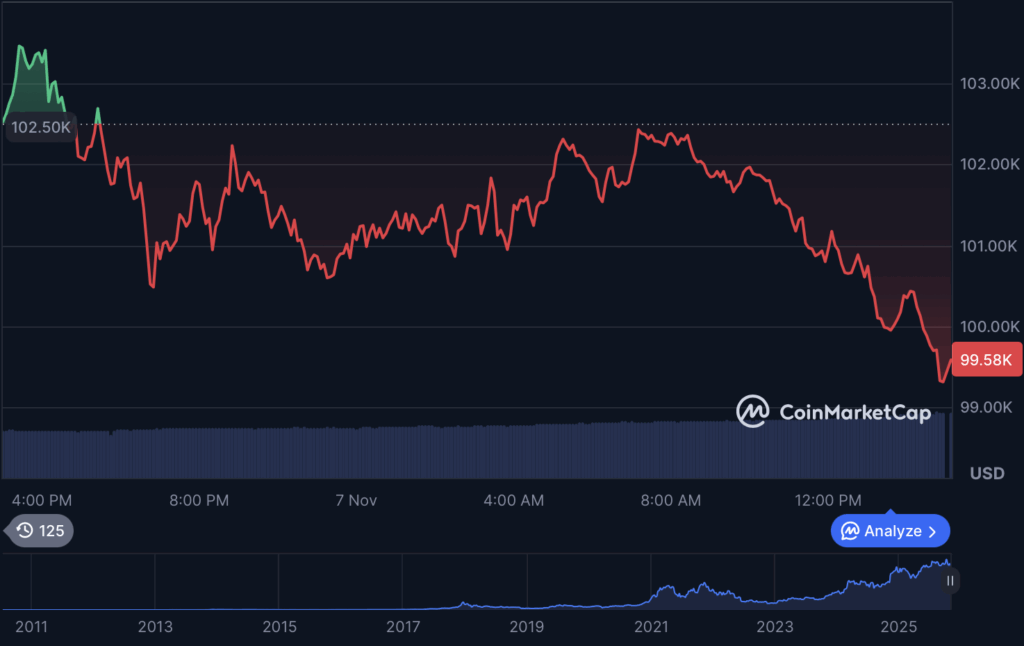

Bitcoin Plunges Below $100K – Panic Sweeps Crypto Markets

Fear grips traders as Bitcoin's price collapses under the $100K psychological barrier.

Market bloodbath: The king of crypto sheds value faster than a meme coin in a bear market.

Whales dump, retail panics – same old story, just bigger numbers this time.

Meanwhile, traditional finance bros smirk and adjust their bond portfolios (how quaint).

The latest correction follows heightened volatility sparked by macroeconomic uncertainty and investor profit-taking after Bitcoin’s run toward new all-time highs in October. Despite strong inflows into institutional funds earlier this quarter, traders appear to be pulling back amid continued liquidation pressure and weakening sentiment across risk assets.

The global cryptocurrency market capitalization now stands at just under $2.9 trillion, with Bitcoin accounting for more than $1.98 trillion of that total. The drop marks Bitcoin’s lowest level in nearly three weeks.

READ MORE:

Broader Market Follows Bitcoin’s Slide

Ethereum (ETH) is also under pressure, trading at $3,223, down 1.14% on the day and over 16% in the past month. solana (SOL) has been hit even harder, slipping 1.4% in the past 24 hours and almost 19% over the month, currently sitting at $151.45.

Other top assets, including BNB ($932.87) and XRP ($2.16), are down roughly 1% on the day, while stablecoin Tether (USDT) remains firmly pegged at $1.00 with a market capitalization above $183 billion.

Analysts point to continued U.S. regulatory uncertainty, slowing ETF inflows, and broader risk aversion as primary drivers behind the decline.

Despite the selloff, some investors view Bitcoin’s pullback below $100,000 as a potential buying opportunity. Historical data suggests that corrections following large rallies often precede periods of consolidation before the next leg higher.

![]()