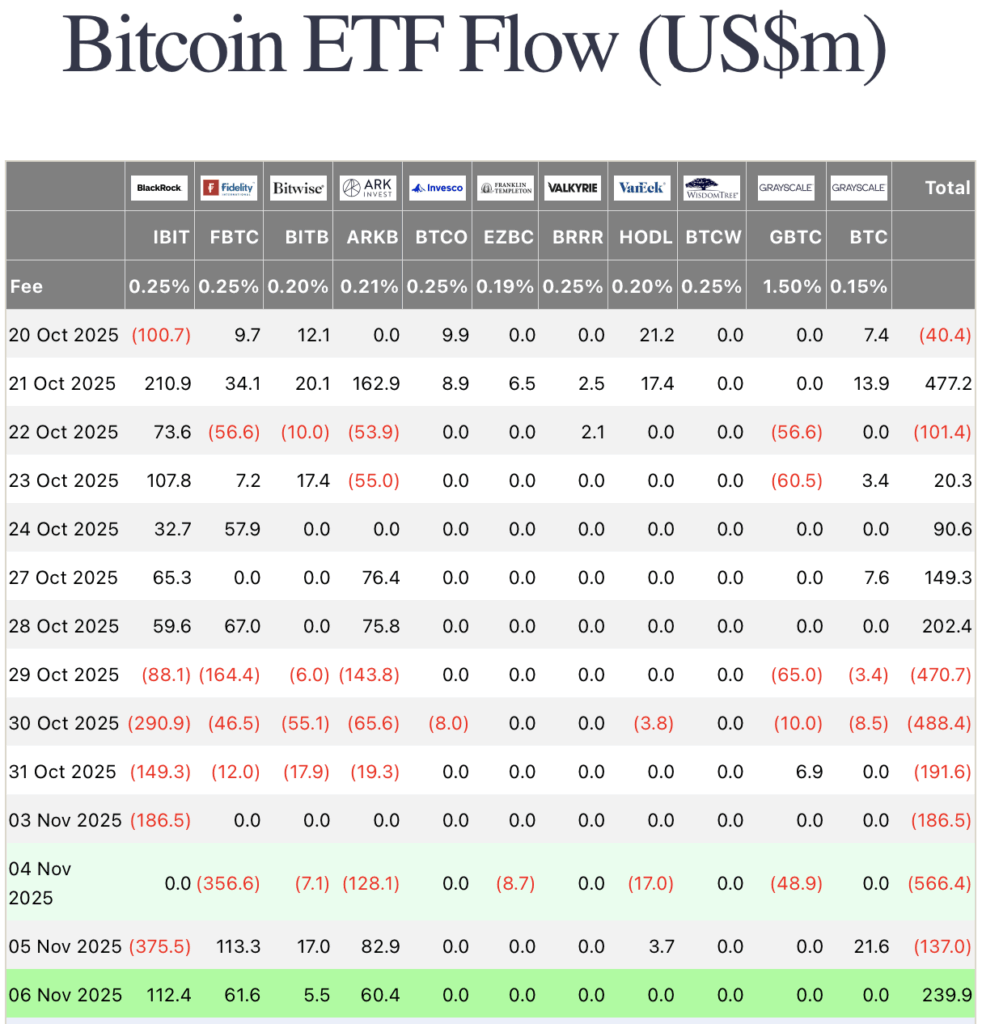

Crypto ETFs Stage $240M Comeback: Bitcoin & Ethereum Snap 6-Day Bleed

After a brutal week of withdrawals, crypto ETFs just flipped the script with a quarter-billion dollar reversal. The big two—Bitcoin and Ethereum—lead the charge as institutional money dips back in.

Wall Street's latest mood swing proves even crypto skeptics can't resist buying the dip (as long as there's an SEC-approved wrapper). Traders are now watching to see if this marks the start of sustained inflows—or just another dead cat bounce in the ongoing crypto volatility saga.

The total assets under management (AUM) for bitcoin ETFs have now reached $135.4 billion, representing roughly 6.73% of Bitcoin’s total market cap. Experts believe that the combination of rebounding ETF inflows and rising expectations for a U.S. interest rate cut is helping to restore confidence across the digital asset sector.

READ MORE:

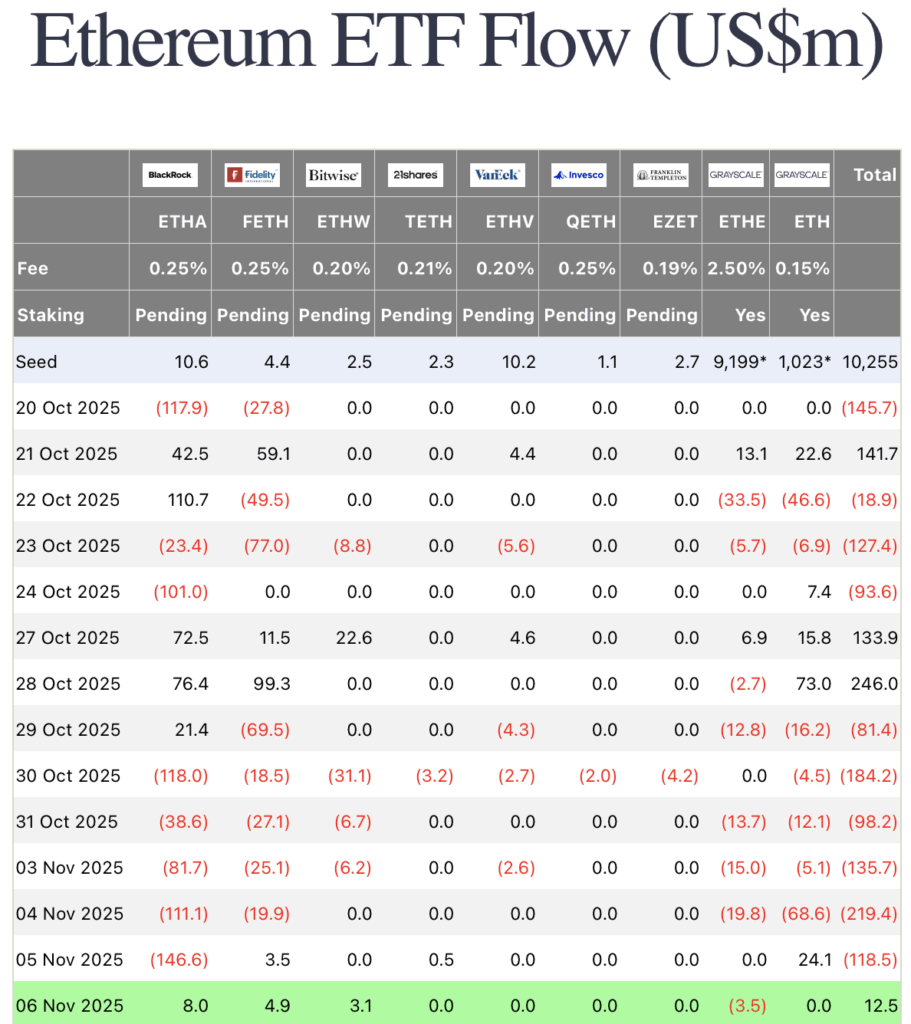

Ethereum ETFs Join the Recovery

Ethereum ETFs followed a similar trajectory, also snapping their six-day outflow trend. On November 6, ethereum spot ETFs posted $12.5 million in net inflows, marking renewed appetite among investors.

Leading the charge were BlackRock’s ETHA ETF, with $8 million in inflows, and Fidelity’s FETH ETF, with $4.94 million. In contrast, Grayscale’s ETHE recorded outflows of $3.52 million, continuing to lag behind its newer competitors.

As of the latest update, Ethereum ETFs hold $21.75 billion in assets, accounting for 5.45% of ETH’s total market capitalization.

The synchronized rebound in both Bitcoin and Ethereum ETFs hints at a possible shift in institutional sentiment, as traders position for potential monetary easing and a broader crypto market recovery.

![]()