Bitcoin Tumbles Below $110K as Smart Money Pours Into Bitcoin Hyper Assets

Bitcoin's sudden plunge below the $110,000 psychological barrier sends shockwaves through crypto markets—just as institutional capital makes a surprising pivot toward hyper-Bitcoinization plays.

The Great Rotation Begins

While retail investors panic over BTC's 15% intraday drop, sophisticated money is quietly executing what traders are calling 'the hyper-rotation.' Major funds are reportedly shifting allocations from plain vanilla Bitcoin into derivatives, infrastructure plays, and scaling solutions that benefit from Bitcoin's eventual dominance.

Market Mechanics Exposed

This isn't your typical dip-buying opportunity. The smart money movement reveals a fundamental truth about crypto maturation: early-stage volatility gives way to strategic positioning. They're not betting against Bitcoin—they're betting on everything that makes Bitcoin unstoppable.

Wall Street's Ironic Embrace

Nothing says 'decentralized revolution' quite like hedge funds deploying complex derivatives to capitalize on the very asset designed to render them obsolete. The irony is thicker than a blockchain ledger.

Bottom Line: The $110,000 breakdown might look like trouble, but it's merely the opening act of Bitcoin's next evolutionary phase—where the real money flows to the infrastructure supporting global adoption.

The Bitcoin Bear and Bull Case

Let’s start by clarifying that the “bear case” does not imply immediate downside for Bitcoin; rather, it’s a mid- to long-term scenario. The short-term outlook (until the end of 2025) is generally seen as positive for the market-leading asset, given recent interest rate cuts, the Fed’s commitment to end quantitative tightening, and the US-China trade agreement.

All these signs suggest that November and December may see increased liquidity, potentially leading to a recovery of October’s losses and a MOVE into fresh highs. However, in the bear case, there are two main risks to watch after December: the conclusion of the four-year cycle and a full pivot to institutional profit-taking.

The four-year cycle that bitcoin has followed since its inception suggests the market peak will occur in Q4 2025, while Farside Investors‘ data shows that ETF outflows have significantly exceeded inflows over the past two weeks. Furthermore, Bitcoin treasury purchases have slowed, indicating that major institutions and corporations may be holding back on fresh investments for the time being.

So, what’s the bullish case? Simply put, it’s the convergence of macroeconomic tailwinds and a favorable regulatory environment. As mentioned, the Fed just cut interest rates, and ING Chief International Economist James Knightley predicts further 75 basis-point cuts by early next year, which will boost liquidity and make risk assets like BTC more attractive.

Moreover, the crypto advocate Michael Selig has just been appointed as the new CFTC chair, which could help usher in more Bitcoin-friendly regulations, leading to a resurgence in institutional adoption.

The analyst Crypto Maxi suggests this paves the way for “an extended institutional supercycle aligned to US politics.”

This is an extended institutional supercycle aligned to US politics.

The four year retail-driven cycle is dead.

You are not bullish enough anon.#Bitcoin to 700K. pic.twitter.com/2JX8325wDL

— Crypto Maxi 💹🧲 (@Crypto_Maxi__) October 28, 2025

He’s not alone in predicting a “supercycle”; in mid-August, Bernstein analysts forecasted that Bitcoin could rally into 2026 and reach $200,000.

Final Verdict: Bitcoin Price Prediction

Bitcoin’s supercycle thesis hangs on macroeconomic trends and how institutional players respond. If institutional interest rekindles, BTC could break the four-year cycle and reach $200,000 next year.

But even if BTC follows historical patterns and ends the bull market late in 2025, the current macroeconomic and regulatory environment suggests that further gains will come first. Regarding Bitcoin’s potential growth, Strategy CEO Michael Saylor appeared on CNBC this week and forecasted a rise to $150,000 by year-end.

Although Bitcoin has faced struggles in recent weeks, with institutional outflows and widespread liquidations, the near-term outlook leans positive, and mid- to long-term gains are certainly not impossible. However, through October, smart money has been shifting into Bitcoin Hyper (HYPER) while BTC has been declining. Let’s explore what this project is all about.

Why Are Traders Rotating Into Bitcoin Hyper?

If Bitcoin reaches $150,000 by the end of 2025, it WOULD represent a 36% rise from its current value. Many investors are aware that better risk-adjusted opportunities lie elsewhere – and Bitcoin Hyper (HYPER) is proving itself as a popular alternative.

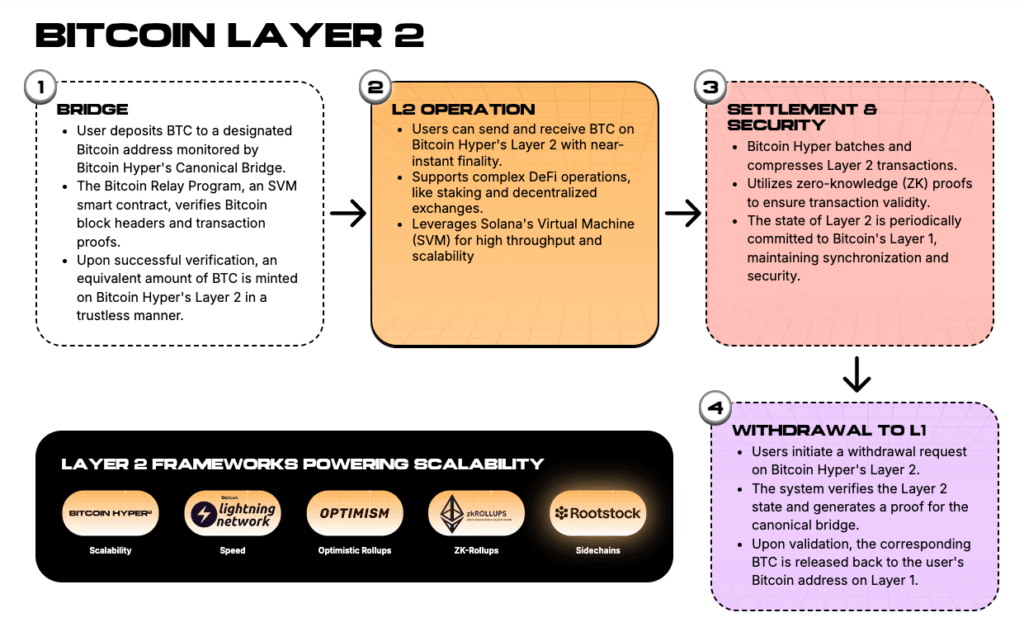

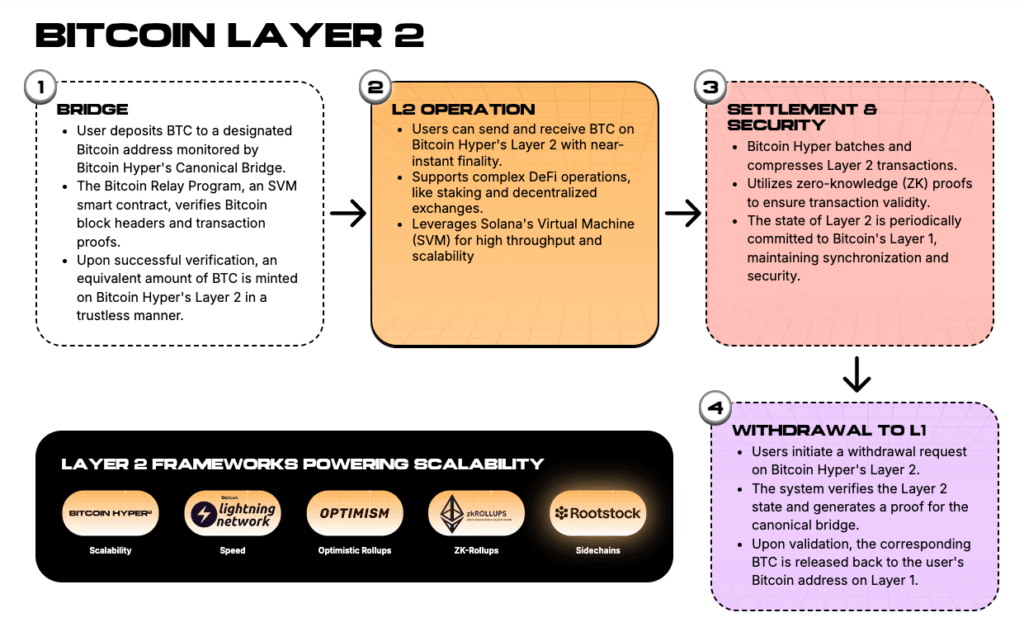

It’s developing a Bitcoin Layer 2 blockchain designed to significantly enhance the Bitcoin Layer 1’s speed and capabilities. It will run on the Solana VIRTUAL Machine, leveraging Solana’s fast performance and smart contract support. For context, Solana can process up to 65,000 transactions per second, making it one of the world’s fastest blockchains.

If Bitcoin Hyper successfully integrates this L2 development into the Bitcoin ecosystem, HYPER could be more than a short-term trade – it might even be a multi-cycle play. That’s because successful implementation would unlock opportunities in DeFi yields, RWAs, stablecoins, meme coins, and AI – all supported by Bitcoin’s security and liquidity.

It’s no surprise, then, that HYPER is attracting the attention of smart money traders, with Borch Crypto recently claiming it has 100x potential.

So far, the Bitcoin Hyper presale has raised $25.3 million, suggesting whales are buying it up, not just talking about it. HYPER is currently priced at $0.013195, and can be staked for dynamic APYs of up to 46%.

While Borch Crypto’s 100x target might take months or years to realize, the potential for major gains soon after HYPER’s exchange debut means investors are unfazed by the broader market conditions and are scrambling to get involved.

Visit Bitcoin Hyper Presale![]()