Top Altcoin Picks as JPMorgan Predicts Base Token Will Reach $34 Billion Valuation

Wall Street's crystal ball just lit up—JPMorgan sees Base token hitting a staggering $34 billion market cap. Time to position your portfolio accordingly.

The Institutional Stamp of Approval

When traditional finance giants start making crypto predictions, smart money pays attention. JPMorgan's forecast isn't just another analyst report—it's a potential market-moving event that could send altcoin valuations soaring.

Beyond the Obvious Plays

While everyone chases the usual suspects, the real alpha often hides in projects with strong fundamentals and real-world utility. Look for protocols solving actual problems rather than just riding hype cycles.

Timing the Altcoin Wave

Major bank predictions tend to create self-fulfilling prophecies—at least temporarily. The trick is getting in before the herd realizes Wall Street suddenly remembers it 'invented' blockchain technology last Tuesday.

JPMorgan's bold call could either mark the start of the next altseason or another case of traditional finance being fashionably late to its own revolution.

Base Token to $34 Billion, Says JPMorgan

JPMorgan analysts noted that the Base token could help Coinbase capture value from the growth of the Layer 2 network. The Wall Street bank estimates that Base could reach a market capitalization between $12 billion and $34 billion, with the project’s team likely to control around 40% of the tokens.

This means Coinbase could hold roughly between $3 billion and $11 billion in tokens, creating a strong incentive to launch. But more importantly, it suggests there could be up to $23 billion in new liquidity for Base users, assuming remaining tokens are airdropped to network participants.

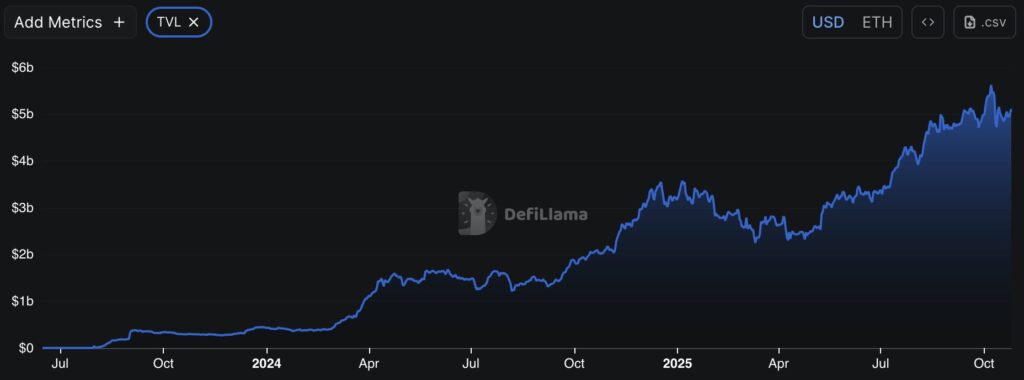

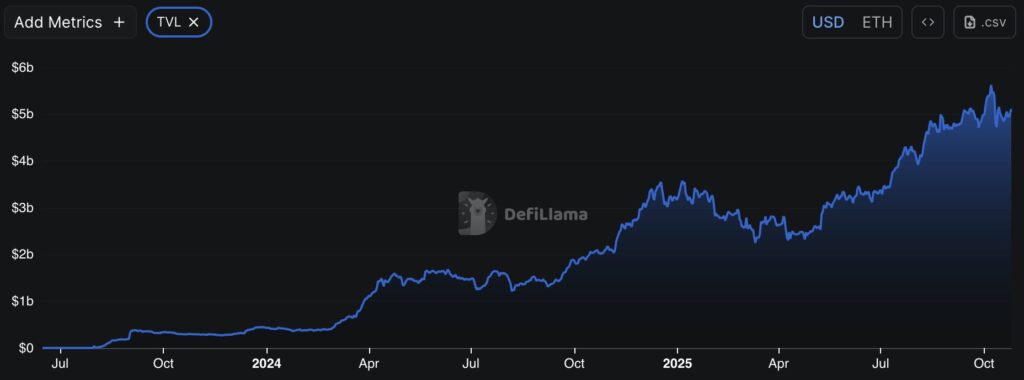

JPMorgan suggests that this initiative might enhance development, boost community involvement, and foster long-term infrastructure expansion. This comes after a steady rise in Base’s on-chain activity, with DeFiLlama data showing over a 2x increase in its DeFi TVL over the past year.

Additionally, the firm upgraded Coinbase’s rating and increased its December 2026 share price target to $404, highlighting “emerging monetization opportunities and decreasing risks” as the company advances more into its Layer 2 ecosystem and stablecoin strategies.

Ultimately, however, the two key takeaways from JPMorgan’s report are:

- On-chain Base users could potentially see a multi-billion-dollar airdrop.

- The bank believes blockchain infrastructure tokens hold significant value.

With this in mind, let’s explore some altcoins that might benefit from this news.

Bitcoin Hyper

JPMorgan’s prediction is a significant bullish indicator for Bitcoin Hyper, the world’s first ZK-rollup-powered Bitcoin Layer 2 blockchain. The project is built on the Solana Virtual Machine (SVM), inheriting Solana-grade speeds, fees, and smart contract support.

Its utilization of ZK-rollups means it bundles transactions and periodically reports its state back to the bitcoin L1, thereby inheriting Bitcoin-level security.

The final piece of the puzzle is Bitcoin Hyper’s Trustless canonical bridge, which enables users to seamlessly and securely transfer BTC to and from the L2. This paves the way for BTC liquidity flows, potentially helping fuel network growth.

Bitcoin is worth 4.6 times more than Ethereum, indicating significant potential for a project like Bitcoin Hyper, which effectively performs what Base is doing, but on Bitcoin.

Currently, Bitcoin Hyper is in a presale, having raised $24.7 million so far, clearly showing that whales are betting big, while also leaving huge upside potential given the $34 billion forecast for the Base token. Visit Bitcoin Hyper.

Toshi

Assuming the Base token is airdropped to network users, this WOULD mark a significant wealth-creation event for the community, likely triggering an on-chain ‘Base Season.’ In this scenario, many airdrop winners would rotate their Base tokens into smaller-cap Base projects in pursuit of larger gains.

As this occurs and prices begin to climb, it could attract more attention to the ecosystem and ultimately draw in more liquidity. So, what crypto could perform best in this situation?

One potential option is Toshi, a meme coin that recently overtook BRETT to become the leading token on the Base network. Unlike Brett, Toshi is listed on Coinbase, which provides a major advantage.

Toshi is a cat-themed meme coin that brands itself as “the face of Base.” It introduces various ecosystem features, including NFTs, merchandise, and community art. Additionally, its price has demonstrated notable strength today, rising 5%, which reaffirms community interest.

Maxi Doge

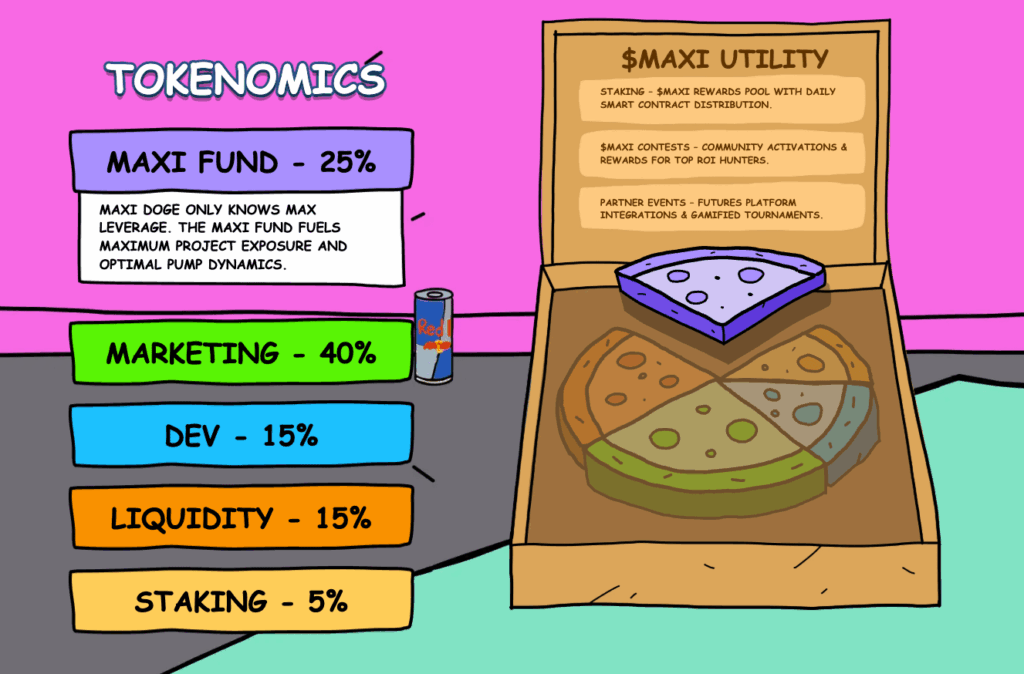

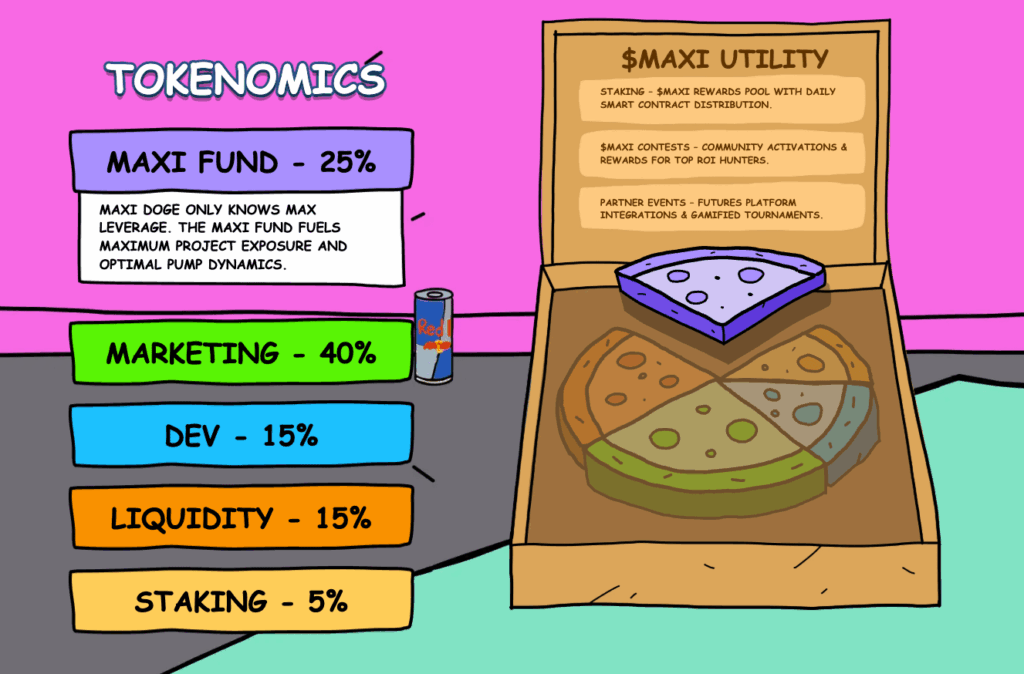

Maxi Doge is a Dogecoin-themed meme coin with futures trading utility. The project is built on the ethereum network, indicating it will ride the rising tide of Base and the broader Ethereum ecosystem.

The project’s mascot is portrayed as Dogecoin’s younger cousin – a bodybuilding crypto bro who trades with 1000x leverage and no stop loss. It aims to capture the degen spirit that has increasingly permeated meme culture in recent years – and it doesn’t stop with just branding.

Maxi Doge plans to integrate the MAXI token into futures trading platforms, allowing users to trade it with up to 1000x leverage. It will also run weekly trade competitions with USDT and MAXI rewards up for grabs.

These futures utilities offer a new perspective beyond the typical meme coin playbook, and this is attracting investor attention. That’s evident in its presale success, with over $3.7 million raised so far.

However, this presale still leaves significant room for growth, as many meme coins are worth hundreds of millions, if not billions of dollars. Visit Maxi Doge.

OriginTrail

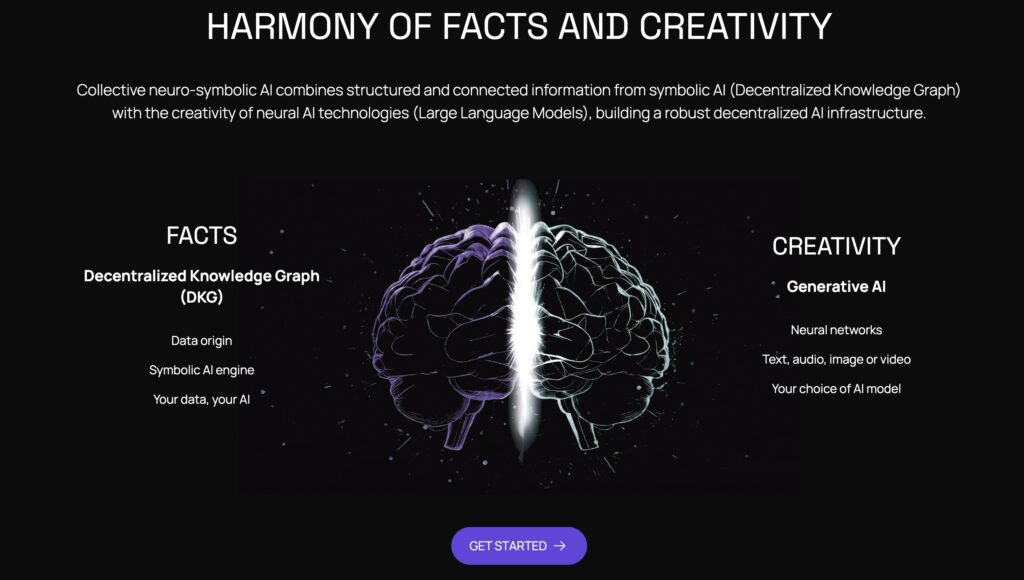

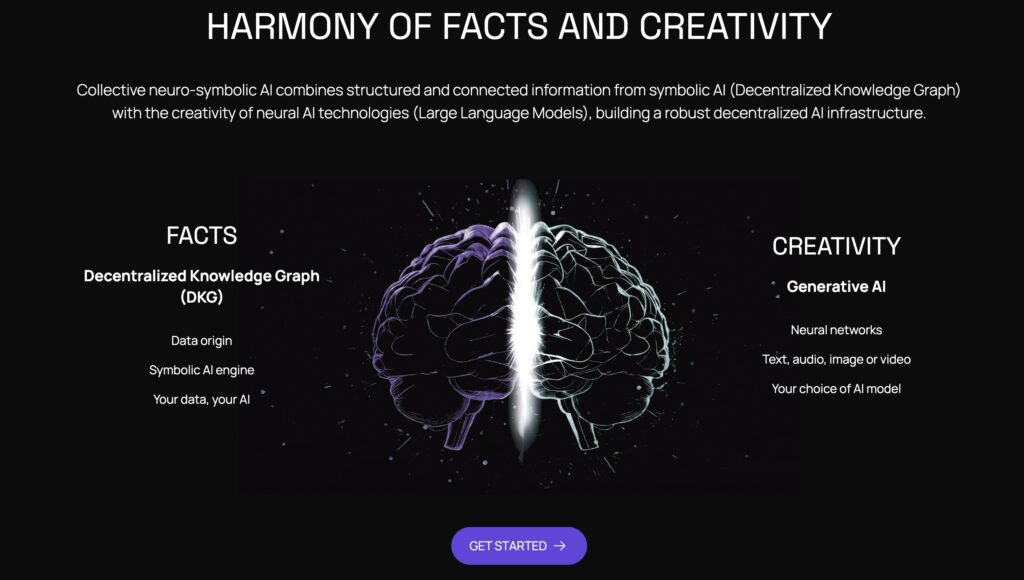

OriginTrail shows exactly why the Base network is popular – real innovation colliding with scalable infrastructure. The project is building a decentralized AI infrastructure that aims to find “the truth in knowledge.”

AI isn’t going anywhere – each year, language models get more advanced, and new types of generative AI appear. But the main challenge with generative AI is where it gets its data and whether that data is reliable and truthful. For example, how does AI determine the relative authority of conflicting information sources, and can we trust its judgment?

OriginTrail uses decentralized knowledge graphs (DKGs) to build a transparent trust layer for AI, where information can be verified, traced, and shared openly across networks. It’s solving one of the largest problems within one of the hottest technology fields – and it’s doing it on Base.

The project’s native token TRAC has been on fire lately, rising 8% today, 30% this week, and 149% this month. This strength, ahead of a potential $34 billion liquidity boon to the Base ecosystem, indicates significant potential for TRAC.

![]()