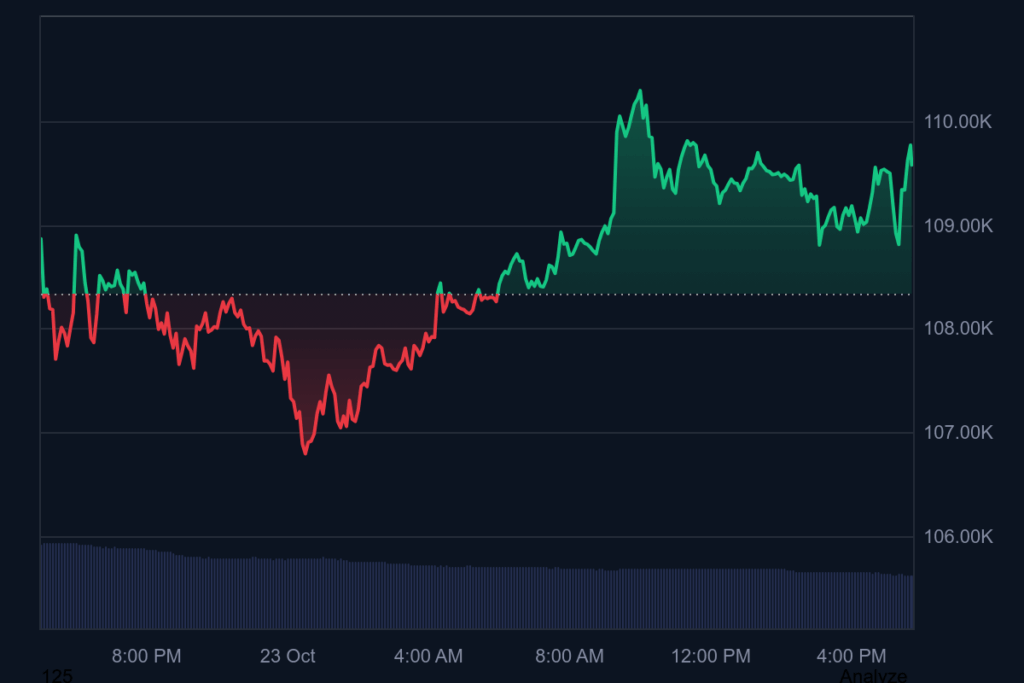

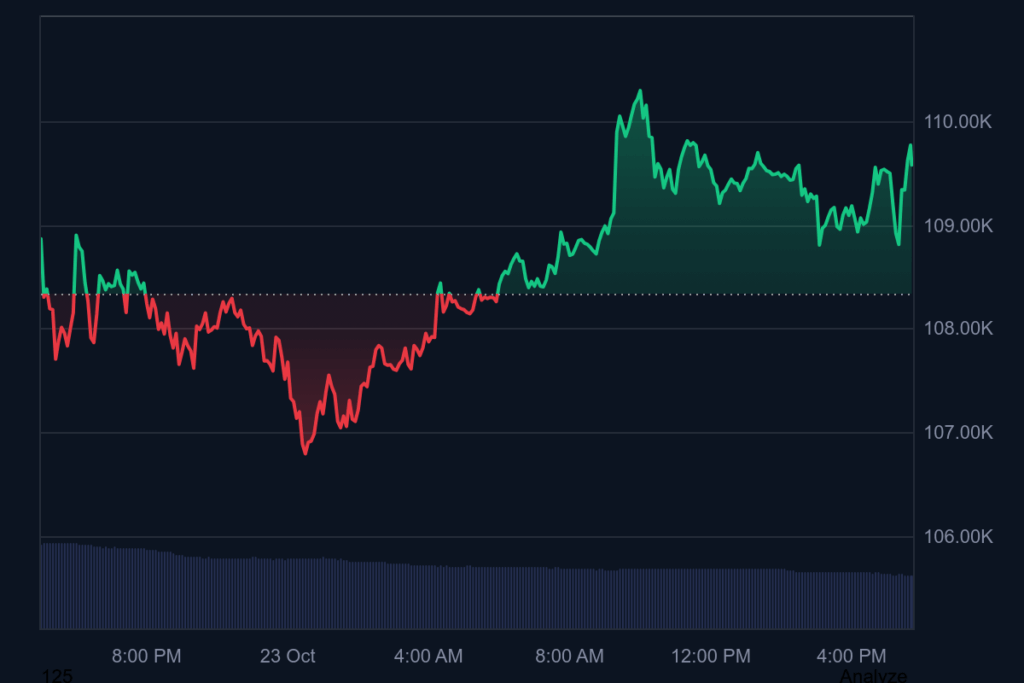

Bitcoin Volatility Explodes – Traders Brace for Massive Sell-Off Before Critical CPI Data Release

Markets tremble as Bitcoin's price swings intensify ahead of inflation numbers

The Fear Factor

Trading desks are flashing red across global exchanges as Bitcoin's volatility spikes to alarming levels. Market makers are pulling liquidity while leveraged positions face imminent liquidation threats. The timing couldn't be worse—with CPI data looming, institutional players are positioning for potential chaos.

Liquidity Crunch

Order books are thinning faster than a trader's hairline during a 20% flash crash. Market depth across major exchanges shows support levels weakening as whales begin testing the waters. The derivatives market tells the real story—funding rates are turning negative while open interest suggests massive position unwinding.

CPI Countdown

All eyes turn to Washington as inflation data could make or break the current market structure. History shows Bitcoin doesn't play nice with unexpected CPI prints—remember last quarter's 15% single-day massacre? Traditional finance types are already circling like vultures, ready to blame crypto's 'irrational exuberance' while ignoring their own balance sheet disasters.

Sometimes the most volatile thing in crypto isn't the price charts—it's the excuses traditional financiers make while missing another generational wealth transfer.

Options traders have also entered a more volatile phase. Open interest in BTC contracts has hit fresh highs, but the build-up in put exposure means dealers are sitting on significant short gamma positions. This setup, analysts say, can quickly amplify volatility when the price shifts, triggering sudden surges or steep drops around critical strike prices.

Institutional sentiment remains mixed. Spot Bitcoin ETFs saw outflows of roughly $101 million on Tuesday, with ethereum products losing another $19 million. The data hint at a pause in institutional appetite after several weeks of uneven inflows.

READ MORE:

Macroeconomic uncertainty is adding to the pressure. With most U.S. government data releases delayed by the ongoing shutdown, investors are now laser-focused on Friday’s CPI print. A softer-than-expected number could revive bullish sentiment, while a higher reading might accelerate risk-off moves across the board.

For now, Bitcoin appears trapped in what analysts describe as a “proof-of-conviction phase,” where long-term holders are trimming positions while institutions continue cautious accumulation through ETFs and treasury vehicles. The result, they say, is a rangebound market—one that could stay choppy until a clear macro or liquidity catalyst emerges.

![]()