Citi Crowns MSTR as Ultimate Bitcoin Bet with $485 Target - Your Move, Wall Street

Citi just placed its chips on the Bitcoin table—and they're betting big on MicroStrategy.

The Banking Giant's Bold Play

Forget subtle positioning. Citi's coverage initiation comes with a $485 price target that screams confidence in Michael Saylor's Bitcoin accumulation machine. They're not just recommending a stock—they're endorsing a strategy.

Leveraged Bitcoin Exposure, Refined

MicroStrategy isn't just another crypto stock. It's corporate Bitcoin adoption perfected—a pureplay with leverage that amplifies both upside and risk. When Bitcoin moves, MSTR moves harder. Simple math, explosive potential.

The Institutional Stamp of Approval

When traditional finance giants start calling Bitcoin bets 'strategic coverage,' you know the landscape has shifted. This isn't fringe investing anymore—it's mainstream portfolio strategy with a volatility kick.

Because sometimes the best way to play digital gold is through a company that treats treasury management like a Vegas high-roller. Just don't look at the balance sheet during bear markets.

Bitcoin and Ethereum Lead the Gains

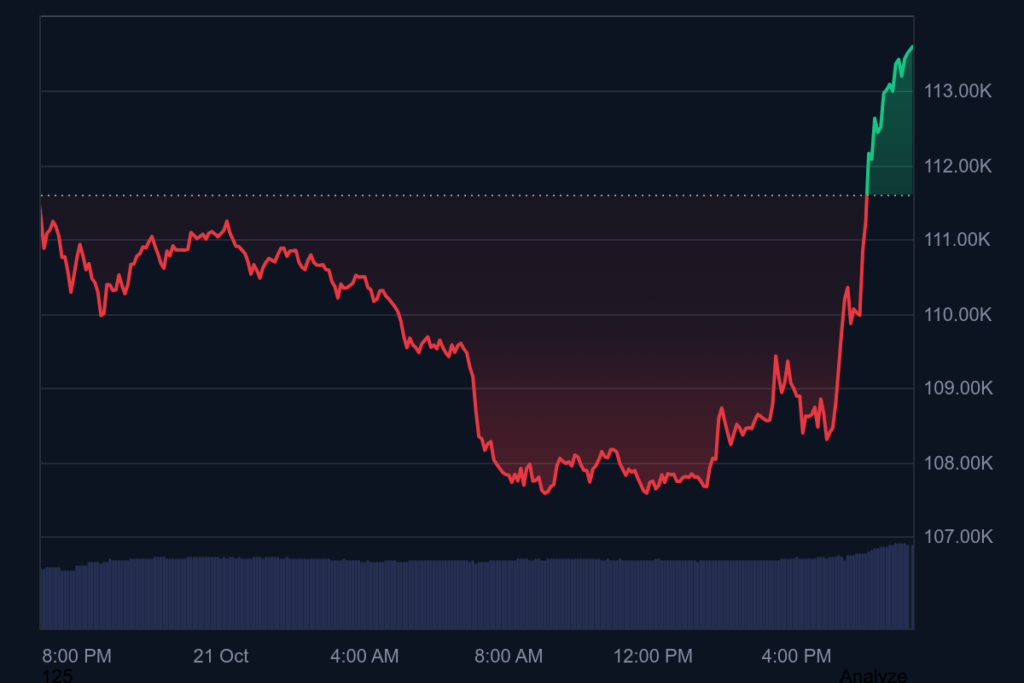

Bitcoin (BTC) continues to dominate with a price of $113,356.69, up 2.05% in the last 24 hours and a market cap of $2.26 trillion.

Ethereum (ETH) follows at $4,079.36, marking a 2.51% increase in the past day and a market cap of $492.37 billion. Both coins show steady growth, reflecting investor confidence despite prevailing market fear.

Stablecoins and Altcoins Show Mixed Performance

Tether (USDT) remains stable at $1.00, while USD Coin (USDC) holds the same value with minimal fluctuations. Among altcoins, BNB is priced at $1,106.44, down 9% over the last week, and Solana (SOL) sits at $196.23, showing a 2.22% weekly decline despite a 3.58% daily gain. XRP is performing well at $2.51, with nearly 1% growth over seven days, and Dogecoin (DOGE) rises slightly to $0.2038.

Trading Volumes and Supply Trends

The market shows robust trading activity, with Bitcoin seeing a 24-hour volume of $77.13 billion, ethereum at $41.19 billion, and Tether leading stablecoin trading at $154.08 billion. Circulating supplies include 19.93 million BTC, 120.69 million ETH, and 181.95 billion USDT, demonstrating consistent liquidity across major networks.

![]()