Crypto Bull Run Reignites: Powell’s Dovish Pivot Meets China’s Liquidity Firehose

Markets roar back as regulatory headwinds reverse course

The perfect storm for digital assets just materialized. Federal Reserve Chair Jerome Powell's unexpected dovish turn combined with China's PBOC announcing massive liquidity injections sent crypto markets soaring overnight.

Powell's pivot: From hawk to dove

The Fed chair's testimony revealed a dramatic shift in tone—hinting at potential rate cuts sooner than markets anticipated. Traders immediately priced in the implications: cheaper capital flowing toward risk assets, including cryptocurrencies.

China opens the liquidity taps

Meanwhile, the People's Bank of China confirmed plans to inject substantial fresh liquidity into global markets. The timing couldn't be more fortuitous for crypto—just as institutional investors were seeking confirmation of supportive macroeconomic conditions.

Technical breakout confirms momentum

Bitcoin smashed through key resistance levels while major altcoins followed with double-digit percentage gains. The fear and greed index flipped from extreme fear to greed in under 48 hours.

Because nothing says 'stable monetary policy' like central bankers changing their minds faster than crypto traders change their leverage positions.

Jerome Powell Adopts Dovish Stance, Here’s What It Means For Crypto Prices

Fed Chair Jerome Powell maintained a cautious tone in September’s post-FOMC speech, calling last month’s interest rate cut just a “risk management” measure.

However, Powell appears to be finally turning dovish, saying that the slowdown in hiring suggests that the US economy still needs additional rate cuts.

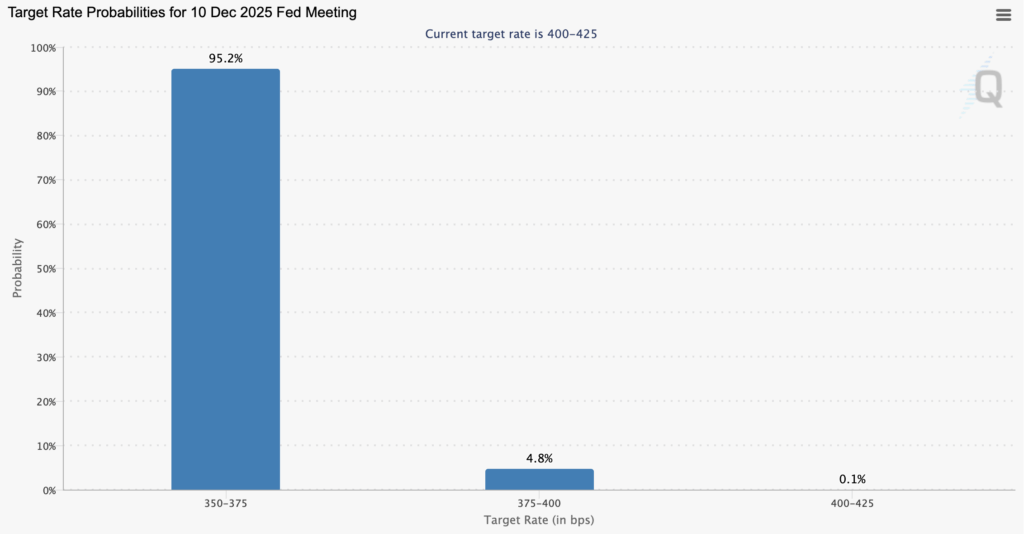

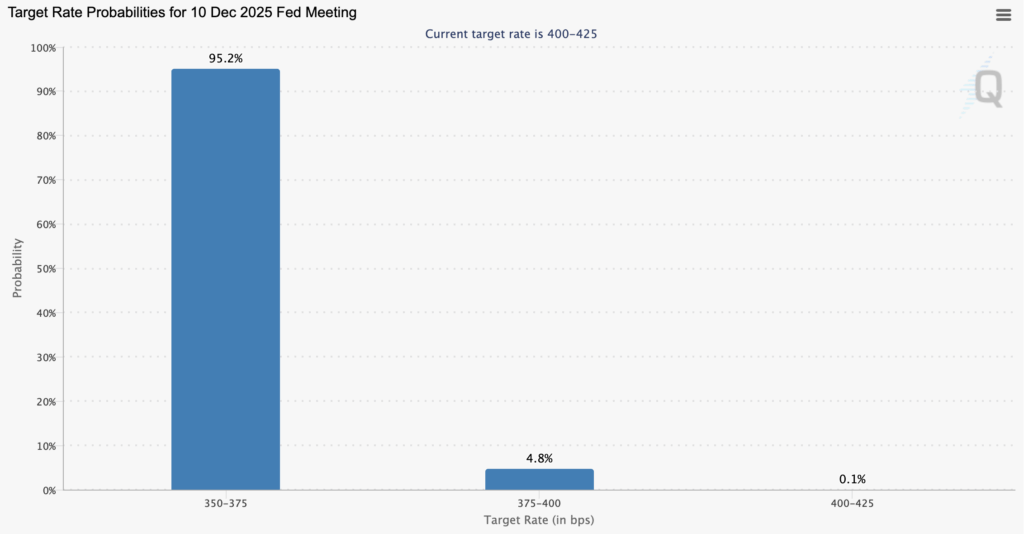

Another 25-basis-point cut later this month is now nearly a guarantee, while the CME FedWatch is signalling yet another cut in December.

However, the fact that the Fed’s QT is now in its final stretch is the biggest takeaway from Powell’s address.

The Fed Chair admitted that a tightening in money markets is now visible, a remark that prominent macro analyst EndGame Macro interpreted as code-speak for liquidity in the system running dangerously scarce.

This is not the ideal backdrop for risk assets and crypto, which explains the recent sluggishness in Bitcoin and large-cap altcoins.

However, with the balance sheet contraction coming to an end and interest rates going down, borrowing costs are expected to fall. This could trigger the start of the next crypto bull rally, and potentially even extend the bull cycle.

As such, GMI’s Head of Macro Research, Julian Bittel, has already signalled that the business cycle could potentially be extended to 2025 and even 2026, as it has been held back due to the high rates. This indicated that a crypto cycle top is still far off.

Best Cryptos To Buy For The Next Rally

Bitcoin continues to be an attractive investment for the next bull rally, especially as it looks to match and outperform Gold’s 60% year-to-date growth.

Experts believe that the BTC price could potentially hit $150,000 by year-end.

However, altcoins would likely lead the rally. Into The Cryptoverse’s Benjamin Cowen claims that the ethereum price is set for a new all-time high, especially as it has tested and successfully defended its bull market support band near the $3,700 mark.

Cowen claims that the ETH price could hit as high as $7,700, but at least $5,300.

Altcoins showing a strong correlation with BTC and ETH could also dominate. For instance, the new BTC layer-2 coin, bitcoin Hyper (HYPER), has raised nearly $24 million in presale funding.

With BTC still at the centre stage, altcoins in its ecosystem are being viewed as attractive investments. Moreover, layer-2 coins tend to have high upside potential. Bitcoin’s Stacks (STX) reached a peak valuation of over $5 billion.

Considering that HYPER is a low-cap coin, it is no surprise that whales are stacking it during its ongoing presale. Recently, a whale purchased over $500k worth of Bitcoin Hyper in a single day.

Whale demand is indicative of excellent upside prospects, with many viewing HYPER as the next 10x crypto.

Buy Bitcoin Hyper

Similarly, ethereum meme coins like Pepe and Floki are heavily undervalued and are attractive investments. A low-cap meme coin Pepenode has also raised nearly $2 million in its ICO, owing to its unique mine-to-earn utility.

PEPENODE holders can actively participate in its mine-to-earn ecosystem by purchasing VIRTUAL Miner Nodes, building server rooms, and upgrading facilities to boost their mining output. Unlike traditional mining, the process requires no GPUs or electricity, making it accessible to everyone.

Moreover, deflationary tokenomics, passive staking rewards and audited smart contracts make Pepenode one of the best low-cap cryptos to buy.

Buy Pepenode

![]()