Bitcoin Alert: Grave Stone Doji & Long-Term Holder Exodus Signal Major Market Reversal

Bitcoin's technical charts flash ominous warning signs as long-term holders begin massive redistribution—potentially marking the end of the current cycle.

The Grave Stone Doji Formation

That ominous candlestick pattern appearing on weekly charts? It's the technical equivalent of a flashing red alert. When this formation emerges after an extended rally, seasoned traders know what typically follows—a significant trend reversal that could wipe out recent gains.

Long-Term Holder Exodus Accelerates

Meanwhile, Bitcoin's most steadfast investors are quietly exiting positions. The long-term holder cohort—those who've held through multiple cycles—has begun distributing coins at an accelerating pace. This behavior pattern historically precedes major market shifts, suggesting the smart money is taking profits while retail remains euphoric.

Market Psychology at Critical Juncture

The convergence of technical warning signals and fundamental holder behavior creates a perfect storm of uncertainty. While permabulls continue chanting 'number go up,' the data tells a more nuanced story—one where patience and risk management might soon outperform reckless optimism.

Because nothing says 'healthy market' like technical patterns screaming 'SELL' while influencers scream 'BUY THE DIP'—the eternal dance between charts and hopium continues.

Grave Stone Doji Suggests Indecision

EGRAG crypto has highlighted the appearance of a potential Grave Stone Doji on Bitcoin’s 12-month chart, a candlestick pattern often associated with trend reversals. The setup forms when prices open and close at similar levels while leaving a long upper shadow, indicating that buyers attempted to push higher but failed to hold those gains.

Such a pattern underscores market indecision and often signals possible downside pressure. EGRAG cautioned that while one candlestick does not dictate the future, this setup on a higher time frame could mark a turning point for Bitcoin dominance, especially as capital continues to rotate into altcoins.

Long-Term Holders Show Restraint

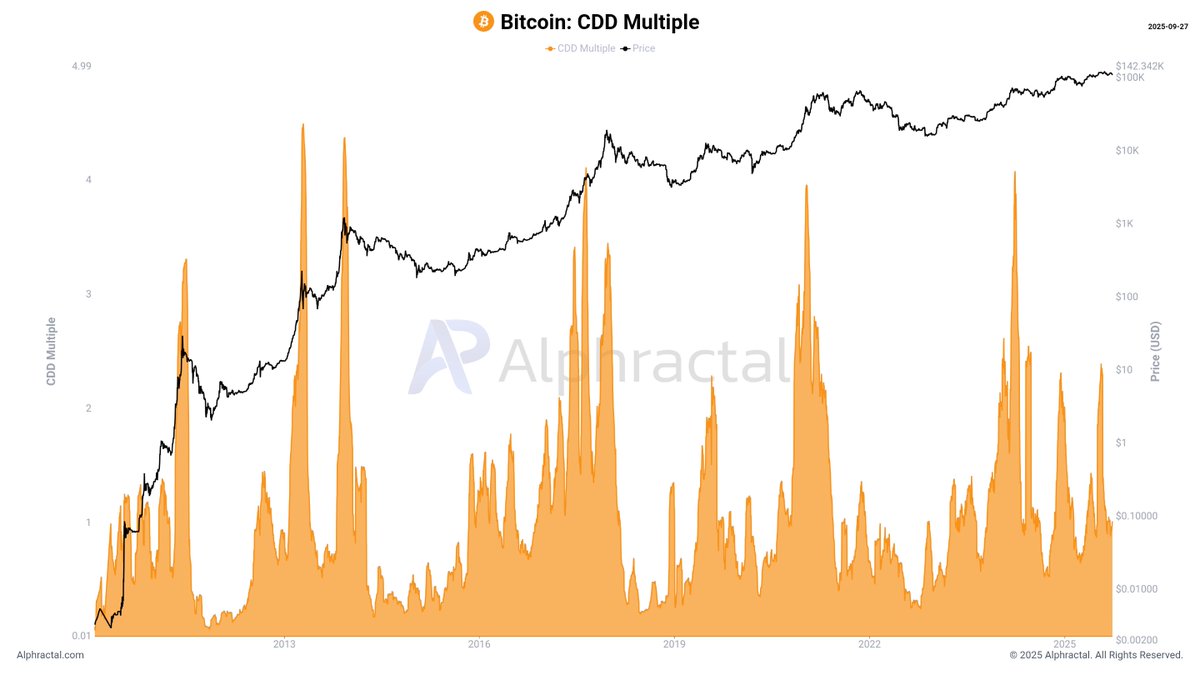

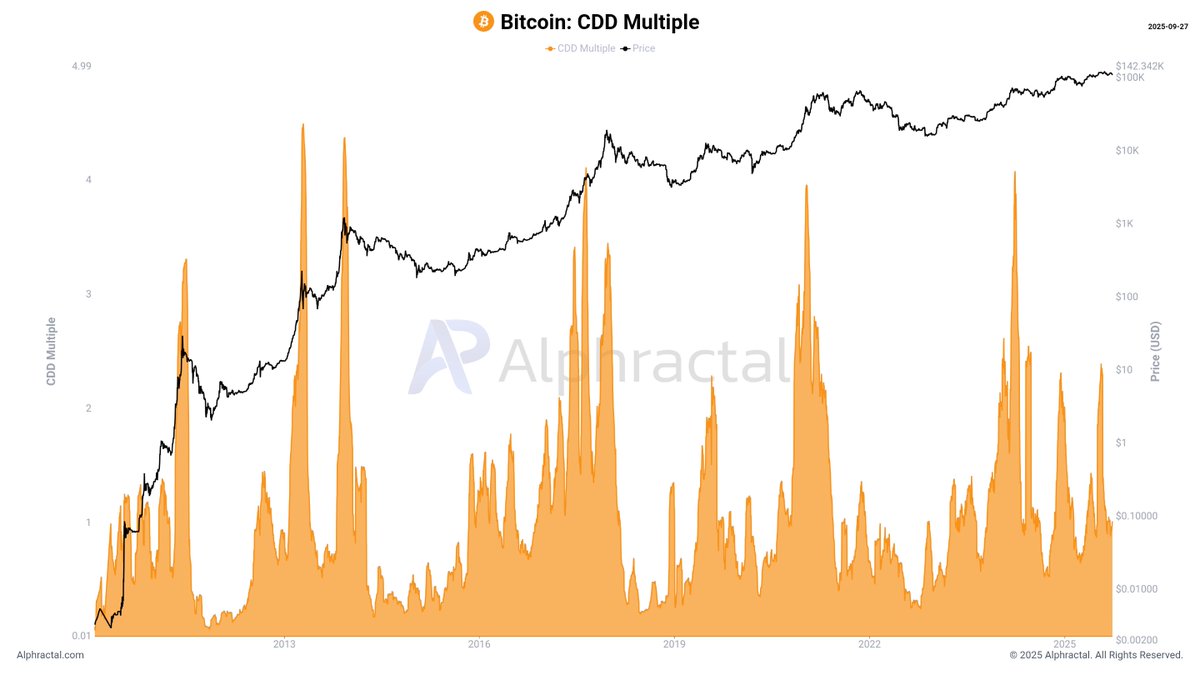

At the same time, data from Alphractal reveals that Bitcoin’s CDD Multiple, which measures how often long-dormant coins move, has declined. Long-term holders have been shifting coins at a much slower pace than in 2024, signaling reduced selling pressure.

This slowdown suggests seasoned investors are content to sit on their holdings rather than realize profits, a behavior historically linked with accumulation phases and market stability. With bitcoin trading near $109,000, many long-term holders appear to be waiting for stronger moves before acting.

READ MORE:

A Market in Balance

Together, these indicators present a split narrative: candlestick formations warn of possible corrections, while on-chain metrics highlight confidence among veteran investors. As the fourth quarter approaches, the tug-of-war between technical fragility and long-term conviction will likely define Bitcoin’s direction.

![]()