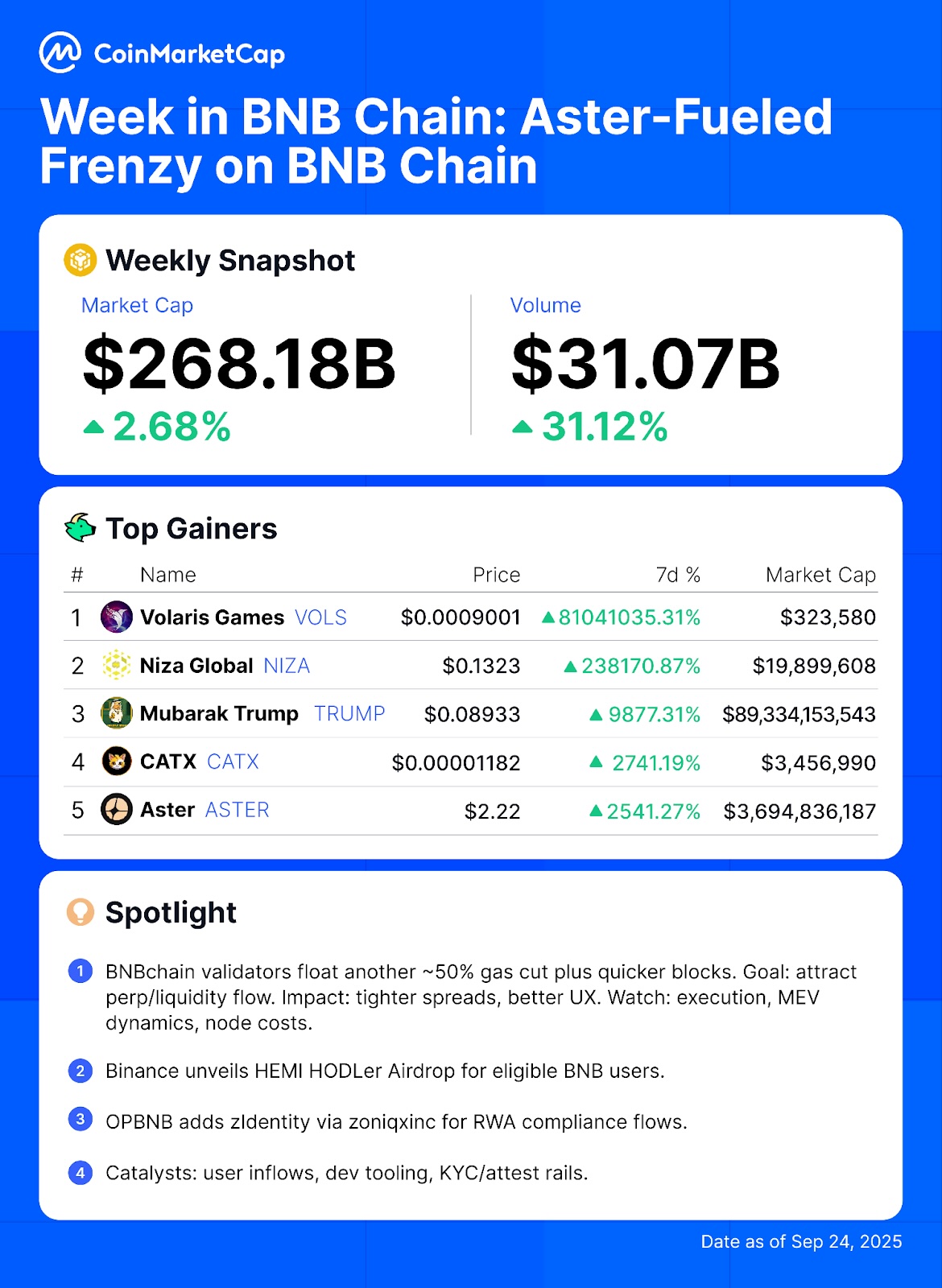

BNB Chain Surges as Airdrops, Fee Reductions, and Aster Frenzy Fuel Explosive Growth

BNB Chain just hit its stride—and traditional finance is scrambling to keep up.

Fueling the Fire

Airdrops are raining down like confetti at a bull market party. Fee cuts slash transaction costs to near-zero. And the Aster protocol's token frenzy has users flocking—bypassing traditional gatekeepers.

The Network Effect

Daily active addresses skyrocket. Transaction volumes hit new peaks. Developers deploy at record pace—cutting through red tape that still plagues legacy systems.

Market Impact

Trading activity surges as users chase yield opportunities Wall Street can't match. The chain's native token climbs while traditional assets stagnate—proving once again that innovation moves faster than regulation.

Bottom line: While bankers debate quarterly projections, BNB Chain's ecosystem executes. Another reminder that in crypto, building beats talking—and action trumps analysis paralysis.

Aster-fueled rally and “perp season”

The standout performers were a cluster of perpetual trading–linked tokens. Aster (ASTER) surged more than 2,600% on airdrop excitement and decentralized exchange traction, while APX soared over 2,200% following swap upgrades. Newcomers STBL (+188%) and AI Companions (AIC, +158%) also drew attention, driven by listings, buyback chatter, and speculative momentum.

Top gainers of the week

Beyond the “perp season” winners, several microcaps delivered eye-popping returns. Volaris Games led with an extraordinary 8,104,1035% spike, followed by Niza Global (+238,170%) and Mubarak TRUMP (+9,877%). CATX and Aster rounded out the top five, underscoring BNB Chain’s role as a launchpad for speculative breakouts.

Infrastructure shifts and incentives

BNB Chain validators are weighing another 50% gas fee cut and faster block times to attract liquidity and boost user experience. Observers note this could tighten spreads but may raise challenges around node costs and MEV dynamics.

READ MORE:

Meanwhile, Binance announced the HEMI HODLer Airdrop for BNB holders, and opBNB integrated zIdentity via Zoniqx to expand regulatory-compliant flows for real-world assets. Together, these upgrades are aimed at strengthening compliance rails, developer tooling, and user inflows.

Looking ahead

Analysts are watching whether BNB’s dominance in daily active users and fees can hold against rivals like solana and Ethereum. With Q4 seasonality approaching, the mix of structural upgrades, token incentives, and speculative flows could set the stage for another volatile stretch across the BNB ecosystem.

![]()