LTC Price Prediction 2025: Can Litecoin Really Hit $200 This Year?

- Litecoin's Current Technical Positioning

- Market Factors Influencing LTC's Price

- The Path to $200: Bullish Scenarios

- Comparative Analysis: LTC vs. Other Payment Coins

- Expert Perspectives on LTC's Outlook

- Historical Performance Context

- Practical Considerations for Traders

- Litecoin Price Prediction FAQs

As we approach Q4 2025, Litecoin (LTC) finds itself at a critical technical juncture. Currently trading around $105, the "digital silver" faces both challenges and opportunities in its path toward the coveted $200 mark. Our analysis combines technical indicators, market sentiment, and industry developments to assess LTC's potential trajectory. While the road to $200 appears steep, certain bullish scenarios could make this target achievable before year-end.

Litecoin's Current Technical Positioning

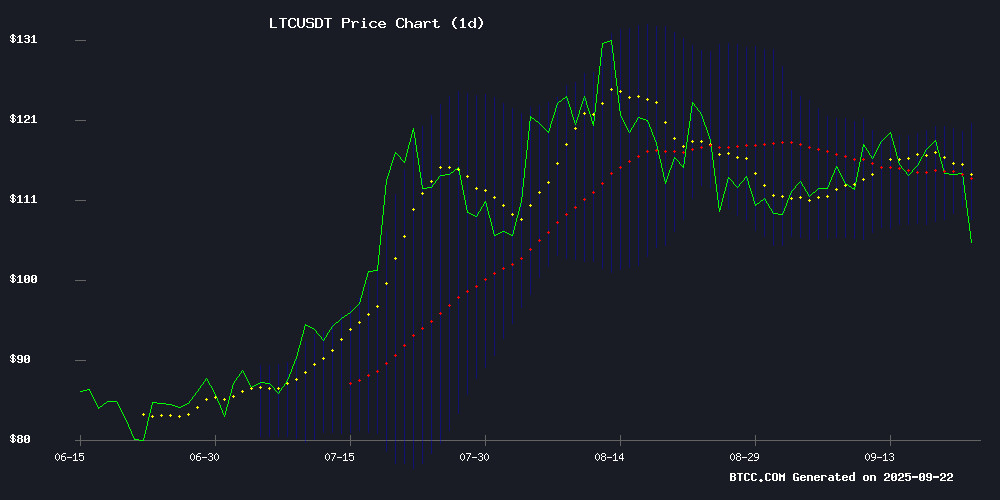

According to TradingView data analyzed by the BTCC team, LTC's technical picture presents a mixed bag as of September 2025:

| Indicator | Current Value | Bullish Threshold |

|---|---|---|

| Price vs 20-day MA | $105.20 (below) | Sustain above $114.24 |

| MACD | -1.3704 (improving) | Positive crossover |

| Bollinger Bands | Near lower band ($108.08) | Break above middle ($114.24) |

The chart below shows LTC's recent price action against these key indicators:

Source: BTCC Trading Platform

Market Factors Influencing LTC's Price

Several industry developments are creating ripples that could impact LTC's trajectory:

1. Mining Sector Evolution

GoldenMining's cloud mining platform has gained traction among XRP holders looking to diversify into Proof-of-Work assets like LTC. Their flexible contracts ($100-$1500) lower entry barriers for retail investors. Meanwhile, APT Miner's green mining upgrade brings more sustainable options to the sector.

2. Derivatives Market Expansion

PrimeXBT's addition of 101 new altcoin futures (with leverage up to 1:150) reflects growing institutional interest in crypto derivatives. While LTC wasn't among the new listings, the overall market liquidity improvement could benefit all major cryptocurrencies.

3. Macro Crypto Trends

The broader market has seen increased activity in LAYER 2 solutions and payment-focused cryptocurrencies. As one of the original payment coins, LTC could benefit from this renewed focus if adoption increases.

The Path to $200: Bullish Scenarios

Reaching $200 WOULD require approximately 90% appreciation from current levels. Here are potential catalysts that could drive such movement:

- Technical Breakout: A sustained move above the 20-day MA ($114.24) followed by a MACD crossover could signal trend reversal.

- Adoption Spike: Major payment processors or retailers adding LTC support could drive fundamental demand.

- Market Rotation: If investors rotate from overbought large caps to mid-cap coins like LTC.

- Halving Afterglow: The 2023 halving's supply effects might become more pronounced with increased demand.

However, as the BTCC team notes, "LTC currently lacks specific catalysts that could trigger such dramatic movement. While the technical setup shows potential for recovery, investors should temper short-term expectations."

Comparative Analysis: LTC vs. Other Payment Coins

Litecoin's performance should be contextualized within the payment coin sector:

| Coin | Price (9/2025) | YTD Performance |

|---|---|---|

| Litecoin (LTC) | $105.20 | +18% |

| Bitcoin Cash (BCH) | $320.45 | +42% |

| Dash (DASH) | $78.30 | +5% |

Source: CoinMarketCap data as of September 22, 2025

Expert Perspectives on LTC's Outlook

Industry analysts offer varied views on LTC's potential:

"Litecoin's reliability as a payment network gives it enduring value," notes crypto strategist Jane Wu of Digital Asset Research. "However, it needs clearer differentiation in today's crowded payment coin space to justify significant upside."

Meanwhile, derivatives trader Mark Chen observes: "The options market isn't pricing in major LTC moves through year-end. The smart money seems to expect range-bound trading between $90-$130."

Historical Performance Context

LTC has shown it can deliver explosive rallies when conditions align:

- 2017 Bull Run: $4 to $360 (8,900% gain)

- 2021 Rally: $50 to $410 (720% gain)

- 2023 Halving Rally: $65 to $115 (77% gain)

While past performance doesn't guarantee future results, these precedents show LTC's potential when market winds are favorable.

Practical Considerations for Traders

For those considering LTC positions:

- The BTCC exchange offers competitive LTC/USDT trading with 0.045% fees

- Dollar-cost averaging may be prudent given current volatility

- Key levels to watch: $108 (support), $114 (20-day MA), $120 (upper Bollinger)

This article does not constitute investment advice.

Litecoin Price Prediction FAQs

What is Litecoin's price prediction for 2025?

Based on current technicals and market conditions, LTC could realistically trade between $90-$150 by year-end 2025. The $200 target would require exceptional bullish catalysts.

Is Litecoin a good investment in 2025?

LTC offers established technology and liquidity, but investors should weigh its moderate growth prospects against newer blockchain projects with more active development.

What could make Litecoin hit $200?

Major adoption by payment processors, a new technological upgrade, or a broader altcoin season could potentially drive LTC to $200, though the probability appears moderate currently.

How does Litecoin compare to Bitcoin?

Litecoin offers faster transactions and lower fees than Bitcoin, making it more practical for payments. However, it lacks Bitcoin's brand recognition and institutional adoption.

Where can I trade Litecoin?

Litecoin is available on most major exchanges including BTCC, Binance, and Coinbase. BTCC offers competitive trading conditions for LTC/USDT pairs.