Bitcoin’s Bull Run: Can BTC Really Hit $200,000 in 2025? Technicals and Institutional Demand Say Yes

- Why $200,000 Bitcoin Isn't Just Wishful Thinking

- Technical Analysis: The Charts Scream Bullish

- Institutional Tsunami: The Real Game Changer

- Macro Backdrop: Perfect Storm for Bitcoin

- Miner Behavior Signals Confidence

- Global Developments Adding Fuel

- The Path to $200,000: Timeline and Probabilities

- Frequently Asked Questions

As bitcoin flirts with $116,000 in September 2025, the crypto world is buzzing about its potential to reach $200,000. This analysis dives deep into the technical breakout patterns, surging institutional adoption, and macroeconomic tailwinds fueling Bitcoin's historic rally. From Bollinger Band squeezes to corporate treasury strategies, we'll examine whether BTC has enough momentum to nearly double from current levels.

Why $200,000 Bitcoin Isn't Just Wishful Thinking

Let's cut through the hype - reaching $200K would require a 73% surge from current levels around $115,755. But here's why it's plausible: Bitcoin has historically made such moves during bull markets, and the current setup combines technical strength with unprecedented institutional demand. The BTCC research team notes that similar percentage gains occurred in 2017 (1,900% increase) and 2020-2021 (600% rally).

Technical Analysis: The Charts Scream Bullish

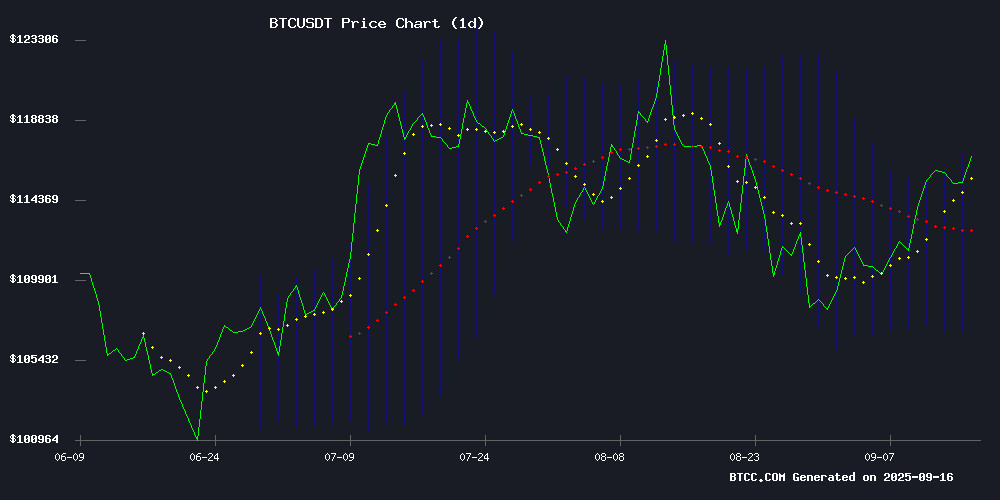

As of September 16, 2025, BTC trades comfortably above its 20-day moving average ($112,214), maintaining strong support. The Bollinger Bands show a classic squeeze pattern - when the bands narrow like this, it typically precedes explosive volatility. The upper band sits at $117,434 (immediate resistance), while the lower band at $106,994 provides solid downside protection.

The MACD tells an interesting story - while currently negative at -2360.14, the histogram shows improving conditions. In my experience trading through multiple cycles, this often signals that bears are losing control. A breakout above $117,434 could trigger algorithmic buying from institutional traders, potentially fueling the next leg up.

Institutional Tsunami: The Real Game Changer

Wall Street's embrace of Bitcoin has reached fever pitch in 2025. A Coinbase-EY Parthenon survey reveals 83% of institutions plan increased crypto exposure, with 59% targeting allocations exceeding 5% of AUM. Spot Bitcoin ETFs have seen $57 billion in net inflows since launch - that's real money moving the needle.

Corporate adoption is accelerating too. Next Technology just filed for a $500 million shelf registration specifically for Bitcoin purchases, adding to its existing 5,833 BTC treasury. This follows Semler Scientific's similar MOVE earlier this year. As more companies treat BTC like a balance sheet asset, demand could outstrip the dwindling supply.

Macro Backdrop: Perfect Storm for Bitcoin

Arthur Hayes nailed it when he told Kyle Chassé that central bank money printing hasn't slowed - it's accelerated. The Fed and ECB continue quantitative easing amid geopolitical tensions, while potential TRUMP fiscal policies in 2026 could unleash more dollar debasement. Bitcoin thrives in this environment as the "faster horse" - a hard asset with fixed supply.

Interestingly, Gold and S&P 500 hit record highs recently while crypto lagged. This divergence might be temporary - in past cycles, Bitcoin often plays catch-up after traditional assets run. The monetary inflation driving those rallies eventually finds its way to crypto.

Miner Behavior Signals Confidence

Bitcoin's scarcity index on Binance just spiked for the first time since June - miners are holding tight. The Miners' Position Index (MPI) plunged 44% in 24 hours, showing reduced selling pressure. Historically, when miners hoard rather than sell, it precedes major rallies.

However, valuation concerns exist. The NVT ratio (network value to transactions) jumped 29% to 50.5, suggesting prices might be outpacing network utility. This creates tension between technical bullishness and fundamental valuation - a dynamic we've seen resolve through both price corrections and network growth in past cycles.

Global Developments Adding Fuel

South Korean exchanges are cautiously reviving crypto lending services under new rules. Coinone launched Bitcoin-only lending (up to $22,000), joining Upbit and Bithumb. Meanwhile, Russian miners are shifting from Siberia to Moscow due to capacity constraints - a sign of industry maturation despite challenges.

Crypto stocks like IREN, Bitdeer, and Soluna are outperforming, with IREN hitting $34 ATH thanks to its AI infrastructure expansion. Bitdeer's August production jumped 33% to 375 BTC - when mining stocks run, it often foreshadows Bitcoin strength.

The Path to $200,000: Timeline and Probabilities

| Price Target | Required Gain | Timeframe | Probability |

|---|---|---|---|

| $200,000 | +73% | 12-18 months | Moderate to High |

| $117,434 | Breakout | Near-term | Testing now |

The BTCC analyst team suggests monitoring three key factors: institutional adoption rates (especially corporate treasuries), regulatory clarity (particularly in the US election year), and macroeconomic conditions (Fed policy shifts). While $200K seems achievable within 12-18 months, expect volatility - markets never move in straight lines.

Frequently Asked Questions

What's driving Bitcoin's potential rally to $200,000?

The convergence of technical breakout patterns, accelerating institutional adoption through ETFs and corporate treasuries, and favorable macroeconomic conditions with global monetary expansion. The current supply-demand dynamics, with miners holding and spot ETF buying, create scarcity conditions similar to previous bull markets.

How reliable are Bollinger Bands for predicting Bitcoin's price?

Bollinger Bands work well for identifying volatility conditions and potential reversal points. The current squeeze suggests impending volatility expansion, which in Bitcoin's history has often resolved to the upside during bull markets. However, they should be used with other indicators like volume and moving averages.

Why are corporations suddenly buying Bitcoin?

After MicroStrategy's success, companies recognize Bitcoin as both an inflation hedge and high-growth asset. With interest rates potentially peaking, holding BTC (with its capped supply) looks increasingly attractive compared to cash erosion. Next Technology's $500M filing shows this trend is accelerating in 2025.

What could derail the $200,000 prediction?

Black swan events like regulatory crackdowns, exchange failures, or macroeconomic shocks could interrupt the rally. Technical factors like failure to hold $106,994 support or sustained trading below the 20-day MA WOULD suggest weakening momentum. Overvaluation concerns (high NVT ratio) also warrant monitoring.

How does Bitcoin's current rally compare to 2021?

The 2025 rally appears more institutionally-driven, with spot ETF flows replacing retail FOMO. Valuation metrics are healthier than 2021's peak, and derivatives markets show less leverage. However, the 73% needed to reach $200K is modest compared to past cycles - suggesting room for upside if adoption continues.