Bitcoin Price Prediction 2025: Why BTC Could Hit $120K This Month (Technical & Fundamental Analysis)

- BTC Technical Analysis: The Bullish Setup

- Fundamental Catalysts Driving Bitcoin Higher

- Key Resistance Levels to Watch

- Mining Metrics Signal Strong Confidence

- Institutional Developments Boost Sentiment

- Macroeconomic Tailwinds

- Bitcoin vs. Gold: The Valuation Gap

- Is Bitcoin a Good Investment Right Now?

- Bitcoin Price Prediction FAQ

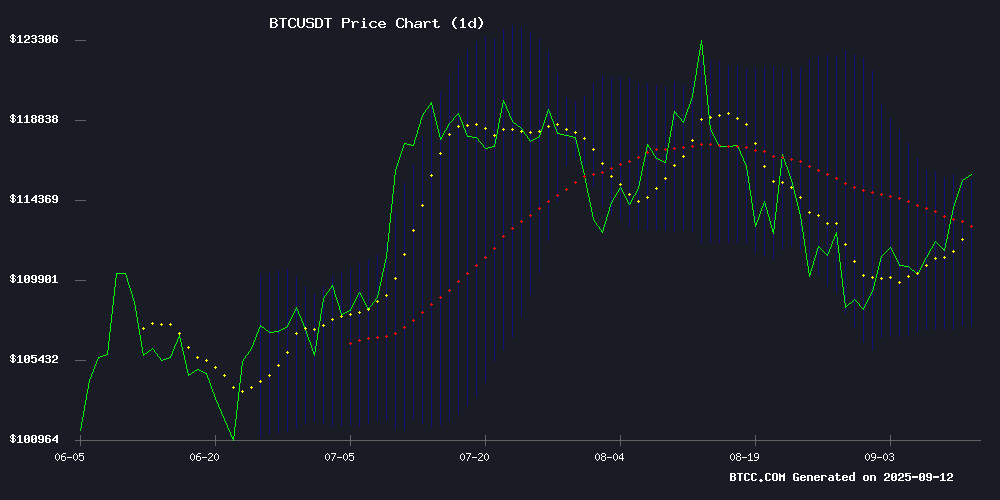

Bitcoin is showing explosive bullish signals as we enter mid-September 2025. Trading comfortably above $116,000 with record network fundamentals and multiple catalysts aligning, crypto analysts are eyeing the $120,000 psychological barrier as the next major target. Here's why both technical indicators and fundamental developments suggest bitcoin could make its next major move upward this month.

BTC Technical Analysis: The Bullish Setup

As of September 12, 2025, BTC is trading at $116,071 - well above its critical 20-day moving average of $111,433. This price action suggests sustained bullish momentum despite some short-term volatility. The MACD configuration shows the signal line at 1,820.4262 with the MACD line at -65.3225, hinting at potential upward movement even with the current negative histogram reading.

"The technical setup strongly supports continued upward movement toward $120,000," notes the BTCC research team. "The $114,000 weekly close serves as critical support for this bullish thesis - if we hold above that level, the path to new highs looks clear."

Fundamental Catalysts Driving Bitcoin Higher

Several fundamental factors are converging to create a perfect storm for Bitcoin:

| Catalyst | Impact |

|---|---|

| Record hash rate (1.12B TH/s) | Demonstrates unprecedented network security |

| Fed rate cut expectations | Macro tailwinds for risk assets |

| Institutional adoption | Gemini's successful Nasdaq debut highlights growing acceptance |

| Miner accumulation | Reserves hit 50-day high of 1.808M BTC |

Key Resistance Levels to Watch

According to TradingView data, Bitcoin faces its next major test at $117,200 - a level reinforced by a CME gap. A clean break above this resistance could open the path to $120,000 and beyond, while failure to hold current levels might see a retest of monthly lows around $107,000.

Analyst Rekt Capital emphasizes the importance of the weekly close: "Bitcoin must hold above $114K on the weekly close to maintain bullish bias. That's the make-or-break level for the $114K-$120K range we're watching."

Mining Metrics Signal Strong Confidence

Bitcoin's network fundamentals have never been stronger. The hash rate reached an unprecedented 1.12 billion terahashes per second on September 12, while network difficulty is projected to hit 136.04T by September 18 - a 6.38% increase from current levels.

Varun Satyam of Davos Protocol notes: "These record metrics show miners are betting big on Bitcoin's future despite the challenges. The arms race in mining efficiency continues to intensify."

Institutional Developments Boost Sentiment

Gemini's Nasdaq debut saw shares surge nearly 40%, valuing the exchange at $3.3 billion. Despite financial losses, the Winklevoss twins remain bullish, predicting Bitcoin could reach $1 million if it captures gold's market position.

Meanwhile, El Salvador continues accumulating BTC despite IMF conditions, with on-chain data revealing 28 new BTC purchases this week alone. The nation now holds 6,318 BTC ($726.8M at current prices).

Macroeconomic Tailwinds

The Federal Reserve's impending rate decision on September 17 adds another potential catalyst, with markets pricing in a 25-basis-point cut. Recent PPI data already sparked $500 million in taker buy volume on Binance, showing how sensitive crypto markets remain to macro indicators.

Bitcoin vs. Gold: The Valuation Gap

With Bitcoin's market cap still under $3 trillion compared to gold's $25 trillion valuation, the upside potential remains enormous. The cryptocurrency's fixed supply and decentralized issuance make it increasingly attractive as "digital gold" in an era of monetary uncertainty.

Is Bitcoin a Good Investment Right Now?

Based on current technicals and fundamentals, Bitcoin presents a compelling case:

| Metric | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $116,072 vs $111,433 | Price above support |

| Bollinger Band Position | Near upper band | Momentum intact |

| Hash Rate | 1.12B TH/s (Record) | Network strength |

| Market Sentiment | Overwhelmingly bullish | Catalysts aligned |

However, investors should always consider volatility and maintain appropriate position sizing according to their risk tolerance. This article does not constitute investment advice.

Bitcoin Price Prediction FAQ

What is Bitcoin's price prediction for September 2025?

Based on current technical indicators and fundamental catalysts, analysts predict Bitcoin could reach $120,000 in September 2025 if it maintains above the critical $114,000 support level.

Why is Bitcoin's hash rate important?

Bitcoin's hash rate (currently at record 1.12B TH/s) measures the computational power securing the network. Higher hash rates indicate greater network security and miner confidence in Bitcoin's future value.

How does Fed policy affect Bitcoin?

Expected Fed rate cuts (like the potential 25-basis-point cut on September 17) typically benefit risk assets like Bitcoin by reducing the opportunity cost of holding non-yielding assets and potentially weakening the dollar.

What's the significance of Gemini's Nasdaq debut?

Gemini's successful IPO (shares up 40%, $3.3B valuation) signals growing institutional acceptance of cryptocurrency infrastructure, potentially bringing more mainstream investors into the crypto market.

How does Bitcoin compare to gold as an investment?

With Bitcoin's market cap under $3 trillion versus gold's $25 trillion, analysts see significant upside potential if Bitcoin continues gaining ground as "digital gold" - especially given its fixed supply and decentralized nature.