Ethereum Price Prediction 2025: Will Institutional Demand Overcome $4,475 Resistance?

- What's Driving Ethereum's Price Action in September 2025?

- How Are Institutions Positioning Themselves in ETH?

- What Technical Levels Should Traders Watch?

- Are Ethereum ETFs Still a Bullish Catalyst?

- How Does the BETH Token Factor Into ETH's Value?

- What Historical Patterns Suggest for September?

- Where Do Analysts See ETH Heading Next?

- Ethereum Price Prediction Q&A

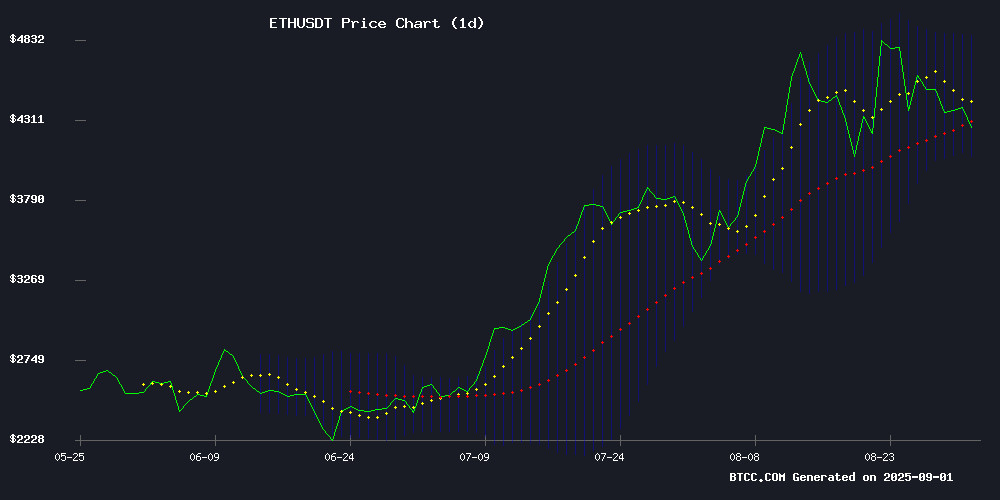

Ethereum (ETH) finds itself at a critical juncture as we enter September 2025, trading below the psychologically important $4,475 level while showing signs of both technical resistance and fundamental strength. The cryptocurrency currently sits at $4,410.87, caught between institutional accumulation reaching 9.2% of total supply and technical resistance at the 20-day moving average. Market indicators reveal an intriguing battle between whales exiting positions ($1.8 billion sold recently) versus institutions quietly accumulating ($358 million moved to cold storage). With Bollinger Bands suggesting a range between $4,093-$4,856 and analysts like Tom Lee projecting $12,000 targets, Ethereum's next moves could define the crypto market's trajectory for Q4 2025.

What's Driving Ethereum's Price Action in September 2025?

The ETH market presents a fascinating dichotomy in early September 2025. On one hand, we're seeing aggressive institutional accumulation - US spot ETFs alone now hold 5.6% of circulating supply ($31.2 billion worth), while corporate treasuries like BitMine Immersion Tech have acquired $8 billion in ETH since June. On the technical side, ETH remains below its 20-day MA ($4,475.10) with MACD showing improving momentum (-14.91 vs -114.11 signal line). This creates what the BTCC team calls a "compression spring" scenario - the fundamentals suggest upside potential, but technicals need to confirm with a breakout above $4,475.

Source: BTCC

How Are Institutions Positioning Themselves in ETH?

The institutional embrace of ethereum has reached unprecedented levels in 2025. VanEck CEO Jan van Eck famously dubbed ETH "the Wall Street token," reflecting its growing role in stablecoin infrastructure. The numbers tell the story:

| Metric | Value |

|---|---|

| Institutional ETH Holdings | 9.2% of circulating supply |

| US Spot ETF Holdings | 5.6% ($31.2B) |

| Corporate Treasury Holdings | 3.6% ($20.1B) |

| Recent Whale Accumulation | $358M (78,891 ETH) |

ARK Invest's recent $15.6 million BitMine purchase exemplifies this trend, despite BMNR's 7.85% price drop on August 27. What's fascinating is how institutions are using price dips - Binance's ETH reserves dropped 10% in a week as whales moved coins to cold storage. As one analyst quipped, "The smart money isn't selling - they're just making sure exchanges can't lend out their coins."

What Technical Levels Should Traders Watch?

The technical setup presents clear levels for ETH traders:

- $4,093 (Lower Bollinger Band) - Strong support that held during August's volatility

- $4,475 (20-day MA) - Key resistance that needs to break for bullish confirmation

- $4,856 (Upper Bollinger Band) - Near-term target if $4,475 breaks

- $5,000-5,500 - Medium-term institutional price target range

The MACD's improvement suggests waning bearish momentum, but as the BTCC technical team notes, "Until ETH reclaims $4,475, the bears still have the ball." The 20-day MA has acted as both support and resistance throughout 2025, making its current position particularly significant.

Are Ethereum ETFs Still a Bullish Catalyst?

US Ethereum ETFs present a mixed picture. After absorbing $1.08 billion over six days, Friday saw $165 million exit - with Grayscale's ETH mini-trust losing $61.3 million alone. This profit-taking comes despite BlackRock's iShares Ethereum ETF recently ranking second among 4,400 tracked funds for inflows.

Standard Chartered's Geoffrey Kendrick observes, "The ETF flows reflect short-term trader behavior, while the underlying institutional accumulation tells a different story." Indeed, treasury firms and spot ETFs have absorbed nearly 5% of circulating supply since June during ETH's climb to $4,955 in late August.

How Does the BETH Token Factor Into ETH's Value?

The Ethereum Community Foundation's new BETH token adds an intriguing dimension. Unlike abstract EIP-1559 burns, BETH makes ETH's burn mechanism tangible - burning ETH to mint BETH. Core developer Zak Cole compares it to WETH, suggesting it could standardize burn tracking across protocols.

This innovation matters because, as the ECF stated, "BETH highlights the role of scarcity and destruction as equally powerful forces alongside creation and issuance." In a market where ETH's circulating supply actually decreased by 0.5% in August due to burns, this visibility could enhance ETH's store-of-value narrative.

What Historical Patterns Suggest for September?

September hasn't traditionally been kind to ETH - with modest gains of 3.20% in 2024 and 1.49% in 2023 following negative Septembers in prior years. Current NUPL metrics (0.62 approaching three-month highs) suggest long-term holders are sitting on significant gains, which historically preceded corrections like August's 8.9% drop at NUPL 0.63.

However, RAAC CEO Kevin Rusher counters, "Corporate demand creates a fundamentally different market structure than previous years." The question becomes whether institutional accumulation can override seasonal tendencies and profit-taking pressures.

Where Do Analysts See ETH Heading Next?

Price targets vary wildly:

- Tom Lee (Fundstrat): $5,500 near-term, $12,000 by year-end

- BTCC Technical Team: $4,856 near-term, $5,000-5,500 medium-term

- Standard Chartered: $6,000 by Q1 2026

Lee's bullish case hinges on ETH becoming the verification layer for AI-generated data: "Agentic AI needs Immutable verification - that's Ethereum's next frontier." Meanwhile, the BTCC team emphasizes watching the $4,475 level: "Break that, and $4,856 becomes likely. Fail, and we retest $4,093."

Ethereum Price Prediction Q&A

What is Ethereum's current price and key technical levels?

As of September 1, 2025, Ethereum trades at $4,410.87. Key levels include support at $4,093 (lower Bollinger Band), resistance at $4,475 (20-day MA), and potential upside to $4,856 (upper Bollinger Band). The MACD shows improving momentum at -14.91 versus a -114.11 signal line.

How much ETH do institutions currently hold?

Institutional investors and ETFs now hold 9.2% of Ethereum's circulating supply. This includes 5.6% held by US spot ETFs ($31.2 billion) and 3.6% held by corporate treasuries (4.36 million ETH worth $20.1 billion).

What are the bullish and bearish factors for ETH?

Bullish factors include institutional accumulation reaching record levels, the BETH token enhancing scarcity visibility, and growing use in AI verification systems. Bearish factors include whale exits ($1.8 billion sold recently), September's historically weak performance, and NUPL metrics suggesting overbought conditions.

Where can I trade ETH?

ETH is available on major exchanges like BTCC, Binance, and Coinbase. This article does not constitute investment advice.