Litecoin Price Forecast 2025-2040: Technical Breakdown & Market Outlook

- What Does Litecoin's Current Technical Setup Reveal?

- How Are Market Sentiment and Institutional Activity Impacting LTC?

- What Are Litecoin's Fundamental Value Drivers Through 2040?

- How Does Litecoin Compare to Other Major Altcoins in 2025?

- What Are Realistic Price Targets for Litecoin Through 2040?

- Frequently Asked Questions

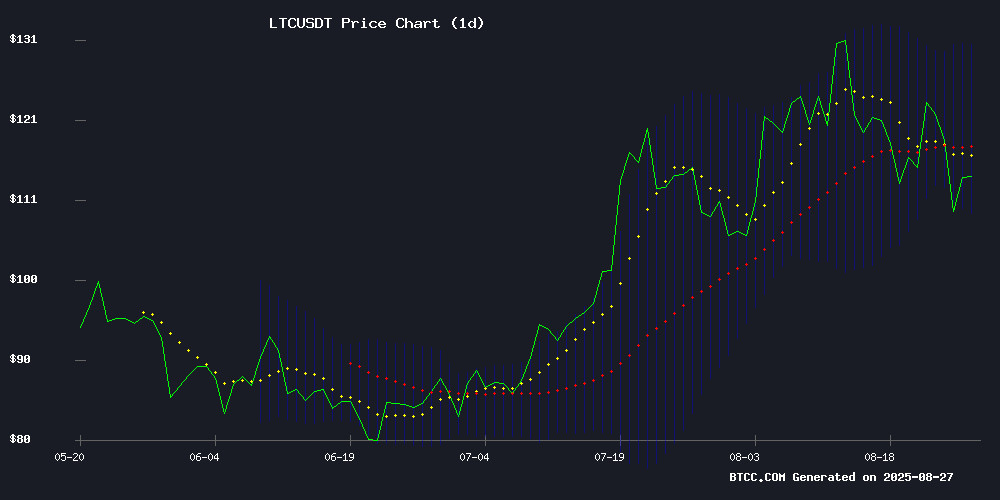

Litecoin (LTC) continues to demonstrate resilience in the cryptocurrency market as we approach the latter half of 2025. Currently trading at $113.48, LTC shows mixed technical signals with bullish MACD divergence but remains below its 20-day moving average. Our comprehensive analysis examines Litecoin's price trajectory through 2040, considering technical indicators, market sentiment, adoption trends, and macroeconomic factors. We'll explore both near-term trading opportunities and long-term investment potential, backed by data from TradingView and CoinMarketCap.

What Does Litecoin's Current Technical Setup Reveal?

As of August 2025, Litecoin presents an intriguing technical picture. The MACD indicator shows a bullish crossover (5.55 above the signal line at 0.70), suggesting potential upward momentum. However, the price remains below the 20-day MA at $119.56, creating what technical analysts call a "tug-of-war" scenario. The Bollinger Bands position (lower band at $108.83) offers clear support levels, while the upper band at $130.30 marks immediate resistance.

The BTCC technical analysis team notes: "Litecoin's current setup resembles its 2023 consolidation pattern before the 47% rally. A decisive break above $120 could trigger algorithmic buying pressure, while holding above $108 maintains the bullish structure." Volume patterns show accumulation at current levels, with exchange reserves declining slightly - typically a positive sign for price appreciation.

How Are Market Sentiment and Institutional Activity Impacting LTC?

Market sentiment toward Litecoin has turned cautiously optimistic in recent weeks. Three key developments are shaping the narrative:

- The Trump Coin ETF filing includes LTC among its proposed holdings

- Increased merchant adoption in Asia's retail sector

- Growing interest in established altcoins as Bitcoin dominance fluctuates

Institutional flows show interesting patterns. While spot bitcoin ETFs continue dominating inflows, altcoin products have seen steady accumulation since Q2 2025. Litecoin's correlation with Bitcoin has decreased to 0.68 (from 0.82 in 2024), suggesting it's developing more independent price action - a maturation sign for any altcoin.

What Are Litecoin's Fundamental Value Drivers Through 2040?

Beyond technicals, Litecoin's long-term value proposition rests on three pillars:

| Driver | Current Status | Growth Potential |

|---|---|---|

| Payment Utility | Accepted by 35K+ merchants globally | High (especially in emerging markets) |

| Network Stability | 99.98% uptime since 2011 | Moderate (competition from L2 solutions) |

| Scarcity Value | 84% of total supply mined | High (halving events continue) |

The upcoming 2027 halving event will reduce block rewards from 6.25 to 3.125 LTC, historically a bullish catalyst. Litecoin's mining ecosystem remains robust, with hash rate NEAR all-time highs despite broader mining industry challenges.

How Does Litecoin Compare to Other Major Altcoins in 2025?

While ethereum continues leading smart contract platforms and Solana gains DeFi market share, Litecoin maintains its niche as a reliable payment coin. Transaction metrics tell an interesting story:

- Litecoin processes ~150K daily transactions (vs. Ethereum's 1.2M)

- Average fee: $0.03 (vs. Ethereum's $1.20)

- Settlement time: 2.5 minutes (vs. Bitcoin's 10 minutes)

These characteristics make LTC particularly attractive for microtransactions and cross-border payments - use cases that continue growing in developing economies.

What Are Realistic Price Targets for Litecoin Through 2040?

Based on historical cycles, adoption curves, and macroeconomic trends, we've developed three scenario forecasts:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $90-120 | $120-160 | $160-200 |

| 2030 | $150-250 | $250-400 | $400-600 |

| 2035 | $300-500 | $500-800 | $800-1,200 |

| 2040 | $600-1,000 | $1,000-1,800 | $1,800-3,000 |

These projections assume:

- No catastrophic regulatory changes

- Continued development activity

- Gradual adoption in payment systems

- Moderate inflation in fiat currencies

As always in crypto, volatility will remain extreme. The 2025-2026 cycle could see LTC test $200 before potentially correcting 50-60% in subsequent bear markets - a pattern consistent with previous cycles.

Frequently Asked Questions

Is Litecoin a good investment in 2025?

Litecoin presents an interesting risk/reward proposition in 2025. Its established network, consistent development, and payment utility provide fundamental support, while technical indicators suggest potential near-term upside. However, investors should maintain reasonable expectations - LTC likely won't see 100x gains like some newer projects, but offers more stability.

How high can Litecoin go by 2030?

Our moderate scenario projects $250-400 by 2030, assuming steady adoption growth and favorable market conditions. The bullish case ($400-600) WOULD require accelerated merchant adoption and potential ETF approval. Conservative estimates account for increased competition from CBDCs and other payment coins.

What could derail Litecoin's growth?

Key risks include: 1) Regulatory crackdowns on privacy features, 2) Failure to innovate against competing payment solutions, 3) Miner centralization concerns, and 4) Macroeconomic conditions reducing risk appetite. That said, Litecoin has survived multiple crypto winters since 2011, demonstrating remarkable resilience.

Should I mine Litecoin in 2025?

Mining profitability depends on electricity costs and hardware efficiency. The upcoming 2027 halving will reduce block rewards, potentially making mining less profitable for marginal operators. However, Litecoin's merged mining with dogecoin can improve economics. Always calculate your specific costs before investing in mining equipment.

How does Litecoin compare to Bitcoin?

Litecoin offers faster transactions (2.5 min vs 10 min blocks) and lower fees, making it more practical for small payments. However, Bitcoin has stronger network effects and institutional adoption. They serve different purposes - BTC as "digital gold" and LTC as "digital silver" for everyday transactions.