BTC Price Prediction 2025: Will $110K Support Hold Amid Market Turbulence?

- What Are the Key Technical Levels for Bitcoin?

- How Is Market Sentiment Affecting Bitcoin?

- What Fundamental Factors Are Influencing BTC Price?

- Where Could Bitcoin Price Go From Here?

- Bitcoin Price Prediction FAQs

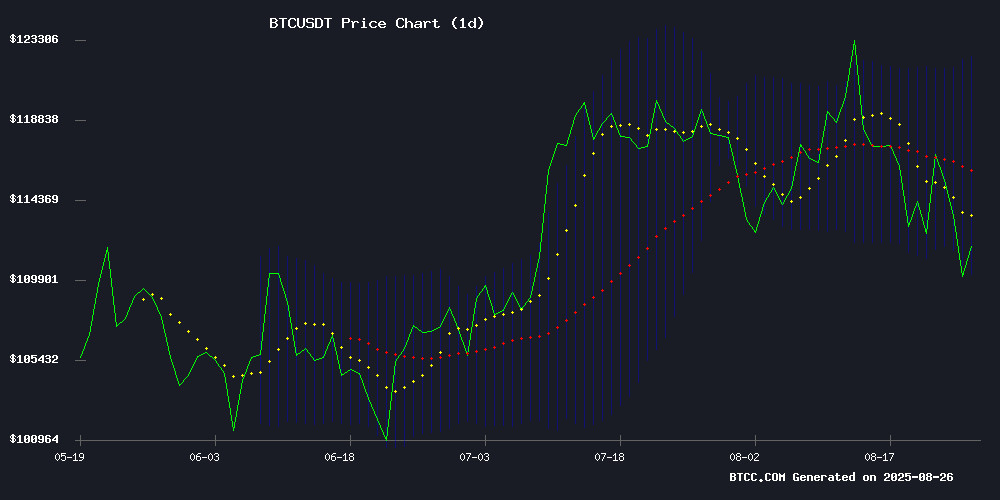

Bitcoin's price action has entered a critical phase as it tests key support levels while facing strong resistance. As of August 27, 2025, BTC trades at $111,216, caught between the lower Bollinger Band at $110,097 and the 20-day moving average resistance at $116,276. This technical battleground comes amid mixed signals - institutional accumulation continues through players like MicroStrategy and UAE sovereign mining, while retail investors panic with ETF outflows reaching six consecutive days. The next price direction likely hinges on whether BTC can maintain this crucial $110K support zone.

What Are the Key Technical Levels for Bitcoin?

The BTC/USDT chart reveals several critical technical levels that traders are watching closely. The immediate support at $110,097 represents the lower Bollinger Band, while the 20-day MA at $116,276 serves as near-term resistance. According to TradingView data, the MACD indicator shows positive but weakening momentum, with the histogram at 1,605.

Looking at the bigger picture, we see three potential scenarios:

| Scenario | Price Target | Probability |

|---|---|---|

| Bullish Breakout | $125,000-$130,000 | 30% |

| Range Bound | $110,000-$116,000 | 50% |

| Bearish Breakdown | $105,000-$100,000 | 20% |

The BTCC team notes: "The $110K level represents a make-or-break moment for Bitcoin's bull cycle. Institutional buyers appear ready to step in around these levels, but technical damage could accelerate if we see a decisive break below."

How Is Market Sentiment Affecting Bitcoin?

Current market sentiment presents a fascinating dichotomy. On one hand, we're seeing panic among retail investors, with bitcoin ETFs experiencing six straight days of outflows totaling $219 million. On the other hand, institutional players continue accumulating - MicroStrategy just added 3,081 BTC to its treasury, while the UAE government has mined 6,333 BTC through sovereign operations.

The negative sentiment stems from several factors:

- Large liquidations totaling $800 million

- Bearish commentary from critics like Peter Schiff

- Technical breakdown below key moving averages

However, the BTCC analyst team observes: "This retail panic often precedes local bottoms. The same pattern occurred in April 2025 before a 28% rally. Institutional players seem to be using this weakness as an accumulation opportunity."

What Fundamental Factors Are Influencing BTC Price?

Several fundamental developments are shaping Bitcoin's price action:

U.S. Government Blockchain Initiative

The Commerce Department announced plans to publish GDP data on blockchain, signaling growing institutional adoption. Howard Lutnick, heading the initiative, stated: "We're putting GDP on blockchain for transparent data distribution." This move follows Trump administration's pro-crypto policies, including the Bitcoin strategic reserve unveiled earlier this year.

Sovereign Bitcoin Mining

The UAE has emerged as a major player in state-backed Bitcoin mining, accumulating 6,333 BTC worth $700 million through operations controlled by the Abu Dhabi royal family. Unlike Western governments that acquire BTC through seizures, the UAE is converting oil wealth into digital assets via industrial-scale mining infrastructure.

Corporate Bitcoin Strategies

French semiconductor firm Sequans filed a $200 million equity offering specifically for Bitcoin accumulation, aiming to hold 100,000 BTC by 2030. This follows MicroStrategy's latest purchase of 3,081 BTC, bringing their total holdings to 632,457 BTC - over 3% of total supply.

Where Could Bitcoin Price Go From Here?

The immediate price trajectory depends largely on whether BTC can hold the $110K support level. A breakdown could see a test of $105K, while holding above could lead to a retest of the 20-day MA at $116,276.

Longer-term, several factors suggest potential upside:

- Institutional accumulation continues despite price weakness

- Government adoption signals growing legitimacy

- Historically, retail panic often precedes rallies

However, risks remain:

- ETF outflows could continue pressuring price

- Technical damage if $110K breaks decisively

- Macroeconomic uncertainty

As always in crypto markets, volatility remains the only certainty. The coming days will reveal whether institutional conviction can overcome retail panic at these critical levels.

Bitcoin Price Prediction FAQs

What is Bitcoin's current support level?

Bitcoin is currently testing crucial support at $110,097 (lower Bollinger Band), with additional support around $107,000 and $100,000 if that level breaks.

What's causing Bitcoin's price decline?

The drop stems from technical breakdowns, ETF outflows ($219 million over six days), large liquidations ($800 million), and negative market sentiment.

Are institutions still buying Bitcoin?

Yes, major players like MicroStrategy (adding 3,081 BTC) and the UAE government (mining 6,333 BTC) continue accumulating despite price weakness.

What's the bullish case for Bitcoin?

Bullish factors include institutional accumulation, government adoption (U.S. putting GDP on blockchain), and historical patterns where retail panic precedes rallies.

What's the bearish case for Bitcoin?

Bearish factors include continued ETF outflows, technical damage below key levels, and macroeconomic uncertainty.

Where can I trade Bitcoin?

You can trade Bitcoin on regulated exchanges like BTCC, which offers secure trading with advanced charting tools and liquidity.