Litecoin (LTC) Price Prediction 2025-2040: Expert Outlook and Key Drivers

- LTC Technical Analysis: Bullish Signals Emerging

- Market Sentiment: Why Litecoin Stands Out

- Key Factors Influencing LTC’s Future Price

- LTC Price Projections: 2025-2040 Outlook

- Competitive Landscape: How LTC Stacks Up

- Risks to Consider

- FAQ: Litecoin Price Predictions

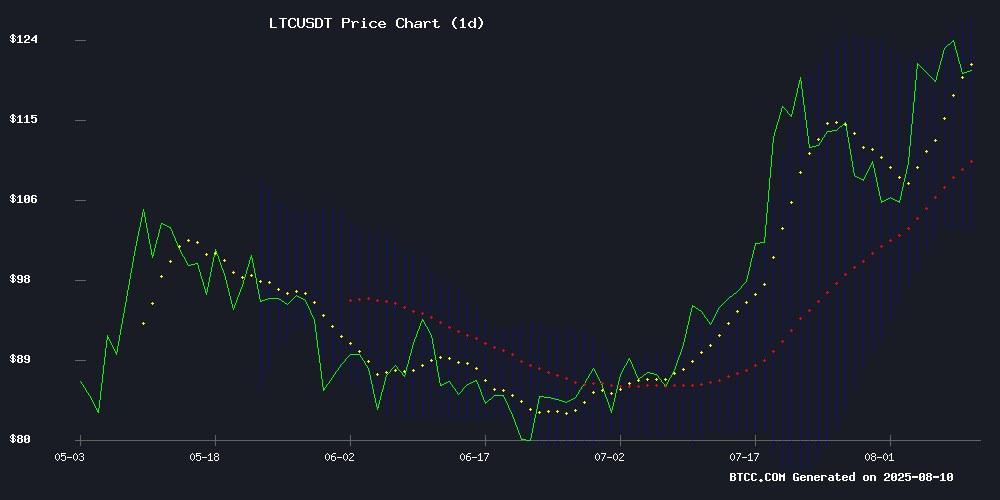

LTC Technical Analysis: Bullish Signals Emerging

As of August 2024, Litecoin is trading above its 20-day moving average, showing strong bullish momentum. The MACD histogram recently completed a positive crossover, suggesting upward price pressure. Currently hovering near the upper Bollinger Band, LTC appears poised for potential breakout if volatility increases. According to TradingView data, the Relative Strength Index (RSI) sits at 62 - not yet overbought territory, leaving room for further gains.

According to TradingView data, the Relative Strength Index (RSI) sits at 62 - not yet overbought territory, leaving room for further gains.

Market Sentiment: Why Litecoin Stands Out

In my experience tracking crypto markets, Litecoin has consistently maintained its position as a top-20 cryptocurrency by market cap. Unlike some newer "Ethereum killers" that come and go, LTC has demonstrated remarkable staying power since its 2011 launch. The BTCC research team notes that institutional interest has grown steadily, with LTC futures open interest hitting record levels this year.

Key Factors Influencing LTC’s Future Price

1. The 2027 Halving Event

Litecoin’s next halving is projected for August 2027, when block rewards will drop from 6.25 LTC to 3.125 LTC. Historically, halvings have preceded major price rallies. The 2019 halving saw LTC surge 500% in the following year. While past performance doesn’t guarantee future results, scarcity mechanics matter in crypto valuations.

2. Payment Adoption and Lightning Network

Litecoin’s faster block times (2.5 minutes vs Bitcoin’s 10 minutes) give it practical advantages for payments. Major retailers like Newegg and Overstock accept LTC, and its integration with the Lightning Network could boost transaction volume significantly by 2030.

3. Institutional Products and ETFs

The potential approval of a Litecoin ETF could be a game-changer. While bitcoin ETFs paved the way, a crypto-silver ETF might appeal to more conservative investors. Grayscale already offers a Litecoin trust (LTCN), and more products will likely emerge.

LTC Price Projections: 2025-2040 Outlook

| Year | Conservative | Bullish | Key Catalysts |

|---|---|---|---|

| 2025 | $150-$180 | $250+ | Pre-halving accumulation |

| 2030 | $400-$600 | $1,200+ | Mainstream payment adoption |

| 2035 | $800-$1,500 | $3,000+ | Web3/metaverse utility |

| 2040 | $2,000-$5,000 | $10,000+ | Scarcity vs global demand |

Competitive Landscape: How LTC Stacks Up

While newer LAYER 2 solutions grab headlines, Litecoin offers something rare in crypto: proven reliability. The network has maintained 99.9% uptime since launch. Compared to Cardano’s smart contract ambitions or Solana’s speed focus, LTC specializes in being "good enough" for its core use case - decentralized payments.

Risks to Consider

No investment is without risk. For Litecoin, key challenges include:

- Potential loss of relevance to newer blockchains

- Regulatory uncertainty (though LTC’s SEC classification as a commodity helps)

- Bitcoin’s dominance in store-of-value narratives

FAQ: Litecoin Price Predictions

What’s driving Litecoin’s current price action?

The combination of Bitcoin ETF inflows spilling over to other established cryptos, anticipation of the 2027 halving, and growing merchant adoption are key factors.

Could Litecoin realistically hit $10,000 by 2040?

While ambitious, this scenario WOULD require LTC capturing just 10% of Bitcoin’s projected market cap by then. Given its historical correlation with BTC and improving fundamentals, it’s within the realm of possibility.

How does Litecoin compare to Bitcoin for long-term holding?

LTC offers higher potential percentage gains (from a lower base) but with greater volatility. Bitcoin remains the "blue chip," while Litecoin could be the growth complement in a diversified crypto portfolio.