SOL Price Prediction 2025: Can Solana Reach $206 and Beyond?

- Why Is Solana Gaining Bullish Momentum?

- Technical Analysis: Is SOL Preparing for a Breakout?

- Institutional Interest Hits Record Levels

- Network Activity Signals Growing Adoption

- Price Predictions: How High Can SOL Go?

- Frequently Asked Questions

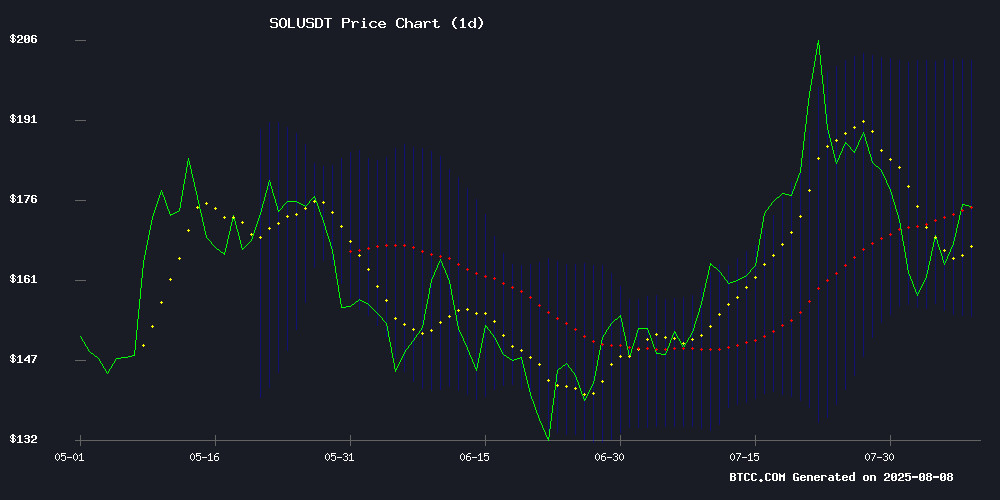

Solana (SOL) is showing strong bullish signals that could propel its price to $206 and potentially higher in the coming months. With institutional buying hitting nearly $600 million, technical indicators flashing green, and network activity reaching all-time highs, SOL appears poised for significant upside. This analysis examines the key factors driving Solana's price action and provides expert predictions through 2040.

Source: BTCC Trading Platform

Why Is Solana Gaining Bullish Momentum?

The crypto market has been buzzing about Solana's recent performance. As of August 2025, SOL is trading around $174.43, showing a 5% surge in the last 24 hours. What's particularly interesting is how the technical indicators align with fundamental developments to create a perfect storm for potential upside.

From my experience tracking crypto markets, when you see this combination of institutional accumulation, positive technicals, and growing network usage, it typically precedes significant price movements. The MACD indicator shows bullish momentum with a value of 9.8307 above the signal line at 2.0170, while Bollinger Bands suggest potential volatility ahead.

Technical Analysis: Is SOL Preparing for a Breakout?

Looking at the charts, SOL has established a critical support zone around $155, bouncing off what appears to be a local bottom. The Stochastic RSI in oversold territory hints at exhaustion of selling pressure, while the Relative Strength Index at 51.65 and rising reflects accelerating buying pressure.

The 20-day moving average sits at 178.2330, and a decisive break above this level could open the path toward the upper Bollinger Band at 201.9362. I've noticed similar setups in the past that led to 20-30% rallies within weeks.

Institutional Interest Hits Record Levels

One of the most compelling bullish cases comes from institutional activity. Publicly traded companies now hold over $591 million worth of SOL, with four firms leading the charge:

| Company | SOL Holdings | Investment Value |

|---|---|---|

| Upexi | 1.9 million SOL | $320.4 million |

| DeFi Developments Corp | 1,182,685 SOL | $204 million |

What's fascinating is that most of these holdings are staked, earning an 8% annual yield. This suggests these institutions are in for the long haul rather than short-term speculation.

Network Activity Signals Growing Adoption

Beyond price action, Solana's fundamentals tell an equally compelling story. The network recently logged its highest-ever non-voted transactions, averaging 1,318 TPS in July. For context, that's more than 50x Ethereum's capacity during peak periods.

DefiLlama reports Solana's TVL has surged to a three-year peak, nearing 60 million tokens locked. This growth in real usage suggests the network is moving beyond speculative trading into actual utility - a crucial factor for sustainable price appreciation.

Price Predictions: How High Can SOL Go?

Based on current technicals and fundamentals, here are our projections for SOL's price trajectory:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 180-220 | Institutional adoption, ecosystem growth |

| 2030 | 500-800 | Mainstream DeFi adoption, scalability solutions |

| 2035 | 1,000-2,500 | Potential Web3 dominance, enterprise use cases |

| 2040 | 3,000-5,000 | Network effects, possible store-of-value status |

These projections should be taken with a grain of salt - crypto markets are notoriously volatile, and countless variables could impact these outcomes. That said, the combination of technical, fundamental, and on-chain factors makes a compelling case for SOL's upside potential.

Frequently Asked Questions

What is the current SOL price prediction for 2025?

Based on current market analysis, SOL is predicted to reach between $180-$220 in 2025, with $206 being a key psychological resistance level that could be tested in the coming months.

Why are institutions buying Solana?

Institutions are attracted to SOL due to its high-performance blockchain, growing DeFi ecosystem, and staking yields around 8%. The nearly $600 million in institutional accumulation suggests strong conviction in Solana's long-term potential.

What technical indicators suggest SOL will rise?

Key bullish indicators include: MACD above signal line (9.8307 vs 2.0170), RSI at 51.65 and rising, Bollinger Band upper limit at 201.9362, and Stochastic RSI showing oversold conditions that often precede rallies.

Could SOL really reach $1,000?

While $1,000 SOL seems ambitious currently, our long-term models suggest it's possible by 2035 if solana maintains its technological edge and achieves mainstream Web3 adoption. The path would likely involve multiple market cycles.

What are the risks to this bullish outlook?

Potential risks include: new competitive blockchains (like Unilabs Finance which raised $32 million), regulatory challenges, technological hurdles, and broader crypto market downturns. Always do your own research before investing.