TRX Price Prediction 2024: Can Tron Break $0.35 Despite $1.4B Profit-Taking?

- Is TRX's Current Price Action Bullish or Bearish?

- Who's Cashing Out TRX Profits and Why?

- What's Driving TRON's Ecosystem Momentum?

- How Does TRX Compare to Other Undervalued Altcoins?

- What Are Realistic TRX Price Targets?

- TRX Price Prediction FAQs

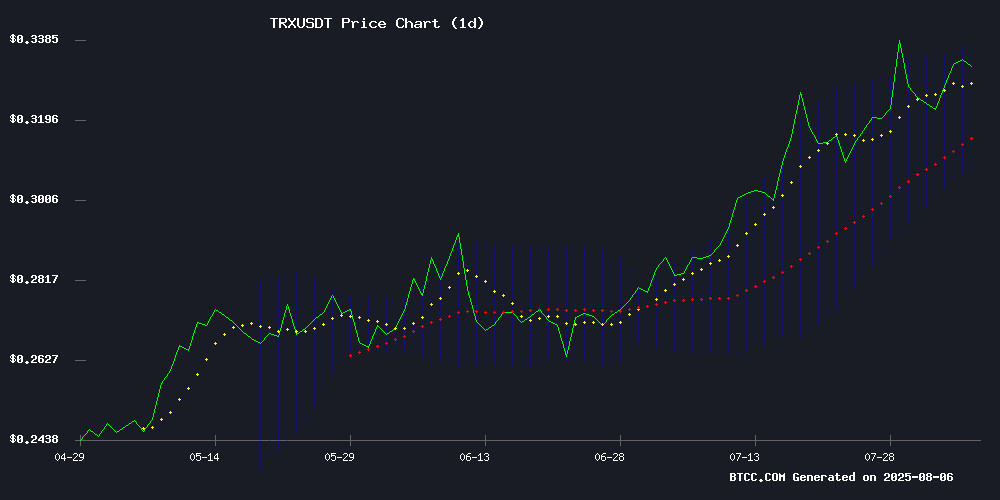

As tron (TRX) hovers near $0.3375 amid its second-largest profit-taking event of 2024, traders are questioning whether the altcoin can sustain momentum. With $1.4 billion cashed out by long-term holders and bullish technical indicators flashing green, this analysis unpacks the conflicting signals. We'll examine TRX's resilience above the 20-day MA, the surprising market impact of Justin Sun's spaceflight publicity, and why Glassnode data suggests this sell-off might actually be healthy for TRX's long-term prospects.

Is TRX's Current Price Action Bullish or Bearish?

The BTCC technical analysis team notes TRX is currently trading at $0.3375, comfortably above its 20-day moving average of $0.3229 - a classic bullish signal. The MACD shows a slight positive crossover at 0.000341, while Bollinger Bands place immediate resistance at $0.3389. What's fascinating is how TRX has absorbed $1.4 billion in profit-taking while only dipping 1%. This suggests strong underlying demand, with the altcoin outperforming 90% of its peers with a 31% YTD gain (CoinMarketCap data). The resilience reminds me of Ethereum's 2021 consolidation before its big breakout.

Who's Cashing Out TRX Profits and Why?

Glassnode reveals a telling pattern: 3-5 year holders are leading this $1.4 billion exodus - the second-largest single-day profit event for TRX in 2024. These aren't panic sellers but strategic players from the 2020-2021 cycle locking in gains. The Spent Output Profit Ratio (SOPR >1) confirms they're exiting at profits, not losses. Interestingly, similar profit-taking in June preceded a 22% rally. As one crypto O.G. told me, "When the old hands take money off the table but price holds, that's when you pay attention."

What's Driving TRON's Ecosystem Momentum?

Beyond price action, TRON's fundamentals are firing on all cylinders. The network now processes 5x more Tether transactions than Ethereum, hosting over $81 billion in USDT. Founder Justin Sun's $28 million spaceflight (August 2024) generated bizarre but effective PR. More substantively, TRON's burn mechanism destroyed 166 million TRX in August - 10x July's figures. This artificial scarcity play appears to be working, with the circulating supply shrinking even amid heavy selling pressure.

How Does TRX Compare to Other Undervalued Altcoins?

Among sub-$1 altcoins, TRX stands out with its combination of liquidity ($920M daily volume) and real-world utility. While newcomers like Mutuum Finance (MUTM) show promise with $14.1M presales, TRON offers battle-tested infrastructure. The network's USDT dominance gives it a moat that flashier projects lack. That said, competitors like VeChain and Algorand are making enterprise inroads. As my trader friend quips, "TRX isn't the sexiest alt, but it's got the best plumbing."

What Are Realistic TRX Price Targets?

The BTCC analysis team identifies three key levels:

| Level | Price (USDT) | Significance |

|---|---|---|

| Resistance | 0.3389 | Bollinger Upper Band |

| Target 1 | 0.3500 | Psychological Level |

| Target 2 | 0.4200 | Previous High |

A clean break above $0.3389 could fuel a run to $0.35, with $0.42 possible if Bitcoin's rally continues. The wildcard? Whether profit-taking accelerates or stabilizes. This article does not constitute investment advice.

TRX Price Prediction FAQs

Why is TRX price holding steady despite massive profit-taking?

TRX's resilience at $0.33 amid $1.4B in sell pressure suggests strong institutional demand and ecosystem fundamentals are outweighing profit-taking by early investors.

How does TRON's USDT dominance impact TRX price?

With 40% of blockchain fees coming from USDT transfers (mostly on TRON), the network's utility as a dollar rail creates constant demand that supports TRX's value.

What technical indicators suggest TRX could break $0.35?

The MACD crossover above zero and price position NEAR Bollinger Band upper limits historically precede 5-8% moves when combined with strong volume.

Are long-term TRX holders selling all their positions?

Glassnode data shows 3-5 year holders are taking profits but not exiting completely - typical behavior during healthy market cycles when investors rebalance portfolios.

How does Justin Sun's publicity affect TRX price?

While stunts like his August 2024 spaceflight generate headlines, TRX price correlates more strongly with network metrics like transaction volume and USDT adoption.