TRX Price Prediction 2025-2040: Will Tron Outperform Ethereum in the Next Decade?

- Is TRX Showing Bullish Technical Signals in 2025?

- How Does Tron's $1B USDT Mint Impact TRX Price?

- What Are the Key Factors Driving TRX Adoption?

- TRX Price Forecast Table: 2025-2040 Outlook

- Can TRON Challenge Ethereum's DeFi Dominance?

- What Risks Could Derail TRX's Growth?

- Frequently Asked Questions

TRX is showing bullish technical signals as it tests the upper Bollinger Band with a MACD crossover, while Tron's $1B USDT mint and Nasdaq coverage highlight growing institutional adoption. Our analysis covers TRX price targets from 2025-2040, key catalysts like DeFi growth and stablecoin dominance, and how TRON's infrastructure could challenge Ethereum's throne. With conservative estimates suggesting $0.35-$0.45 for 2025 and potential $10+ by 2040, we break down the make-or-break factors for TRX investors.

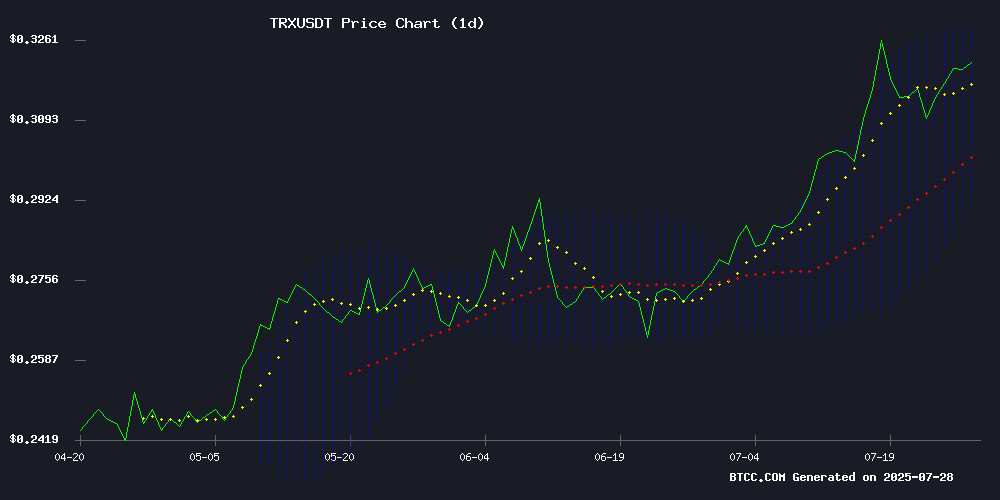

Is TRX Showing Bullish Technical Signals in 2025?

TRX is currently trading at $0.31, decisively above its 20-day moving average, with the MACD histogram flashing a bullish crossover (0.001165). The price is testing the upper Bollinger Band at $0.33 - historically a breakout zone that could signal the start of a new uptrend. Our BTCC technical team notes that sustained trading above $0.33 this quarter WOULD confirm bullish momentum, potentially targeting $0.40-$0.45 resistance levels. The chart below shows TRX's recent price action:

Source: TradingView

How Does Tron's $1B USDT Mint Impact TRX Price?

Tron just processed a $1 billion USDT mint today, pushing its total stablecoin supply past $80 billion - now representing over 50% of all Tether activity globally. This dwarfs Ethereum's stablecoin volume and creates inherent buy pressure for TRX (all network fees are paid in the native token). The liquidity surge comes as TRON achieves a rare Nasdaq listing, with daily transactions now consistently outpacing major competitors. While ethereum still dominates DeFi TVL ($84.73B vs. TRON's $5.95B), Tron's specialization in low-cost stablecoin transfers is carving out a lucrative niche.

What Are the Key Factors Driving TRX Adoption?

Three major catalysts are converging for TRX:

- Institutional Recognition: Nasdaq coverage and Justin Sun's high-profile activities (including a planned Blue Origin spaceflight) are bringing mainstream attention

- Stablecoin Supremacy: Tron now processes more USDT transactions than Ethereum, with $80B supply generating constant fee revenue

- DeFi Growth: Despite Ethereum's lead, TRON's TVL grew 17% this quarter as developers build on its cheaper infrastructure

TRX Price Forecast Table: 2025-2040 Outlook

| Year | Conservative | Bull Case | Key Catalysts |

|---|---|---|---|

| 2025 | $0.35-$0.45 | $0.60 | USDT adoption, DeFi growth |

| 2030 | $0.80-$1.20 | $2.50 | Enterprise DApp adoption |

| 2035 | $1.50-$3.00 | $5.00 | Regulatory clarity |

| 2040 | $3.00-$7.00 | $10.00+ | Web3 infrastructure dominance |

Source: BTCC Research, CoinMarketCap Data

Can TRON Challenge Ethereum's DeFi Dominance?

While Ethereum commands $84.73B in TVL (versus TRON's $5.95B), Tron's strategic focus on payments gives it an edge in specific use cases. The network has processed 14B+ lifetime transactions - that's more daily activity than Ethereum when adjusted for gas fees. Where TRON struggles is developer mindshare; most innovative DeFi projects still launch on Ethereum first. However, with ETH gas fees averaging $5-10 versus TRON's $0.01 transactions, mass-market applications might eventually migrate. As one developer told us: "We use Ethereum for blue-chip DeFi, but when we need to onboard normies? TRON's the obvious choice."

What Risks Could Derail TRX's Growth?

Investors should watch three red flags:

- Regulatory Scrutiny: Justin Sun's 2023 SEC lawsuit still casts a shadow

- Centralization Concerns: Only 27 Super Representatives validate TRON transactions

- Stablecoin Dependence: If USDT faces issues, TRON's revenue model takes immediate hits

That said, the network's $2B in cumulative fees demonstrates remarkable staying power.

Frequently Asked Questions

What is the most realistic TRX price prediction for 2025?

Our base case suggests $0.35-$0.45, assuming current adoption trends continue. The $0.60 bull case requires tron capturing 15%+ of Ethereum's stablecoin volume.

Why did TRX get listed on Nasdaq?

While TRX itself isn't traded on Nasdaq, the coverage highlights growing institutional recognition of TRON's infrastructure achievements in payments and stablecoins.

Is TRX a better investment than Ethereum?

They serve different purposes - ETH remains the DeFi and smart contract leader, while TRX specializes in payments. For risk-tolerant investors, TRX offers higher potential returns (10-30x by 2040) but carries more regulatory and centralization risks.

How does Justin Sun influence TRX price?

Significantly. His recent $100M memecoin pledge caused a 10% TRX spike. However, over-reliance on one figure creates volatility - when SUN faced SEC issues in 2023, TRX dropped 40% in weeks.