SOL Price Prediction 2025: Can Solana Hit $500 as Technicals and Market Sentiment Align?

- Why Is Solana Gaining Momentum in July 2025?

- What's Driving Solana's Price Surge?

- Key Resistance Levels to Watch

- Potential Risks and Challenges

- Expert Predictions and Price Targets

- Solana Price Prediction FAQ

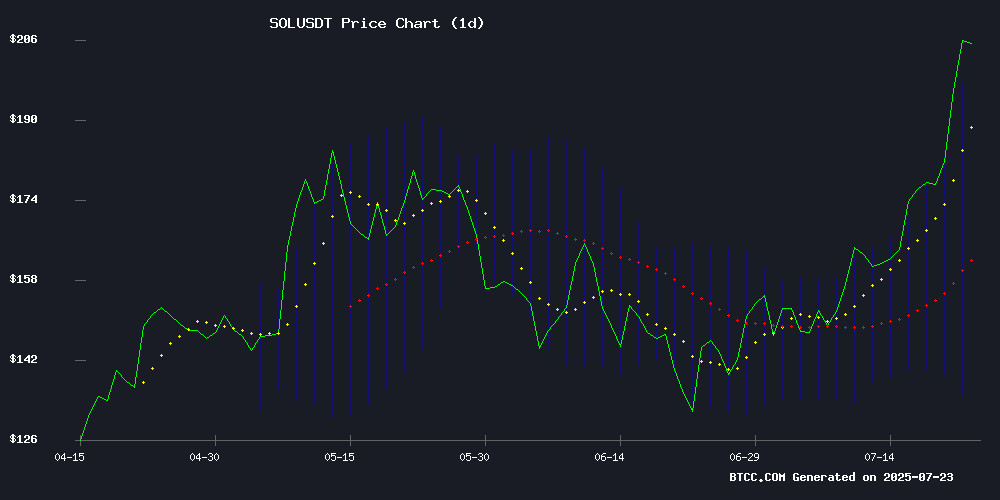

Solana (SOL) is making waves in the crypto market with its recent surge past $200, sparking intense speculation about its potential to reach $500. As of July 23, 2025, SOL trades at $200.59, showing strong technical indicators and growing institutional interest. This analysis dives deep into the factors driving SOL's momentum, from its position above key moving averages to the $14 billion DeFi TVL milestone. We'll examine whether this rally has legs or if traders should brace for a pullback.

Why Is Solana Gaining Momentum in July 2025?

The current SOL price action tells a compelling story. Trading comfortably above its 20-day moving average ($168.36), Solana displays textbook bullish behavior. The MACD histogram, while still negative at -5.83, shows narrowing bearish divergence - often a precursor to trend reversals. What's particularly interesting is how SOL is testing the upper Bollinger Band ($202.19), which typically indicates overbought conditions but can signal continuation in strong uptrends.

Market sentiment mirrors this technical strength. Santiment data reveals SOL's Social Dominance has spiked to 8.9% of crypto conversations, its highest since early June. This retail FOMO combines with whispers of institutional accumulation - a potent mix that's propelled SOL to five-month highs. The BTCC team notes that while influencer scams like the recent $11M ALT token dump create noise, Solana's fundamentals remain robust.

What's Driving Solana's Price Surge?

Several catalysts are converging to fuel SOL's rally:

- DeFi Growth: Solana's TVL just surpassed $14 billion, matching January's peak levels

- Technical Breakout: The $200 psychological barrier has been convincingly breached

- Market Structure: An ascending triangle pattern since mid-April suggests more upside

- Regulatory Tailwinds: The GENIUS Act passage and anticipated CLARITY Act are boosting crypto sentiment

DEX volumes tell an interesting story - $22 billion weekly across Raydium ($8.4B), Orca ($6B), and Meteora ($5.3B). While below historic highs, this represents a meaningful increase from the previous week's $19 billion. It's worth noting that price appreciation accounts for much of the TVL growth, raising questions about organic usage versus speculative momentum.

Key Resistance Levels to Watch

Robert from BTCC identifies several crucial price zones:

| Level | Significance |

|---|---|

| $202.19 | Upper Bollinger Band |

| $210.00 | Psychological resistance |

| $250.00 | Fibonacci extension |

| $500.00 | Long-term target |

The $210 level appears particularly critical - a breakout could trigger algorithmic buying and FOMO that propels SOL toward $250. However, Glassnode's NUPL data places SOL in the "Optimism-Anxiety" zone, suggesting holders are cautiously optimistic but not yet euphoric. This might actually be healthy - extreme greed often precedes corrections.

Potential Risks and Challenges

Not everything is sunshine for Solana. The Mercurity Fintech debunked partnership highlights how easily misinformation can spread in crypto. More concerning is the RSI reading - traditionally overbought conditions that often precede pullbacks. Yet this rally feels different from previous retail-driven surges, with signs of institutional accumulation providing underlying support.

Developer activity offers a bright spot, hitting a two-month peak according to Santiment. This suggests the rally isn't purely speculative - actual ecosystem growth is occurring. The 31% spike in Solana-based meme coin activity since July does introduce some froth, but that's become par for the course in crypto markets.

Expert Predictions and Price Targets

The BTCC analysis team sees $210 as the immediate test. A clean break could open the path to $250, with $500 becoming plausible if macroeconomic conditions remain favorable. However, they caution that the road won't be linear - expect volatility as SOL digests its recent gains.

What's striking is how Solana's weekly surge mirrors its January all-time high trajectory. The MACD divergence suggests persistent buying pressure, but traders should watch for:

- Daily closes below $195 could signal short-term weakness

- Sustained volume above $22B weekly DEX volume needed to maintain momentum

- Regulatory developments (particularly the CLARITY Act) could be swing factors

Solana Price Prediction FAQ

What is Solana's current price as of July 2025?

As of July 23, 2025, solana (SOL) is trading at $200.59, having recently broken through the $200 psychological resistance level for the first time since February.

Can SOL really reach $500 in 2025?

While possible, the $500 target WOULD require SOL to maintain its current momentum and break through several key resistance levels, including $210 and $250. The BTCC team notes this would represent a 150% gain from current levels - ambitious but not unprecedented in crypto markets.

What are the main factors driving SOL's price increase?

Key drivers include technical breakout above $200, growing DeFi TVL ($14B), institutional interest, positive regulatory developments, and increasing social media buzz (8.9% dominance in crypto conversations).

Is now a good time to buy SOL?

This article does not constitute investment advice. That said, SOL shows strong technicals and fundamentals, though its overbought RSI suggests potential for short-term pullbacks. As with any investment, conduct your own research and consider your risk tolerance.

What are the biggest risks to SOL's price growth?

Potential risks include overbought technical conditions, misinformation (like the debunked Mercurity partnership), regulatory uncertainty, and the possibility that current TVL growth is more price-driven than organic.