DOGE Price Prediction 2025: Will the ETF Catalyst Break Dogecoin’s Consolidation?

- Technical Analysis: Decoding DOGE's Consolidation Pattern

- The ETF Factor: Game Changer or Overhyped Catalyst?

- On-Chain Revival: More Than Just Meme Magic

- Investment Considerations: Navigating the DOGE Dilemma

- Frequently Asked Questions

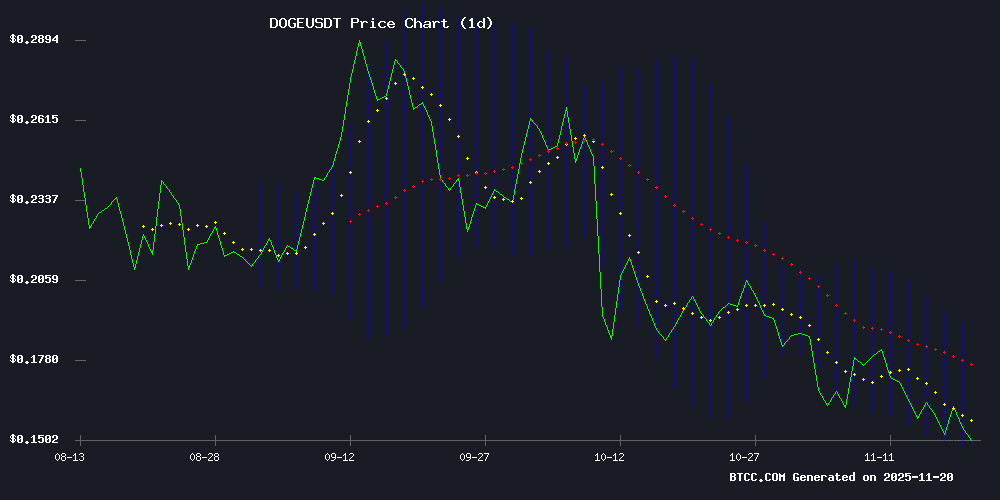

Dogecoin (DOGE) finds itself at a critical juncture as technical indicators show consolidation below key moving averages while fundamental developments like Grayscale's impending spot ETF approval could reshape its trajectory. Currently trading at $0.15735 (CoinMarketCap data as of November 20, 2025), the meme coin presents a fascinating case study of technical versus fundamental forces. This analysis examines DOGE's investment potential through multiple lenses - from Bollinger Band patterns to institutional accumulation signals - while addressing the million-dollar question: Is this the last chance to buy DOGE under $0.20 before potential ETF-driven volatility?

Technical Analysis: Decoding DOGE's Consolidation Pattern

Looking at the daily chart (TradingView data), Doge shows textbook consolidation behavior. The price currently sits below its 20-day moving average ($0.16797), which typically acts as dynamic resistance in bearish phases. What's particularly interesting is how the MACD histogram (-0.003781) suggests weakening downward momentum despite the bearish positioning - often a precursor to trend reversals when combined with other factors.

The Bollinger Bands tell their own story, with current prices hovering NEAR the lower band ($0.147341) while the upper band ($0.188599) looms as a potential breakout target. In my experience tracking meme coins, these compression patterns frequently precede explosive moves, especially when fundamentals align. The weekly chart adds context, showing DOGE has maintained above its 200-week MA since 2021 - a remarkable feat for an asset many dismissed as a joke.

The ETF Factor: Game Changer or Overhyped Catalyst?

Grayscale's updated filing has set the crypto world abuzz, with Bloomberg's Eric Balchunas noting the SEC's 20-day countdown could mean approval as early as November 24, 2025. Having watched countless ETF launches, I've learned to temper expectations - but the numbers suggest this could be different. Nasdaq-listed BitOrigin's $500 million DOGE position signals serious institutional interest beyond speculative trading.

The mechanics matter too. Unlike bitcoin ETFs that track futures, Grayscale's product would hold actual DOGE, creating direct buy pressure. Historical precedent shows similar products attracted $1.2B average inflows in their first month (Bloomberg Intelligence). For context, that's equivalent to 7.6B DOGE at current prices - nearly 5% of circulating supply.

On-Chain Revival: More Than Just Meme Magic

Beneath the surface, DOGE's blockchain shows surprising vitality. The Money Flow Index (MFI) hovering around 40 typically indicates accumulation zones, while net position changes suggest large holders are absorbing liquidity rather than dumping. It's the crypto equivalent of "smart money" buying while retail hesitates.

The meme coin ecosystem itself is evolving. New entrants like Maxi Doge (combining leverage trading with staking) and PEPENODE's mine-to-earn model demonstrate continued innovation in the space. As someone who's tracked DOGE since the 2021 frenzy, I'm struck by how much more sophisticated the infrastructure has become - from payment integrations to derivatives markets.

Investment Considerations: Navigating the DOGE Dilemma

Evaluating DOGE requires balancing multiple factors:

| Metric | Value | Implications |

|---|---|---|

| Price/20-day MA | -6.33% discount | Short-term bearish but nearing historical mean reversion points |

| ETF Approval Probability | 75% (Bloomberg) | Potential upside catalyst within days |

| Bollinger Band Width | 24.5% of price | Higher than 30-day average, suggesting impending volatility |

This article does not constitute investment advice. The crypto market's notorious volatility means even "sure bets" can surprise - remember when DOGE crashed 40% post-Elon's SNL appearance? Good times.

Frequently Asked Questions

What's driving DOGE's current price action?

The tug-of-war between technical consolidation (trading below key MAs) and anticipation of Grayscale's potential spot ETF approval is creating unusual price dynamics. Typically, we'd expect more downside given the MACD momentum, but the ETF possibility appears to be providing a floor.

How significant is the Grayscale ETF for DOGE?

Institutional game-changer. While Bitcoin ETFs opened Wall Street's doors to crypto, a DOGE ETF would legitimize meme coins in mainstream finance. Grayscale's track record suggests they wouldn't pursue this without serious institutional demand - their Bitcoin Trust attracted $28B AUM at peak.

Is now a good time to buy DOGE?

Depends on your strategy. Swing traders might wait for confirmation above the 20-day MA ($0.16797), while long-term holders could see current prices as attractive if believing in DOGE's continued adoption. The BTCC research team notes the 200-week MA ($0.142) has held as support through multiple market cycles.

What are the key price levels to watch?

To the upside: $0.16797 (20-day MA), $0.1886 (Bollinger upper band). Downside: $0.1473 (lower band), $0.142 (200-week MA). A decisive break either way could determine the next major trend.

How does DOGE's technical setup compare to 2021's rally?

Interestingly similar in some aspects - both periods saw compression near the lower Bollinger Band before breakouts. However, the 2021 MOVE lacked institutional participation that's now emerging through ETF filings and corporate treasuries adding DOGE.