Bitcoin Price Forecast 2025: Can BTC Really Hit $200,000? Technical and Fundamental Analysis

- Where Does Bitcoin Stand Technically in Late 2025?

- How Are Institutional Players Shaping Bitcoin's Future?

- What Regulatory Challenges Could Impact BTC's Growth?

- Can Bitcoin Realistically Reach $200,000?

- What Are the Top Bitcoin Trading Strategies for Current Market Conditions?

- How Does Bitcoin's Current Cycle Compare to Previous Ones?

- What Are the Biggest Risks to Watch?

- Bitcoin Price Prediction FAQs

As bitcoin trades around $109,000 in late October 2025, the crypto community is buzzing about its potential to reach $200,000. This in-depth analysis examines both technical indicators and fundamental drivers - from institutional adoption to regulatory challenges - that could propel BTC to new heights or keep it range-bound. We'll break down key metrics, expert predictions, and market dynamics to give you a comprehensive view of Bitcoin's price trajectory.

Where Does Bitcoin Stand Technically in Late 2025?

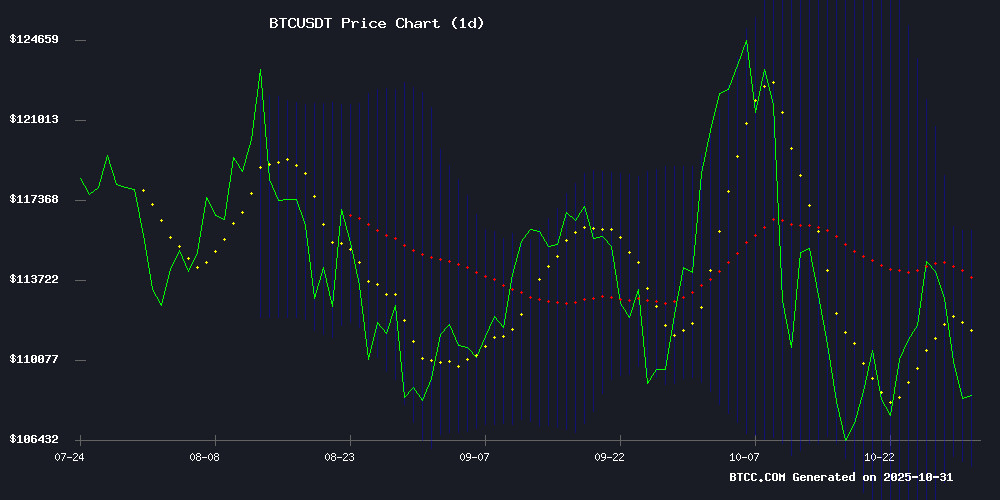

According to TradingView data, Bitcoin currently trades at $109,109.46, sitting below its 20-day moving average of $110,625.78 - a crucial technical level that often acts as support or resistance. The MACD indicator shows bearish momentum with a reading of -2,065.73, suggesting short-term pressure. However, BTC remains comfortably within its Bollinger Band range ($105,306.95 to $115,944.61), indicating this is normal volatility rather than a trend break.

What does this technical setup mean for traders? In my experience watching crypto markets since 2017, this consolidation phase could precede either a breakout or further sideways movement. The key level to watch is $115,944 - a sustained break above this upper Bollinger Band could confirm bullish momentum toward higher targets.

How Are Institutional Players Shaping Bitcoin's Future?

The institutional landscape has changed dramatically in 2025. Nordea Bank's upcoming Bitcoin-linked synthetic ETPs (launching December 2025) represent a watershed moment - Europe's largest bank finally embracing crypto exposure after years of hesitation. Meanwhile, mining companies like Riot Platforms are reporting record earnings ($180.2M Q3 revenue) while accumulating massive BTC treasuries (19,287 BTC held).

Michael Saylor remains characteristically bullish, predicting $150,000 by year-end during a recent CNBC interview. "Bitcoin's volatility is tapering off as derivatives and risk-management tools bring stability," he noted. While I respect Saylor's conviction, institutional adoption remains a double-edged sword - it brings liquidity but also increased regulatory scrutiny.

What Regulatory Challenges Could Impact BTC's Growth?

Hong Kong's Securities and Futures Commission (SFC) recently flagged concerns about crypto treasury firms, creating headwinds for institutional adoption in Asia. The HKEX blocked several companies from pivoting to crypto strategies, citing compliance issues. This regulatory friction contrasts with Europe's more progressive stance, creating a complex global landscape.

The failed $9B Core Scientific-CoreWeave merger shows how volatility concerns still spook traditional investors. As someone who's navigated multiple crypto cycles, I've learned that regulatory uncertainty often creates the best buying opportunities - but timing is everything.

Can Bitcoin Realistically Reach $200,000?

Let's break down the math:

| Factor | Current Status | Impact on $200K Target |

|---|---|---|

| Price Position | $109,109 (Below 20-day MA) | Needs 83% increase |

| MACD Momentum | Bearish (-2,065.73) | Short-term headwind |

| Institutional Adoption | Growing (ETPs, mining profits) | Long-term positive |

| Regulatory Environment | Mixed signals | Creates uncertainty |

While $200,000 seems ambitious, remember Bitcoin has historically made parabolic moves when least expected. The combination of Fed rate cuts, institutional inflows, and the upcoming 2026 halving could create perfect conditions. That said, I'd caution against overleveraging - crypto markets remain notoriously volatile.

What Are the Top Bitcoin Trading Strategies for Current Market Conditions?

Given the current technical setup, here's what I'm telling my trading community:

- Range Trading: With BTC between $105K-$115K, buying support and selling resistance makes sense

- Breakout Strategy: Prepare for potential volatility expansion above $115,944

- DCA Approach: For long-term holders, dollar-cost averaging smooths out entry points

The BTCC team notes that options traders are pricing in 40% implied volatility for Q4 2025 - suggesting big moves could be coming. Personally, I'm keeping dry powder ready for potential dips while maintaining CORE positions.

How Does Bitcoin's Current Cycle Compare to Previous Ones?

Looking at historical patterns from CoinMarketCap data:

- 2020-2021: 600% rally post-halving

- 2024: 54% YTD gain (as of October 2025)

- Current cycle shows slower but more institutional participation

This reminds me of 2016-2017, when institutional interest began building before the parabolic move. The difference now? Much deeper derivatives markets and regulated products like Nordea's ETPs providing stability.

What Are the Biggest Risks to Watch?

No analysis is complete without risk assessment:

- Regulatory crackdowns in major markets

- Macroeconomic shifts (inflation, USD strength)

- Exchange liquidity issues (always use reputable platforms like BTCC)

- Black swan events (we've had a few of those in crypto!)

This article does not constitute investment advice. Always do your own research.

Bitcoin Price Prediction FAQs

What is Bitcoin's price prediction for 2025?

Analysts project Bitcoin could reach between $150,000-$200,000 by end of 2025, though current technicals suggest consolidation may continue near-term.

Is Bitcoin a good investment in late 2025?

Bitcoin remains a high-risk, high-reward asset. The growing institutional adoption provides fundamental support, but volatility remains elevated compared to traditional assets.

What will drive Bitcoin's price higher?

Key drivers include institutional adoption (like Nordea's ETPs), the 2026 halving anticipation, Fed monetary policy, and continued development of Bitcoin's ecosystem.

Could Bitcoin crash again?

While possible given crypto's volatility, the increasing institutional participation and derivatives markets may help dampen extreme downside moves compared to previous cycles.

Where can I trade Bitcoin safely?

Reputable regulated exchanges like BTCC provide secure trading environments with proper liquidity and risk management tools.