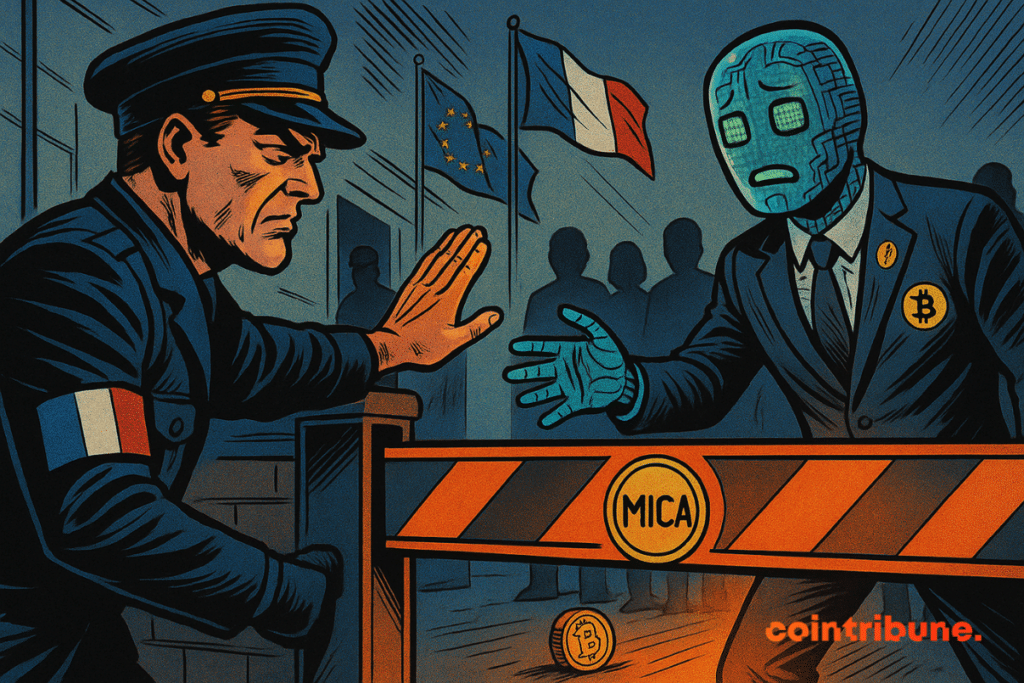

France Threatens to Block Crypto Firms Under MiCA Regulation - Here’s What You Need to Know

Paris draws line in sand as MiCA enforcement looms—crypto firms face ultimatum: comply or get shut out of EU's second-largest economy.

The Regulatory Hammer Drops

French authorities aren't playing nice with crypto companies dragging their feet on MiCA compliance. The message echoes across boardrooms from Paris to Nice: adapt to Europe's new rulebook or lose access to 67 million potential users overnight.

Brussels' Big Stick Approach

MiCA's provisions give national regulators teeth—and France just bared them. The threat isn't empty rhetoric; it's backed by EU-wide authority that could freeze non-compliant firms out of the entire single market. Suddenly those compliance costs don't look so expensive compared to getting locked out of 450 million consumers.

Industry's Compliance Race Against Time

Crypto exchanges and wallet providers scramble to overhaul KYC procedures, liquidity requirements, and governance frameworks. The clock's ticking toward full implementation—and French regulators made clear they won't grant grace periods for outfits that bet against regulatory momentum.

Traditional finance veterans smirk watching crypto learn the oldest lesson in the book: regulators always win in the end—usually while charging administrative fees for the privilege of beating you into compliance.

In brief

- France could refuse the MiCA passport to crypto companies licensed in countries considered too lenient.

- Paris demands centralized European supervision to avoid uneven crypto regulations among EU member states.

France Raises the Threat of Blocking the MiCA Crypto Passport

The MiCA regulation came into effect at the end of 2024. It allows crypto platforms licensed in a European Union member state to operate throughout the zone thanks to. This tool is supposed to facilitate harmonization. Yet, it opens the door to a race for the most lenient regulation.

The president of the Financial Markets Authority (AMF), Marie-Anne Barbat-Layani, expressed her concerns about this “regulatory shopping.” According to her, some crypto companies deliberately seek more permissive jurisdictions to bypass French requirements. Paris therefore does not rule out. A measure described as a nuclear option by the leader.

Behind the scenes, several players fear ineffective supervision for crypto platforms with complex and cross-border structures. In the short term, France therefore wants to(the European crypto regulator) to prevent a weakening of control at the continental level.

Towards a Redefinition of ESMA’s Role in Crypto Asset Oversight

The AMF is not alone in raising the alarm. Along with its Italian (Consob) and Austrian (FMA) counterparts, it advocates transferring competencies to ESMA. Areveals strong disparities in the application of the regulation among national crypto regulators. This undermines the unity of the MiCA project.

Concrete cases illustrate these differences. For example, Malta granted a license to a crypto platform without sufficiently assessing the risks. Luxembourg, meanwhile, has already granted approvals to crypto giants like Coinbase and Gemini.

The three countries also call for:

- increased control of operations outside the EU;

- better cybersecurity requirements;

- clarification on token management.

If these reforms succeed, ESMA could become.

In any case, the current standoff around MiCA could well redefine regulatory balances in Europe. Meanwhile, crypto platforms navigate between opportunity and uncertainty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.