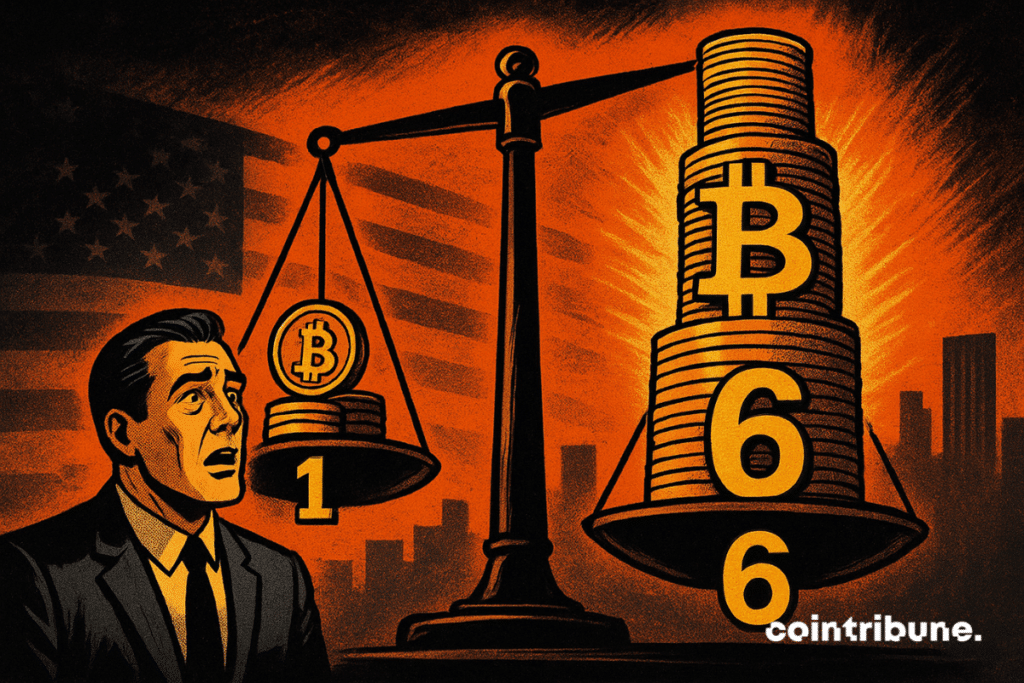

Capital Group’s $1 Billion Bitcoin Bet Explodes to $6 Billion

Wall Street giant Capital Group just turned a billion-dollar Bitcoin gamble into a six-fold windfall—proving even traditional finance can't ignore crypto's siren call.

The Numbers Don't Lie

That initial $1 billion allocation now sits at a staggering $6 billion valuation. Not exactly pocket change, even for a firm that manages trillions. The move signals institutional adoption isn't just happening—it's printing generational wealth while traditional portfolios chase bond yields.

Why This Matters

Capital Group didn't just dip toes—it plunged headfirst into digital assets. Their massive position demonstrates Bitcoin's maturation from speculative toy to legitimate store of value. Meanwhile, traditional banks still debate whether crypto belongs in retirement accounts.

The Bottom Line

When a conservative asset manager scores 500% returns on Bitcoin while traditional finance debates paperwork compliance, maybe the real risk isn't volatility—it's being left behind. Sometimes the boldest move is copying the homework of crypto natives who've been right all along.

In brief

- Capital Group’s Bitcoin holdings jumped from $1B to $6B, led by veteran portfolio manager Mark Casey.

- Early $500M investment in Strategy now valued at $6.2B after the stock gained 2,200% in five years.

- Capital Group also owns stakes in Metaplanet and Mara Holdings, boosting its Bitcoin exposure.

- Corporate Bitcoin holdings exceed $117B, with Strategy leading at 638,460 BTC worth $73.57B.

Strategic Bitcoin Bets Pay Off With Multi-Billion-Dollar Gains

Veteran portfolio manager Mark Casey spearheaded Capital Group’s entry into the bitcoin market, a move that has seen the asset manager’s BTC stake surge from $1 billion to over $6 billion. Casey boasts 25 years of experience working with the 94-year-old mutual fund.

In a Sunday report by The Wall Street Journal, Casey, who has become a Bitcoin maximalist, referenced Benjamin Graham and Warren Buffett as notable figures who have influenced his investment approach.

During a recent podcast interview with venture firm Andreessen Horowitz, Casey expressed his love for the OG crypto. The portfolio manager even referred to Bitcoin as the “coolest” invention in history.

Capital Group Gains Market Exposure Through Corporate Treasury Investments

Since 2021, Capital Group has strategically invested in Bitcoin stocks through stakes in corporate crypto treasuries, which provide price exposure to the asset. The asset management firm has invested substantially in several Bitcoin treasury companies, most notably Michael Saylor-led Strategy (formerly MicroStrategy).

Capital Group’s first involvement in Bitcoin came in 2021, following an over $500 million investment in Strategy for a 12.3% stake in the company.

BTCUSDT chart by TradingViewAlthough that stake has since dropped to 7.89% due to fresh share issuance and equity financing, the investment is now worth about $6.2 billion after Strategy’s stock jumped more than 2,200% in five years.

Speaking to the WSJ, Casey said that when evaluating Bitcoin-focused companies, he and his colleagues use the same approach applied to commodities like Gold or oil.

Apart from Strategy, Capital Group also owns a 5% stake in Tokyo-listed corporate BTC firm Metaplanet and Mara Holdings.

Corporate Bitcoin Holders Surpass $117 Billion as Institutions Deepen Crypto Exposure

According to data from BitcoinTreasuries.NET, corporate firms currently hold about 1.01 million BTC, which is worth more than $117 billion at current market prices.

Here are the firms that currently make up the top five:

- Strategy (MSTR) tops the list at a distant first with 638,460 BTC, worth $73.57 billion.

- MARA Holdings, Inc. (MARA) comes second with 52,477 BTC, valued at about $6.05 billion.

- XXI (CEP) sits third with 43,514 BTC, worth about $5.01 billion at current market rates.

- Bitcoin Standard Treasury Company (BSTR) holds 30,021 BTC, totaling $3.46 billion.

- Bullish (BLSH) owns 24,000 BTC, worth $2.77 billion.

With 20,136 BTC—worth $2.32 billion—Metaplanet is in sixth place, ahead of Riot Platforms, Trump Media & Technology Group Corp., and CleanSpark. crypto exchange Coinbase Global completes the top 10 list with 11,776 BTC, worth approximately $1.36 billion.

At the time of writing, Bitcoin is hovering just above the $115,000 mark, with projections pointing to a strong close to the year.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.