DeFi Market Flexes Strength as Weak US Jobs Data Fuels Fed Rate Cut Speculation

DeFi isn't just surviving—it's thriving while traditional finance wobbles.

Weaker-than-expected jobs data just handed decentralized finance its best narrative in months. TradFi's looking shaky while DeFi protocols stack gains.

The Fed's potential pivot away from hawkish policy suddenly makes yield-bearing crypto assets look downright sophisticated. Who needs bonds when you've got algorithmic stablecoins and liquidity pools?

DeFi's pumping while Wall Street frets about rate cuts—because nothing says financial revolution like outperforming traditional markets during macroeconomic uncertainty. Banks are still writing memos about blockchain while DeFi actually uses it.

Maybe the real stimulus package was the decentralized protocols we built along the way.

in brief

- The decentralised finance market capitalisation increased by more than 3% in the past 24 hours to around $168 billion according to Coingecko.

- DeFi tokens are attracting more attention as investors seek yield amid potential rate cuts.

- Weaker employment data has raised speculation about a potential 25 basis point Federal Reserve rate cut.

US Jobs Revision Highlights Weakening Labour Market

The US Bureau of Labor Statistics released preliminary benchmark revisions to its employment figures, cutting nonfarm payrolls for the year ending March 2025 by 911,000 jobs. That represents a 0.6% downgrade, far larger than the historical average of 0.2% over the past decade. The change points to a labour market that is considerably weaker than previously thought.

A sharper-than-expected slowdown has led to speculation that the Federal Reserve may adjust policy at its upcoming meeting. The prospect of lower rates has boosted appetite for risk, with investors turning attention towards alternative assets such as decentralised finance tokens.

DeFi Gains Momentum

Weaker employment data typically raises expectations of interest rate cuts, which can provide support for Bitcoin. The cryptocurrency still dominates the market, holding around 57% of total market share according to CoinMarketCap.

However, despite its leading position, Bitcoin does not generate yield for holders. In contrast, DeFi tokens offer returns through lending and borrowing protocols, making them especially attractive when rate cut expectations are rising.

BTCUSDT chart by TradingViewArthur Hayes, co-founder of BitMEX, linked the weaker jobs data to expectations for a 50 basis point cut, pointing to signals from the two-year Treasury yield. He explained that products such as sUSDe, offering yields of around 7%, show why large sums held in money market funds could shift into DeFi in search of better returns. To illustrate this, Hayes referred to the rise of Ethena’s ENA, now above $1.50, and the expansion of USDe supply beyond $20 billion.

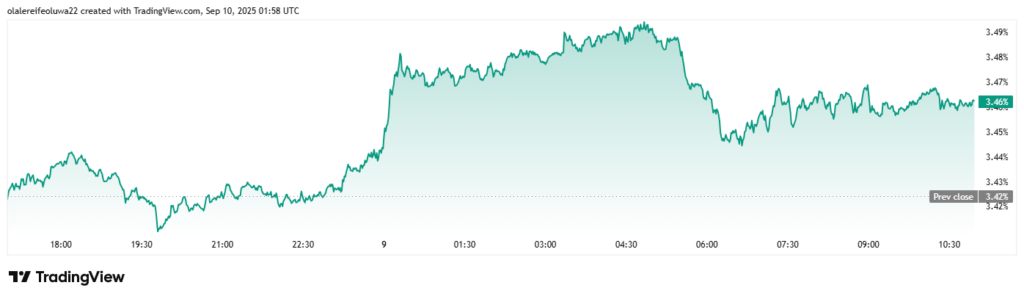

Rising DeFi Dominance

Measures of market share underline this shift. According to TradingView data, the DeFi dominance index has increased to 3.46%, its highest level since early February. The rise signals that DeFi is securing a larger position within the wider digital asset market.

Some of the tokens linked to decentralised exchanges and other DeFi projects have recorded notable gains:

- Hyperliquid’s HYPE rose about 4% in the last 24 hours and more than 23% over the past week.

- MYX Finance’s token surged over 139% in a single day and more than 1,153% across seven days.

- Ethena’s ENA added 1.7% in the past day.

- ONDO advanced 1% in the same period.

Key Events and Factors That Could Influence the Market

Attention now turns to the Federal Reserve’s policy meeting, expected around 17 September 2025. Market participants on platforms such as Polymarket are currently pricing in a likely 25 basis point reduction in the Fed funds rate. Such a MOVE could support further gains across digital assets by lowering borrowing costs.

Other key factors for market watchers in the coming days include:

- One important development to watch is the US producer price index on Wednesday and the consumer price index on Thursday, which could heighten concerns about inflation.

- Another key development to watch is the political situation in Europe, particularly in France, which could affect market sentiment and contribute to volatility.

- Situations in Japan, along with movements in bond markets, could further affect global financial stability.

If these conditions remain supportive, DeFi tokens could see continued activity and modest gains, even as the wider crypto market remains relatively stable.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.