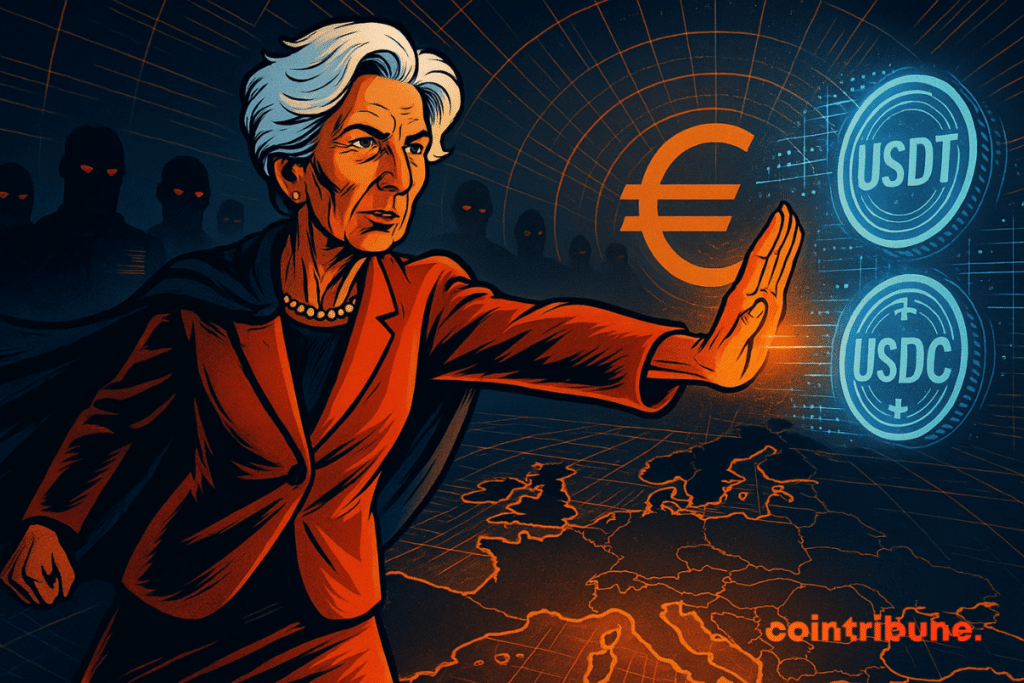

Christine Lagarde Declares War on Foreign Stablecoins as Europe Fights for Financial Sovereignty

ECB President draws regulatory battle lines against offshore digital currencies.

The Regulatory Onslaught Begins

Lagarde's team launches aggressive oversight framework targeting non-European stablecoin issuers. New compliance requirements demand unprecedented transparency from foreign operators. The move signals Europe's determination to prevent dollar-dominated stablecoins from dominating its digital economy.

Brussels Flexes Regulatory Muscle

EU regulators deploy MiCA legislation provisions with surgical precision. Foreign stablecoin providers face stringent capital requirements and operational restrictions. The bloc establishes clear demarcation between 'compliant' and 'non-compliant' digital assets.

Financial Sovereignty at Stake

European officials openly question why offshore entities should control euro-pegged payment instruments. The crackdown represents strategic positioning for upcoming digital euro implementation. Banking traditionalists quietly cheer—nothing makes central bankers happier than regulating something they don't yet understand.

Market Implications Unleashed

Crypto exchanges scramble to adjust listing policies for European users. Stablecoin issuers face existential questions about geographic fragmentation of what were designed as borderless assets. The regulatory walls go up—because nothing says 'financial innovation' like recreating seventeenth-century mercantilism with blockchain.

In brief

- Christine Lagarde imposes strict equivalence conditions on foreign stablecoins wishing to operate in the EU.

- The ECB fears that a banking rush on stablecoins will favor the best-protected jurisdictions like Europe.

- Stablecoins now represent nearly 290 billion dollars in global capitalization, dominated by the American USDT.

- This stance is part of a European strategy to counter the hegemony of the dollar via stablecoins.

Christine Lagarde demands strict guarantees for foreign stablecoins

On Wednesday, during the European Systemic Risk Board conference in Frankfurt, Christine Lagarde raised her voice.

The ECB President demands that foreign stablecoins comply with European standards before any activity in the Union. A stance that marks a turning point in the European approach to digital assets.

In a speech in Frankfurt, Christine Lagarde hammered that these assets must respect the regulatory framework of the bloc to prevent arbitrage and protect financial stability.

Behind this red line, an obvious target: American giants Tether (USDT) and Circle (USDC), whose combined capitalization exceeds 220 billion dollars. The issue goes beyond technicalities: it is a monetary infrastructure battle in the digital age.

The ECB chief also warned against poor liquidity management across jurisdictions. In case of a trust crisis, holders will seek redemption in the best-protected zones.

However, in Europe, MiCA prohibits redemption fees: an influx of requests could quickly dry up local reserves if the issuer operates elsewhere while capturing repayments.

This offensive is part of a broader strategy. For months, European authorities have multiplied warnings about stablecoins. The Bank of France had also warned in June of a risk of “privatization of money.” A deliberate vocabulary, revealing the growing concern of central bankers about the rise of private assets likely to circumvent their control.

USDCUSDT chart by TradingViewEurope facing the challenge of monetary sovereignty

The numbers speak for themselves: nearly 290 billion dollars worth of stablecoins are circulating worldwide today. USDT accounts for about 60% of the market, reinforcing the dollar’s hegemony in the digital economy. A situation Christine Lagarde intends to oppose.

She compares these challenges to those faced by international banking groups, subject to strict liquidity ratios to avoid imbalances between subsidiaries.

Facing this rise of foreign stablecoins, Europe is accelerating its own projects. The digital euro, technically ready according to the authorities, could be launched before the end of 2025. A defensive project aimed at preserving European monetary autonomy in an increasingly digitalized world.

But the task looks tough. While Europe hesitates, the United States advances. The American GENIUS Act has already set a favorable legal framework for domestic stablecoins.

On his side, Tether’s CEO Paolo Ardoino has categorically refused to subject USDT to the MiCA regulation, deeming the European requirements “dangerous” for the banking system.

Christine Lagarde’s statements mark a new stage in the regulatory battle over stablecoins. Far from being a simple technical debate, this offensive reveals geopolitical tensions around the future of digital money. Europe seems determined not to leave the field open to the American crypto giants.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.