Ethereum Outshines Bitcoin as Market Dynamics Shift - Here’s Why ETH is Stealing the Spotlight

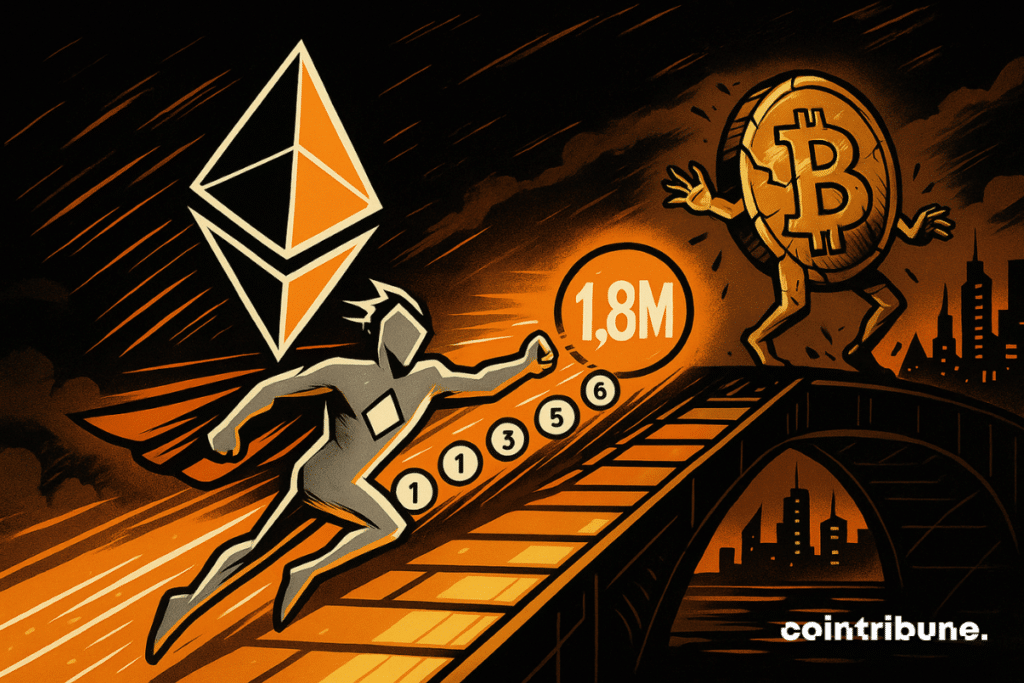

While Bitcoin treads water, Ethereum surges ahead—flipping the script on crypto's oldest rivalry.

The Scaling Advantage

Ethereum's layer-2 ecosystem finally delivers what promises always hinted at—real throughput without crippling gas fees. Meanwhile, Bitcoin maximalists still debate block size over expensive whiskey.

Institutional Play

Smart money rotates into ETH's staking yields while Bitcoin remains the digital gold narrative—pretty but unproductive. Traditional finance loves yield even more than it loves acronyms.

Developer Momentum

Builders flock to Ethereum's modular stack while Bitcoin's script limitations show their age. Innovation doesn't wait for consensus—it migrates to where it can breathe.

Market sentiment shifts like hedge fund allegiances—today's darling becomes tomorrow's bagholder. But for now, Ethereum's proving that in crypto, utility eventually cashes louder than nostalgia.

In brief

- Ethereum breaks an annual record with 1.8 million transactions in a single day in August.

- Nearly 30 % of the ETH supply is now staked, a sign of investor confidence.

- A whale sells 24,000 BTC for $2.7 billion, triggering a market crash.

- Bitcoin dominance falls from 60 % to 57 %, giving Ethereum room to gain ground.

Ethereum : activity records and regulatory turning point

In August, the Ethereum network crossed a technical and symbolic threshold by recording more than 1.8 million transactions in a single day, setting a record for the past year.

This activity peak occurs in a context where the Ethereum ecosystem seems to be entering a phase of strategic consolidation. The growing volume of transactions is accompanied by a notable phenomenon: the share of staked Ether now reaches nearly 30 % of the total supply, illustrating investors’ current preference for passive income rather than short-term selling.

ETHUSDT chart by TradingViewHere are the main points noted :

- 1.8 million transactions processed on August 5 : an unprecedented level this year for the Ethereum network ;

- Nearly 30 % of the Ether supply is locked in staking, a strong signal of confidence from long-term holders ;

- The US SEC issued a statement on liquid staking, clarifying its legal position on this mechanism;

- The announcement fuels speculation about a potential Ethereum ETF with staking, an option that could sustainably change the balance of institutional investments in crypto.

This sequence of converging signals (increase in on-chain activity, massive staking, and the start of regulatory clarity) indicates a progressive repositioning of Ethereum as an institutionalized crypto asset, potentially eligible for structured financial products.

Unlike a purely speculative dynamic, these movements reflect a long-term commitment from holders, who now bet on regulated stability and performance rather than short-term volatility. If this trend continues, Ethereum could position itself as the preferred technological and economic support in a market seeking maturity.

Bitcoin : a brutal liquidation that shakes the market

On August 24, Bitcoin suffered a sudden and significant shock, caused by the sale of 24,000 BTC by a whale, valued at an estimated $2.7 billion. This move triggered a flash correction in the market, leading to the liquidation of about $500 million in Leveraged positions in just a few minutes.

Such an event contributed to a decline in Bitcoin’s dominance, which dropped from 60 % to 57 % over August. This is a notable setback in a market where the balance between major assets is closely watched.

This relative decline of Bitcoin is accompanied by renewed attention on Ethereum, reinforced by recent regulatory signals. The QCP firm considers that if an Ethereum ETF incorporating staking were to be approved, it could fuel the sentiment that “ETH will soon outperform the others”, in other words that Ether could outperform Bitcoin in the coming months.

Bitcoin liquidity remains vulnerable to isolated moves, which could discourage some institutional investors. Furthermore, the decline in dominance could signal a new phase of rebalancing between major assets, where performance will no longer be dictated solely by ecosystem size, but by its ability to generate yield, adapt to new regulations, and attract institutional flows. If Ethereum confirms its current trajectory, the crypto landscape could enter a new era of much more sophisticated arbitrage.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.