XRPL Q2 2025 Shatters Records: RWAs Hit All-Time High, XRP Surges, and Stablecoins Gain Unstoppable Momentum

XRP Ledger just delivered its most explosive quarter yet—defying traditional finance's glacial pace with blockchain's signature velocity.

Real-World Assets Go Vertical

RWAs on XRPL smashed previous records, cementing the network's role as a premier destination for tokenized real-world value. Institutions finally wake up to what crypto natives knew years ago.

XRP's Meteoric Rise

XRP isn't just holding ground—it's aggressively climbing, outpacing broader market trends and reinforcing its utility beyond mere speculation.

Stablecoin Invasion Accelerates

Stablecoin volume and adoption surged, highlighting XRPL's growing appeal for predictable, efficient digital dollar transactions—because sometimes even crypto needs a taste of stability.

While Wall Street still debates blockchain's value, XRPL builds, executes, and dominates—quarter after quarter. The future isn't coming; it's already here.

In Brief

- XRPL saw strong growth in Q2 2025, with new RWAs issued and rising token activity.

- Real-world assets on XRPL reached a record market cap of $131.6M in Q2 2025.

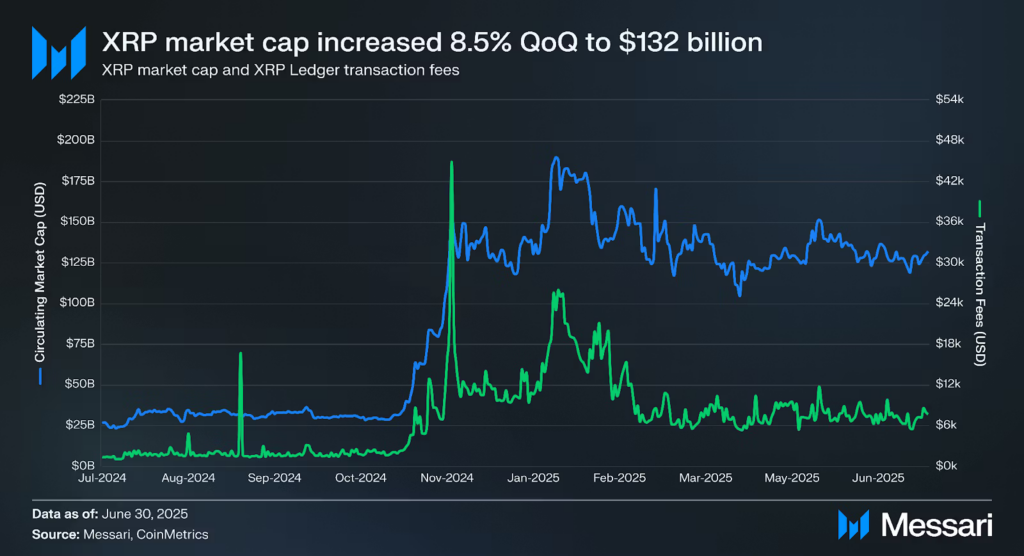

- XRP closed Q2 2025 as the fourth-largest crypto at $132B, up 8.5% from the previous quarter.

Real-world assets reach new highs

Messari’s “State of XRP Ledger Q2 2025” noted that the market capitalization of real-world assets (RWAs) issued on XRPL climbed to an all-time high of $131.6 million by the end of the quarter.

The increase was driven by several issuances first announced at the XRPL Apex event in Singapore in June. These included :

- Tokenized real estate from Ctrl Alt ;

- Digital commercial paper from Guggenheim ;

- The OUSG tokenized Treasury fund from Ondo.

Each of these offerings expanded the scope of what can be represented and transacted on XRPL.

Infrastructure has also improved. In March, the analytics provider RWA.XYZ integrated the XRPL into its platform, making it possible to monitor performance and activity of RWAs issued on the network. At present, thirteen RWAs have been added to the platform, with more integrations expected.

XRP closes Q2 as fourth-largest cryptocurrency

The quarter also reflected continued strength for XRP, the native token of the ledger. By the end of Q2 2025, XRP closed as the fourth-largest cryptocurrency by market capitalization, with a value of $132 billion. That represented an 8.5% increase from the previous quarter, while the price of XRP rose by 7.1% over the same period.

Momentum carried beyond the quarter’s close. At the time of writing, XRP’s market capitalization had risen further to $166.8 billion, reinforcing its position among the top digital assets.

Transaction Fees Decline on XRPL

While value on the ledger expanded, fee revenue declined. Messari emphasized that XRPL differs from many other networks in how it handles fees. Rather than rewarding validators or stakers, XRPL permanently removes transaction fees from circulation.

During the second quarter of this year, fees collected in U.S. dollars fell 38.7% quarter-over-quarter, from about $1.1 million to $680,900, while fees measured in XRP dropped 27.4%, from 425,300 XRP to 308,700 XRP

XRPUSDT chart by TradingViewStablecoin Growth on XRPL and Ethereum

Alongside these developments, Ripple’s stablecoin RLUSD gained further ground, ending Q2 with a combined market capitalization of $455.2 million across XRPL and Ethereum.

Subsequent data from RWA.XYZ indicated continued growth. At the time of writing, RLUSD’s total market value has reached $701.6 million, up more than 16% in the last 30 days.

On XRPL specifically, RLUSD ended the quarter with $65.9 million in market capitalization, a 49.4% rise compared to the previous quarter. This made it the leading stablecoin on the ledger. Current data places its XRPL share at $85.9 million, with another $615 million issued on Ethereum.

Taken together, the expansion of RLUSD, the record high for real-world assets, and the steady rise of XRP all signaled strong momentum. XRPL ended the second quarter of 2025 on a high note, and the months ahead will show how the network can leverage this foundation while navigating its distinctive fee model in the face of growing asset demand.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.