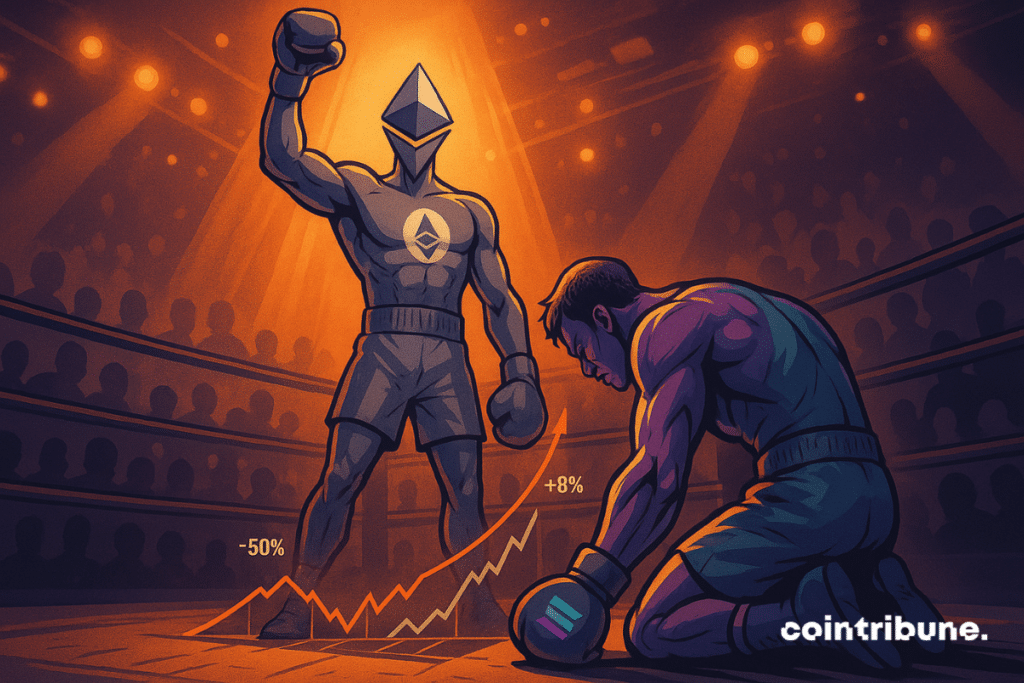

Solana Lags Behind… Could Now Be the Perfect Time to Buy?

Solana stumbles while rivals surge—is this the ultimate contrarian play?

The once-high-flying blockchain's recent underperformance raises eyebrows across crypto circles. While Ethereum scales new heights and BNB flirts with ATH territory, SOL quietly consolidates at levels that veteran traders recognize as potential accumulation zones.

Market mechanics suggest hidden strength

Network activity tells a different story than price action alone. Developer migration continues unabated, with serious builders ignoring short-term price fluctuations. The underlying technology keeps evolving—transaction speeds improve while costs remain negligible compared to legacy chains.

Institutional money moves differently

Smart money accumulates during fear periods, and current SOL prices offer what hedge funds term 'asymmetric upside.' Traditional finance veterans might dismiss this as another crypto gamble, but then they said the same about Bitcoin at $50.

The cynical take? Wall Street will eventually pile in once retail has done the heavy lifting—as always.

In brief

- Solana shows a lagging performance compared to Ethereum in 2025.

- Ethereum keeps attracting more capital thanks to liquid staking and DeFi.

- Solana appeals by its speed, low fees, and institutional use cases.

- Diversification between ETH and SOL appears to be a winning strategy.

Solana catches up to Ethereum

This year highlights a striking contrast between the two blockchain giants. On one side, Ethereum trades around 4,600 dollars, after setting a new ATH at 4,900 dollars on August 24th.

On the other, solana struggles to keep pace, showing stagnation that contrasts with its spectacular performances in previous years.

Yet, this stock underperformance does not reflect Solana’s technical reality. The blockchain founded by Anatoly Yakovenko and Raj Gokal shows an impressive capacity of 2,600 transactions per second, compared to barely 15 for Ethereum.

Added to this are almost negligible fees and an annual staking yield of 6.8%, well above Ethereum’s 3%.

Some observers believe that Ethereum, strong from its historic position, has rested on its laurels, leaving room for faster and more economic blockchains like Solana. This situation opens space where Solana can differentiate and attract investors looking to diversify their blockchain allocations.

Beyond technical performances, the Solana ecosystem stands out for its dynamism and capacity for innovation. “Blinks,” for example, allow direct integration of transactions into web links, making usage smoother. The Saga smartphone, launched in 2023, also illustrates this will to offer tools designed for native Web3 use.

For some observers, this integrated strategy positions Solana as a blockchain focused on user experience, combining infrastructure and concrete applications.

SOLUSDT chart by TradingViewInstitutional adoption accelerates

The year 2024 marks a decisive advance for Solana in the institutional world. The agreement concluded with fintech R3 has paved the way for partnerships with several heavyweights of traditional finance.

Actors such as HSBC, Bank of America, Euroclear, and even the Monetary Authority of Singapore are now experimenting with the Solana blockchain for asset tokenization and accelerating settlements.

In the payments sector, a strong signal came from PayPal, which chose Solana as infrastructure for its stablecoin in 2024. This strategic choice by a global giant validates the technological solidity of the network and confirms its ability to respond to large-scale concrete uses.

On the markets side, the investment offer related to Solana is expanding. Individuals can access the ecosystem through several thematic ETFs: the ProShares Ultra Solana (SLON), offering leverage on futures contracts, or the REX Osprey Solana + Staking (SSK), which combines spot exposure and yield via staking.

At the same time, the Securities and Exchange Commission is reviewing several Spot-SOL ETF applications filed by Fidelity, VanEck, 21Shares and Franklin Templeton, while TRUMP Media has submitted a proposal for a “Crypto Blue Chip” ETF including SOL.

This momentum has not gone unnoticed by trading professionals. Solana’s arrival on the retail market, combined with the progressive integration of concrete uses, fuels an organic activity that distinguishes the blockchain from other alternatives.

Ultimately, although Solana currently shows underperformance compared to Ethereum on the stock level, its technological advances, its institutional adoption and the diversification of its use cases strengthen its credibility. This consolidation phase could prove to be only a step before a new growth sequence.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.