Polkadot’s Bold Move: New Capital Markets Division Targets Wall Street Titans

Polkadot just dropped a bombshell on traditional finance—launching a dedicated capital markets division aimed squarely at Wall Street's biggest players.

The Interoperability Play

This isn't just another crypto project dabbling in finance. Polkadot's parachain architecture finally gets its Wall Street trial run, offering institutional-grade infrastructure that could actually handle real trading volumes.

Wall Street's Crypto FOMO

Traditional finance firms have been circling crypto for years without committing—Polkadot's move forces their hand. Suddenly every major bank needs a parachain strategy, not just Bitcoin exposure.

The Compliance Gambit

Unlike DeFi purists, Polkadot's playing the regulatory game. Their new division works within existing frameworks—because nothing gets institutional money flowing like knowing you won't wake up to SEC headlines.

Because apparently blockchain wasn't complicated enough—now we're recreating entire financial hierarchies with extra steps and more jargon. Wall Street bankers must feel right at home.

In brief

- Polkadot Capital Group aims to connect Wall Street to Web3 by tokenizing traditional assets for financial institutions.

- Polkadot Capital Group could boost demand for DOT and propel its price between $12 and $15 by the end of 2025.

- With the support of leaders like David Sedacca and growing interest in a Polkadot ETF, blockchain is establishing itself as a new major institutional player.

Why Polkadot Capital Group arrives at the right time for global finance

The timing of the launch of Polkadot Capital Group is no coincidence. It fits within a global dynamic where financial institutions seek to:

- Diversify their portfolios with digital assets;

- Reduce intermediation costs through blockchain;

- Access alternative yields via staking and DeFi;

- Comply with increasingly clear regulatory frameworks, notably in the United States.

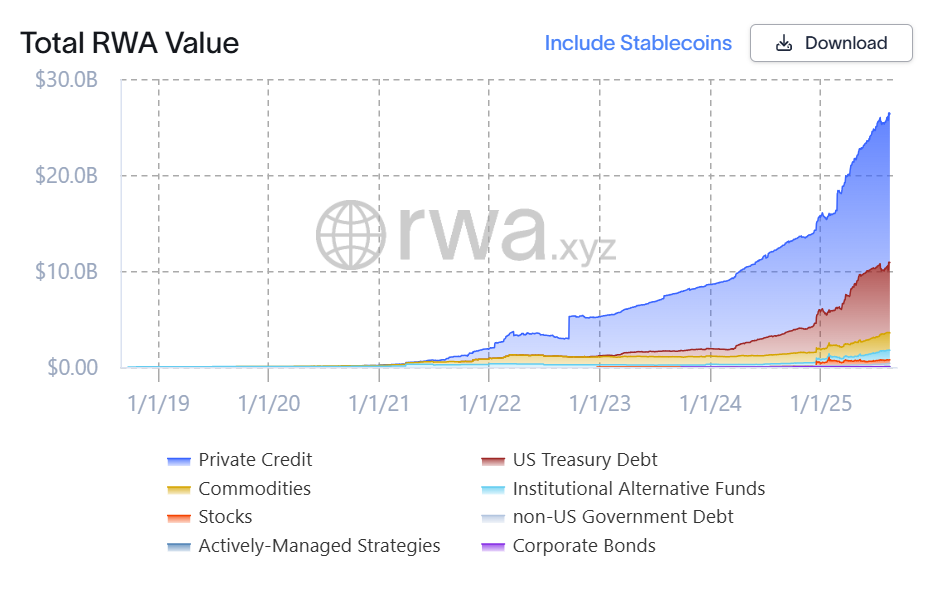

According to the latest estimates, the real-world asset (RWA) tokenization market exceeds 26 billion dollars, with exponential growth expected in the coming years.

How Polkadot wants to connect Wall Street to Web3

By launching a capital markets division, Polkadot aims to educate, support, and integrate financial institutions into its ecosystem. Thus, Polkadot Capital Group offers:

- The tokenization of real assets (real estate, bonds, funds);

- The integration of institutional staking;

- DeFi solutions for OTC desks and asset managers;

- Infrastructure for centralized and decentralized exchanges.

An initiative targeting banks and investment funds, family offices and allocators, VCs and wealth managers, and finally consulting firms and regulators.

At the helm of Polkadot Capital Group, David Sedacca embodies a pragmatic and educational vision. With experience in traditional finance and enterprise technologies, he wants to build a bridge of trust between institutions and Web3.

Our mission: to provide clear, credible, and actionable education, data, and access to Polkadot so that institutions – especially in the United States – can confidently engage in Web3 and digital assets.

Can Dot benefit from institutional adoption and reach 15 dollars?

The arrival of Polkadot in the institutional arena opens new prospects with benefits for institutions, namely:

- Access to Web3 yields without compromising compliance;

- Reduction of transaction times and costs;

- Increased transparency thanks to blockchain technology;

- Flexibility in structuring financial products.

However, challenges remain to anticipate such as adaptation to Web3 technology standards, internal team training, and dialogue with regulators. Nevertheless, Polkadot Capital Group could stimulate institutional interest, strengthening demand for DOT. If adoption progresses, the crypto price could aim for $12 to $15 by the end of 2025.

DOTUSD chart by TradingViewPolkadot Capital Group therefore does not seek to replace Wall Street but to reinvent it. By offering concrete, compliant, and performant solutions, this division could well become the institutional blockchain hub in the years to come! Especially right now when Nasdaq and 21Shares are betting big on a Polkadot ETF. For players in finance and even crypto, it is time to choose: remain spectators or become pioneers of a new era.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.