Bitcoin Teeters on the Brink: Ghost Month Jitters Fuel $100K Comeback Speculation

Bitcoin's price action turns skittish as Asia's 'Ghost Month' looms—but whispers of a six-figure rebound won't die.

Superstition vs. speculation: Traders split between seasonal caution and institutional FOMO as BTC dances around key support levels.

The $100K siren call: On-chain metrics show whales accumulating at current prices, while retail traders check lunar calendars (and their leverage).

Wall Street's crypto desks keep pushing the 'digital gold' narrative—funny how that always happens when their quarterly bonuses are on the line.

Bitcoin drops after its record at $124,000: a confirmed bearish signal

After reaching a record of 124,000 dollars a few days ago, Bitcoin underwent a nearly 6% drop, falling back below 117,000 dollars on August 14. The daily chart revealed a bearish engulfing pattern, a technical signal indicating a trend reversal. This episode marks the sharpest retreat of the month, reinforcing the idea of a consolidation phase.

Despite this correction, on-chain indicators highlight a strong market absorption capacity:

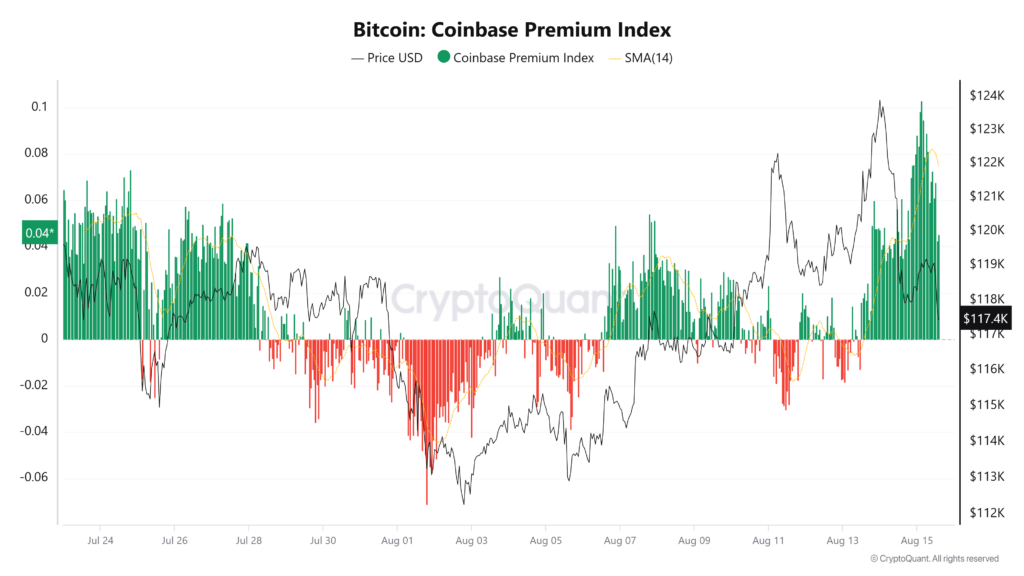

- The Coinbase Premium Index reached a monthly peak on August 14, evidence of increased demand in the United States.

- Meanwhile, the Kimchi Premium, an indicator specific to South Korea, returned to positive territory. Confirming a renewed appetite from local investors.

Moreover, capitulation signals remained limited. Indeed, only 16,800 BTC were liquidated at a loss by short-term holders! This is well below the 48,000 bitcoin observed during previous corrections.

The ” Ghost Month “: when superstition weighs on Bitcoin

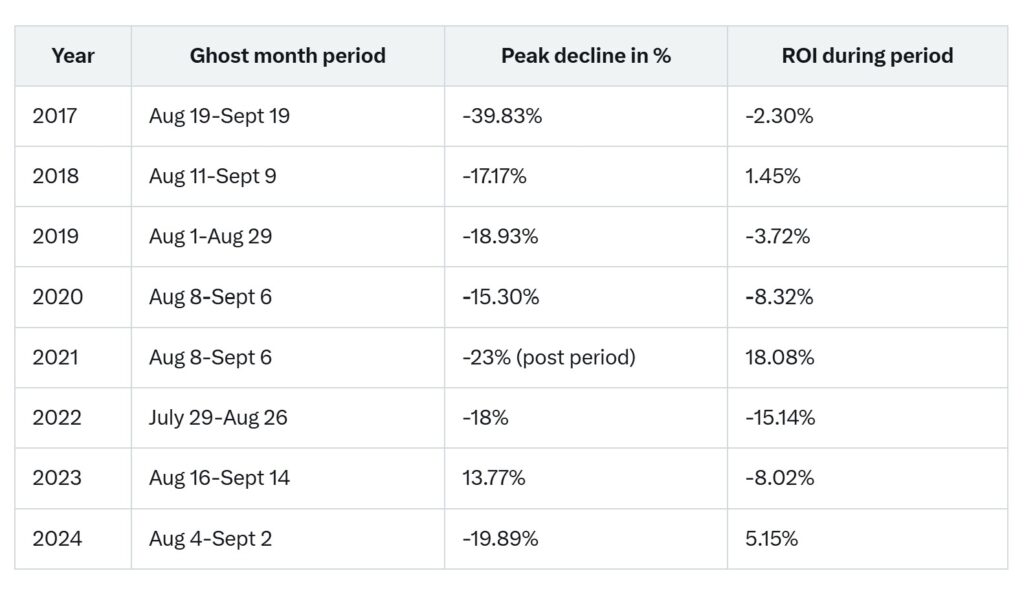

Beyond technical indicators, cultural seasonality plays a role. In this respect, the “Ghost Month“, which runs this year from August 23 to September 21, is seen in Asia as a period of bad omen. While this belief has no direct economic basis, its psychological impact on markets is real. Among other things, reduced risk appetite and increased profit-taking.

Historically, bitcoin has often declined during this period. Since 2017, the average drop recorded stands at 21.7%. This includes notable episodes: -39.8% in 2017 and -23% in 2021. As such, applying this pattern to the current price, an additional correction could bring BTC down to the 100,000 to 105,000 dollars range before hoping for a sustainable rebound.

Is a return to $100,000 inevitable for BTC?

From a technical point of view, the 116,000 to 117,000 dollars zone represents a key support for bitcoin, where spot purchases and futures positions concentrate. If this base holds, the market could quickly regain an upward trajectory. Conversely, a marked retreat of BTC during the Ghost Month WOULD reinforce the scenario of a test phase around 100,000 dollars.

BTCUSD chart by TradingViewIn the longer term, several analysts believe that a summer correction of bitcoin due to the ” Ghost Month “ could prepare a strong bitcoin rebound in the fourth quarter. This will be supported by a recovery in institutional demand and accumulated capital flows. The central question remains whether collective psychology will yield to seasonal fear or whether fundamentals will counter this repeated cycle.

How far will the current bitcoin drop go? Currently, BTC operates in a tension zone between signs of resilience and the threat of a seasonal correction. If the Ghost Month prolongs the decline, it may offer a long-term accumulation opportunity for investors before a possible recovery at year-end. This annual meeting of superstition and finance reminds us that collective psychology weighs as much as technical indicators on the crypto market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.