How Ethereum ETFs in 401(k)s Are About to Reshape Crypto Investing

Wall Street's favorite retirement tool just got a crypto upgrade—and Ethereum's the prime beneficiary.

Forget moonboys and memecoins. The real crypto revolution's brewing in your 401(k) statement. With SEC-approved Ethereum ETFs now eligible for retirement accounts, institutional money's about to flood the second-largest blockchain. It's the ultimate validation—provided you ignore that 401(k) providers will probably charge 2% fees for the privilege.

The mechanics are simple: fund managers package ETH exposure in familiar wrappers, HR departments rubber-stamp the option, and suddenly crypto's no longer 'that risky thing millennials do.' Expect pension funds to drip-feed billions into staking yields while maintaining plausible deniability about actually understanding smart contracts.

This isn't just price action—it's infrastructure. More institutional ETH holdings mean deeper liquidity, tighter spreads, and (finally) credible derivatives markets. The network effect could make Ethereum the TCP/IP of decentralized finance. Or it might just create a new generation of bagholders when the next 'risk-off' cycle hits. Either way, the suits are all-in.

In Brief

- Ethereum ETFs record a net inflow record of 1 billion dollars in one day.

- American 401(k) plans are now allowed to include cryptos and private equity.

- The ETF + 401(k) combination could trigger a massive and lasting inflow of capital into Ethereum.

1 Billion in 24h: The Ethereum ETF Breaks All Records

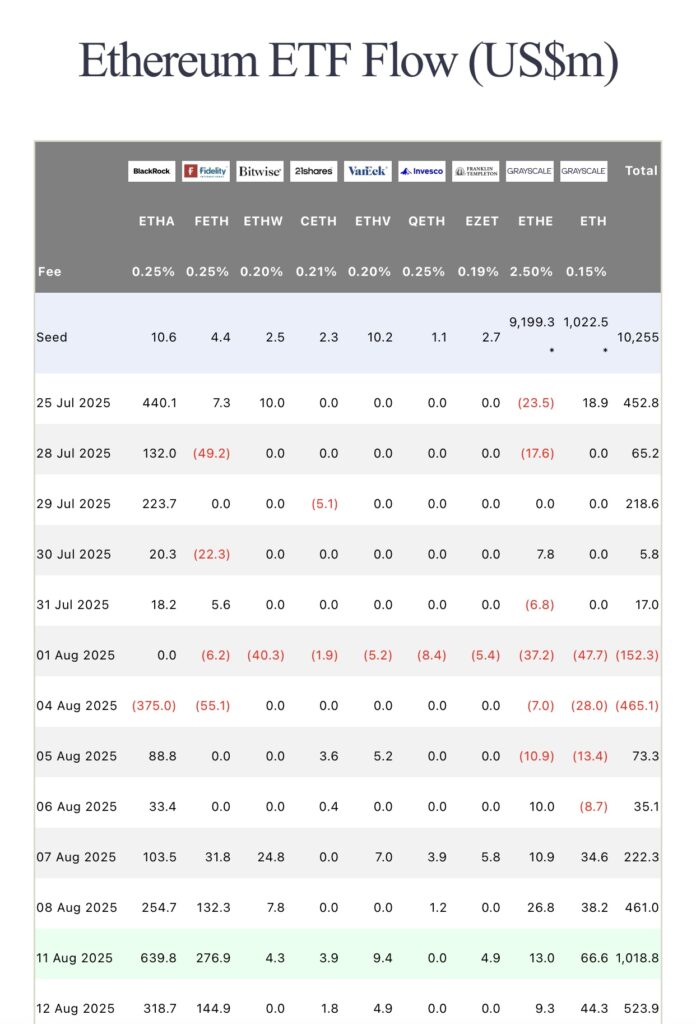

Ethereum ETFs recorded more than 1 billion dollars in net inflows on August 11, a historic record for the asset. BlackRock, with its ETHA product, captured 640 million dollars, while Fidelity, through FETH, attracted 277 million.

This enthusiasm for ETH is explained by several macroeconomic factors. US inflation stands at 2.8% year-over-year, strengthening expectations of Fed rate cuts. Investors are returning to risky assets, including cryptos, pushing Ethereum toward the 4,600 dollar zone, with bullish momentum in the short and medium term.

American 401(k) Plans Open Their Doors to Cryptos

The TRUMP administration has reached a milestone by allowing cryptos and private equity in 401(k) plans by repealing a directive dating from 2021. This change opens access to digital assets to millions of Americans via tax-advantaged accounts, a potentially colossal lever for long-term adoption.

This measure could replicate the impact that Gold ETFs had in the 2000s, when the SPDR Gold Trust facilitated gold exposure for institutional and retail investors.

ETHUSD chart by TradingViewETF + 401(k): The Duo That Could Transform Ethereum

The arrival of Ethereum ETFs strengthens the asset’s legitimacy with institutional investors. At the same time, opening 401(k) plans to crypto creates an unprecedented retail investment channel. This dual dynamic is amplified by cash strategies of companies like BitMine Immersion Technologies, which now holds 1.15 million ETH.

This mix of institutional flows, corporate accumulation, and retirement savings could inject tens or even hundreds of billions into the Ethereum ecosystem. As Ryan Lee, chief analyst at Bitget, points out:

This combination will strengthen the role of cryptocurrencies as an alternative to traditional financial investments, paving the way for sustainable capital inflows in the coming months.

Despite this optimism, several points of caution remain:

- Ethereum remains a highly volatile asset, susceptible to sharp corrections.

- Integration into 401(k) plans raises questions about liquidity and risk management for retirement portfolios.

- The SEC and Congress may still clarify the regulatory framework, notably regarding eligibility criteria for crypto assets in retirement accounts.

Bullish signals are multiplying for Ethereum. The combination of institutional adoption through ETFs and massive retail opening via 401(k) plans could be the catalyst for a structural bull cycle for Ethereum. If the trend is confirmed, this year could be retrospectively seen as the moment when ETH transitioned from an innovative asset to a cornerstone of global financial allocation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.