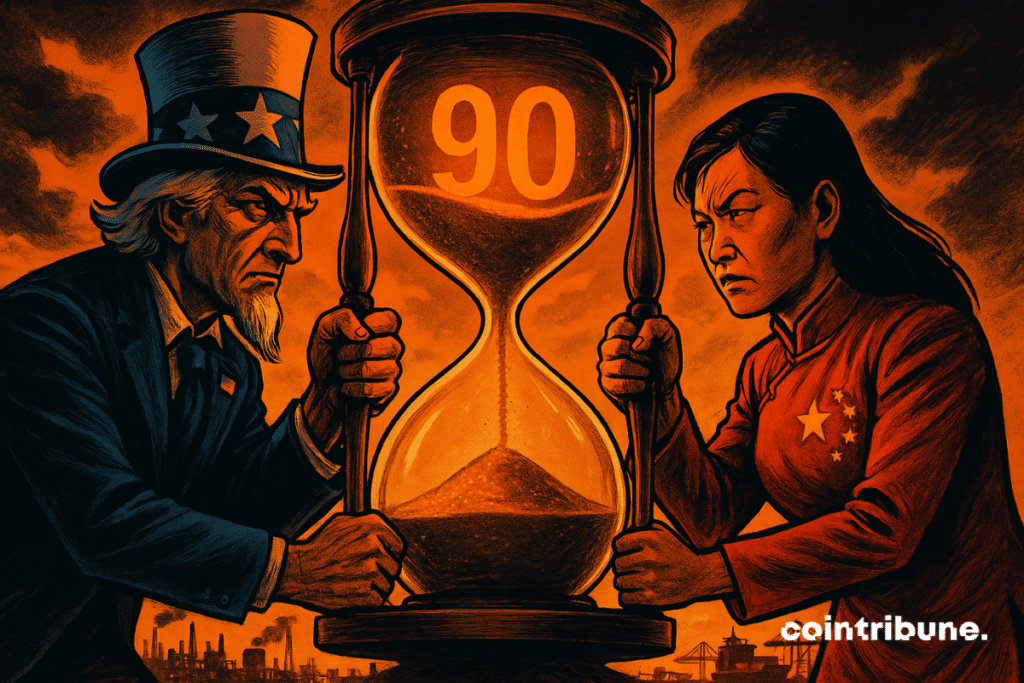

BREAKING: Washington & Beijing Lock in 90-Day Trade Truce Extension—Markets Hold Their Breath

Geopolitical tensions take a pause as the U.S. and China hit snooze on their trade war—again. Here’s what it means for your portfolio (spoiler: volatility isn’t going anywhere).

The Truce Playbook: Another 90-day extension kicks the can down the road—because why solve problems today when you can spreadsheet them into next quarter?

Market Whiplash: Futures ticked up on the news, but let’s be real—this is the same dance since 2018. Traders are already pricing in the next ‘will-they-won’t-they’ tweetstorm.

Cynical Finance Jab: ‘Stability’ lasts exactly as long as it takes hedge funds to reposition their algo trades. Happy hunting, bulls.

In Brief

- Washington and Beijing extend the 90-day trade truce until November 10, maintaining current surcharges.

- Discussions continue, Washington requesting more agricultural purchases from China.

- Gold remains exempt from taxes, but other existing surcharges are maintained.

Content and scope of Washington’s extension

On August 11, the United States announced, by presidential decree, the 90-day extension of the trade truce concluded with China. As a result, the end of the suspension of tariff increases is postponed until November 10.

This measure suspends the implementation of increases planned at the initial deadline and maintains current rates: 30% on Chinese imports and 10% on American exports. It extends the May agreement in Geneva, which had established a 90-day pause to reduce tensions.

China confirmed, via the Xinhua agency, that it is applying the same extension, aligning its position with Washington’s.

Both parties maintain the dialogue mechanism established since spring. This has allowed freezing the tariff escalation while maintaining pressure on points of disagreement. No changes have been made to the existing tariff conditions, offering a degree of short-term commercial stability.

Status of negotiations and consequences for markets and businesses

Since May, several rounds of talks have taken place in Geneva, London, and Stockholm. Washington states that China has taken measures considered significant to address American economic and national security concerns. Thus, exchanges continue with the goal of finding common ground before the new deadline.

The American president indicates that negotiations are constructive. Also, he insists on the need to obtain concrete concessions. Among these is an increase in Chinese purchases of agricultural products, particularly soybeans. And Beijing on its side declares it wants a positive outcome, based on equality and mutual benefit.

In fact, this extension provides visibility to importers and exporters. Trade flows can be planned at current rates until November 10 to reduce short-term uncertainty. The exemption of Gold from new duties, confirmed by Washington, has eased market concerns and contributed to price stabilization after rumors of taxation.

However, other surcharges decided in recent months, notably on steel, aluminum, and some industrial goods, remain in effect. New taxes could be applied if no agreement is found before the deadline. Companies must therefore anticipate several scenarios and adapt their supply strategies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.