Ethereum Dominates $572M Crypto ETP Influx as Bulls Charge Back

Crypto's phoenix moment? Ethereum ETPs just vacuumed up the lion's share of last week's $572M market rebound—while TradFi dinosaurs scramble to keep up.

Blood in the water, sharks circling

Institutional money isn't dipping toes—it's cannonballing into ETH products. The smart contract pioneer accounted for over 60% of total inflows, leaving Bitcoin's haul looking downright pedestrian.

Wall Street's FOMO playbook

After months of sidelined capital, asset managers are suddenly racing to backstop crypto exposure. Too bad their 'risk-managed' products still trail spot prices by 3-5%—but hey, those 2-and-20 fees won't milk themselves.

The closer: This isn't 2021's mindless greed. It's 2025's calculated accumulation—with Ethereum clearly wearing the institutional crown. For now.

In Brief

- Cryptocurrency ETPs saw a rebound last week with $572 million in net inflows.

- Ethereum led inflows with $268 million, pushing its year-to-date total to a record $8.2 billion and assets under management to $32.6 billion.

- Bitcoin attracted $260 million in inflows after two weeks of outflows.

From Early Outflows to Strong Recovery

The week began on a weaker note. CoinShares reported that outflows reached $1 billion in the early days, driven by concerns over slowing US economic growth following disappointing payroll data. These withdrawals were later overshadowed by a surge in demand after a major policy update in the United States.

Toward the end of the week, investment flows turned around, climbing to $1.57 billion after US authorities signaled that 401(k) retirement plans could include digital assets. This policy shift paved the way for increased retirement fund participation and coincided with gains in major cryptocurrencies, including Ethereum, which reached $4,000 on Friday for the first time since December 2024.

CoinShares reported that trading activity in digital asset ETPs fell by 23% from the prior month, a dip they linked to the typically slower summer season.

Ethereum Leads Weekly Inflows

Ethereum led cryptocurrency inflows last week, attracting $268 million in fresh capital. James Butterfill, CoinShares’ head of research, noted this brought total inflows for 2025 to a new high. At the same time, assets under management increased significantly since January, reaching $32.6 billion.

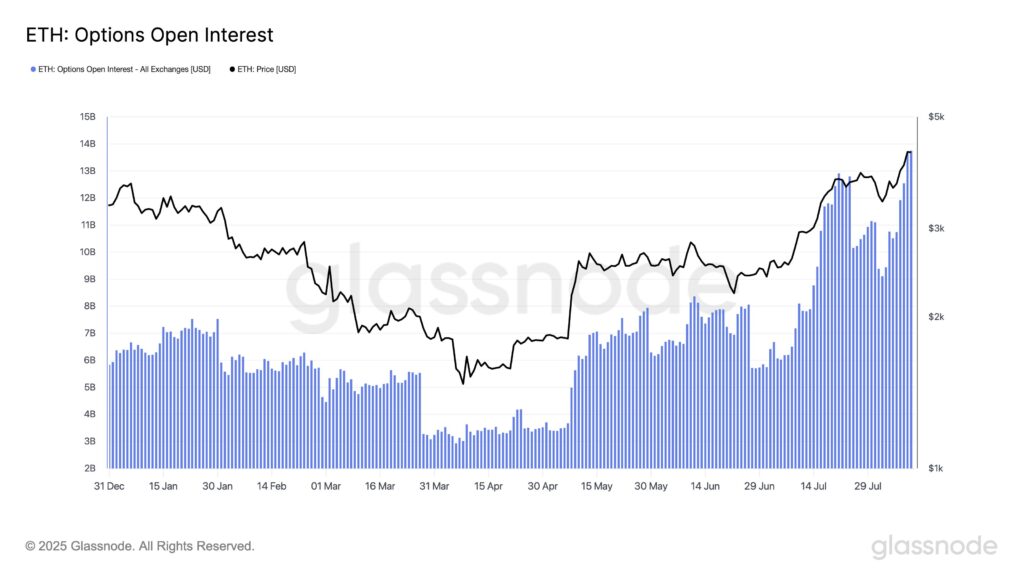

Derivatives data also highlighted Ethereum’s growing market activity. Glassnode reported that open interest in ETH options reached $13.75 billion, the highest level in 2025 so far and just short of the $14.6 billion peak recorded in March 2024. This surge signals increased trading activity in ethereum derivatives, matching the recent upward movement in its price.

Bitcoin, which had experienced two weeks of consecutive outflows, saw renewed investor interest. Weekly inflows reached $260 million, while products betting against Bitcoin recorded $4 million in outflows, reflecting reduced bearish sentiment.

Other altcoins also attracted capital, here is how much they gained:

- Solana gained $21.8 million in inflows

- XRP attracted $18.4 million in inflows

- Near saw $10.1 million in inflows

BlackRock Nears $100B in Crypto Assets

Among ETP providers, BlackRock’s iShares crypto ETF led the week in results. The company drew $294 million in inflows, although this was a 61% drop from the $749 million gained the week before. The firm’s crypto assets under management closed the week at $98.9 billion, placing it within reach of the $100 billion mark.

ETHUSDT chart by TradingViewMeanwhile, Grayscale reported $87 million in inflows, with total assets under management at $35.4 billion. Bitwise posted a slightly higher figure of $95 million. Fidelity moved in the opposite direction, recording $55 million in outflows from its cryptocurrency products.

CoinShares revealed that the United States led with $608 million in inflows last week, followed by Canada with $16.5 million. In contrast, Germany, Sweden, and Switzerland together posted outflows totaling $54.3 million. Overall, the week’s data still reflects strong investor appetite for Ethereum, which continues to lead in attracting new capital.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.