🚀 Ethereum Targets $5,000 as CME Futures Volume Explodes to Record Highs

Ethereum's rally isn't just retail hype—Wall Street's diving in headfirst. CME's ETH futures just smashed all-time trading volume records, flashing a big-money green light for the next leg up.

The institutional stampede: When CME whales place bets, markets tend to follow. This surge in regulated derivatives activity suggests ETH's $5K target isn't moonboy fantasy—it's becoming consensus.

Liquidity meets speculation: Record CME volume means two things: easier price discovery for bulls, and fresh ammo for shorts. But with ETH's supply looking tighter than a VC's vesting schedule, the momentum favors breakout traders.

Reality check: Let's see how fast the 'smart money' exits when volatility hits—Wall Street's crypto love affair lasts exactly until the next Fed meeting. For now, the charts scream acceleration.

In Brief

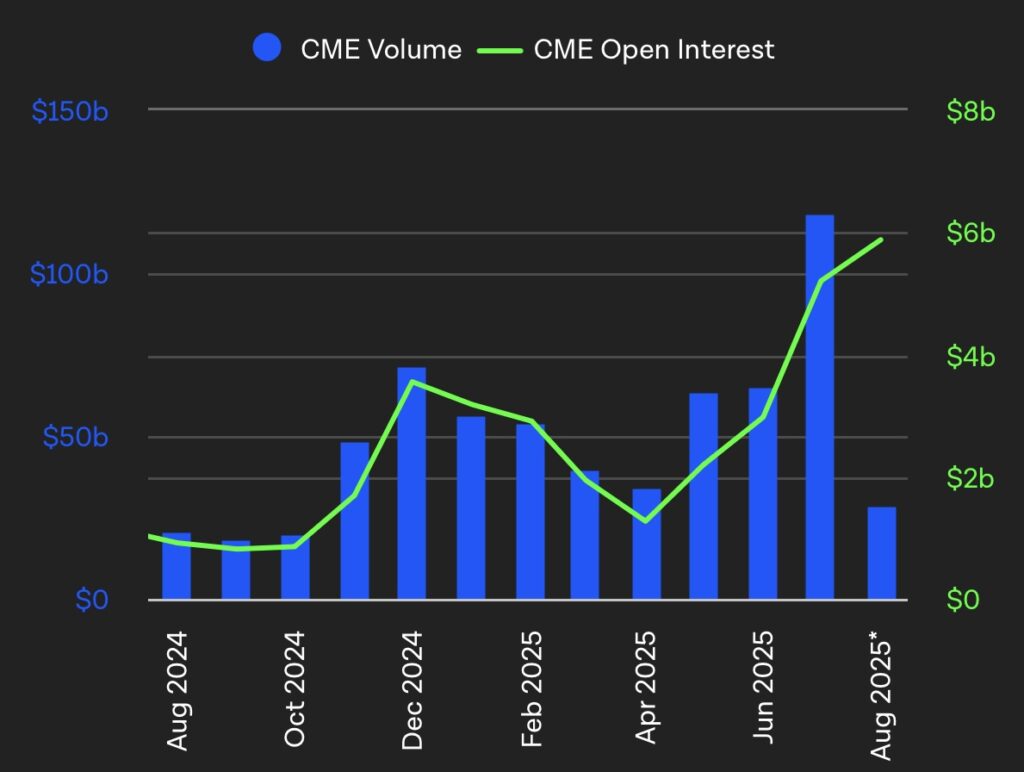

- Ethereum reaches $118 billion volume on the CME in July, a historic record.

- With an open interest of $6 billion, Ethereum shows strong institutional engagement.

- If momentum continues, Ethereum could see a crypto rally to $5,000 in August.

$118 billion on the CME: Ethereum smashes all its historic records

According to recent crypto data, the aggregated volume of ethereum futures contracts on the CME increased dramatically in July to reach $118 billion. This level far exceeds previous peaks observed around $80 to $90 billion, recorded in November 2024 and January 2025.

This performance takes place in a context where the CME, a reference platform for professional investors, has established itself as an essential gateway to exposure to Ethereum. This volume increase reflects not only heightened activity but also an expansion of the participant base, ranging from hedge funds to traditional asset managers.

Record volumes and open interest at all-time highs: the institutional rush on Ethereum accelerates

Alongside the record $118 billion volume on the CME, the average monthly open interest on Ethereum, representing the total amount of open positions, ROSE to about $6 billion, its highest level ever recorded. This rise began in March 2025 and shows no signs of slowing.

The correlation between high volumes and rising open interest suggests recent Ethereum activity is not limited to short-term operations. On the contrary, it reflects a more durable positioning, often associated with institutional strategies. Indeed, these aim to leverage price movements over several weeks or months.

For market analysts, this combination of factors can be interpreted as a sign of strategic accumulation. This reinforces Ethereum’s role as a preferred asset in institutional crypto portfolios.

Ethereum at $5,000 in August? The signals igniting the crypto market

Can this renewed activity in the derivatives markets translate into a lasting bullish impulse for Ethereum? Historically, a simultaneous increase in volume and open interest on the CME has often preceded phases of marked volatility, both upward and downward. If the current momentum continues and institutional appetite holds, ETH could test $5000 in August.

ETHUSD chart by TradingViewHowever, this outlook will also depend on several external factors:

- The evolution of macroeconomic conditions;

- Regulatory announcements;

- Bitcoin movements, often driving bullish cycles across the entire crypto market.

With SharpLink buying $54 million in ETH and a historic $118 billion record on the CME, Ethereum now stands as the star of the derivatives markets. Institutional interest is growing and could trigger a new bullish cycle. August will therefore be decisive to see if crypto ETH is really aiming for an unprecedented peak.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.