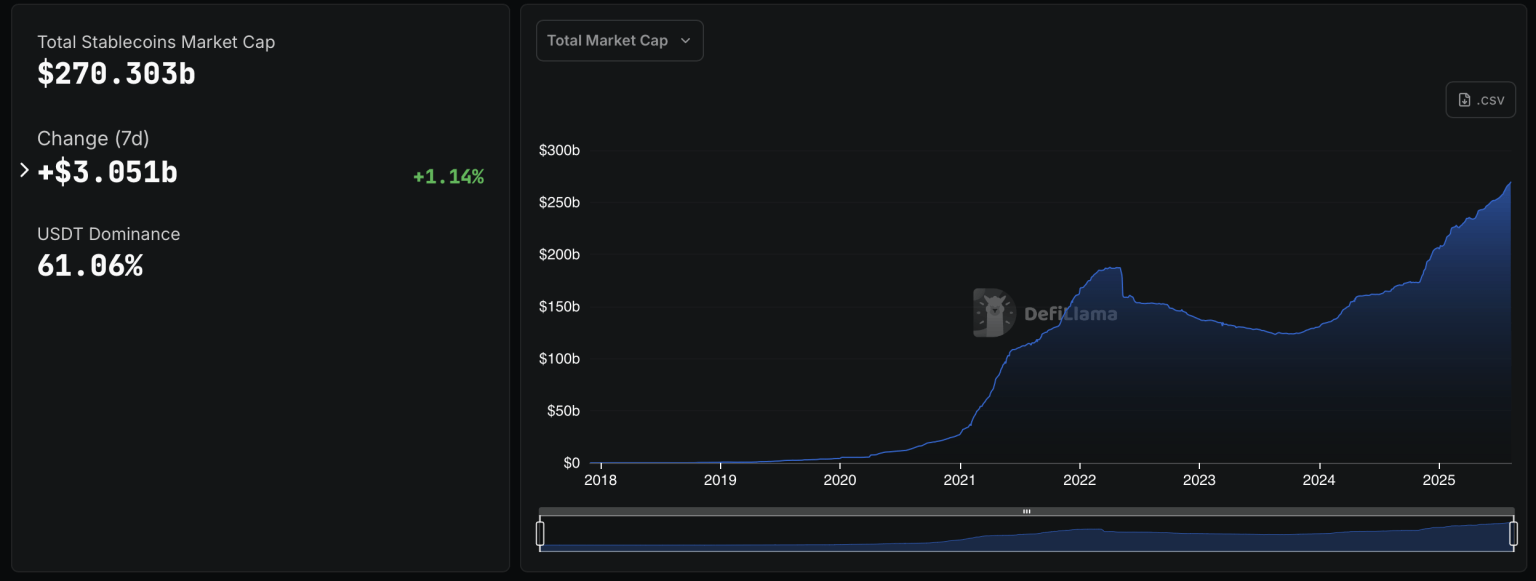

Stablecoin Market Smashes $270.3B Barrier – A New Era of Dollar Dominance in Crypto?

The stablecoin revolution just hit ludicrous speed. With $270.3 billion now parked in these digital dollar proxies, traditional finance is getting a masterclass in monetary velocity.

No banks. No opening hours. Just pure, programmable liquidity.

Meanwhile, Wall Street still charges $25 for wire transfers that take three days to clear.

In Brief

- Stablecoins reach 270.303 billion dollars in capitalization, with a weekly increase of 3.051 billion dollars.

- USDT holds 61.06% of the market, USDC largely dominates global DeFi transactions.

- American regulation propels TRON to 51% of USDT in global circulation.

- Ethereum keeps DeFi leadership, while Base and Solana quickly gain strategic importance.

A historic peak that redefines the stablecoin market

For stable cryptos, a record was set in August 2024 in terms of market cap. 12 months later, thereachedaccording to DefiLlama, and 368 billion if the entire market is taken into account. In one week,were, +1.14%. Growth reflecting a worldwide adoption.

In detail,with 61.06% market share.follows closely but shines mainly in the DeFi universe where it captures. This shift toward usage, rather than simple holding, tells a different story than just the volume battle.

The flows are colossal:, a level comparable to the Visa network and much higher than PayPal or classic international transfers. These movements come from 42.8 million active addresses over a month, spread across Ethereum, Tron, BNB Chain, Solana, Base, and Arbitrum.

Transaction geography shows dominance of North America and Asia, while Europe progresses. Latin America, Africa, and Southeast Asia remain vibrant markets, showing stablecoins are establishing themselves as a universal bridge between fiat and crypto.

American regulation: a springboard for stablecoins

July 2025 marked a turning point with the, establishing a clear framework for fiat-backed stablecoins. For institutions, it is an official green light. Investors, previously cautious, are now rushing into this class of digital assets.

The SEC added another stone to the building by recognizingon company balance sheets. This status opens the doors to broader integration into traditional finance.

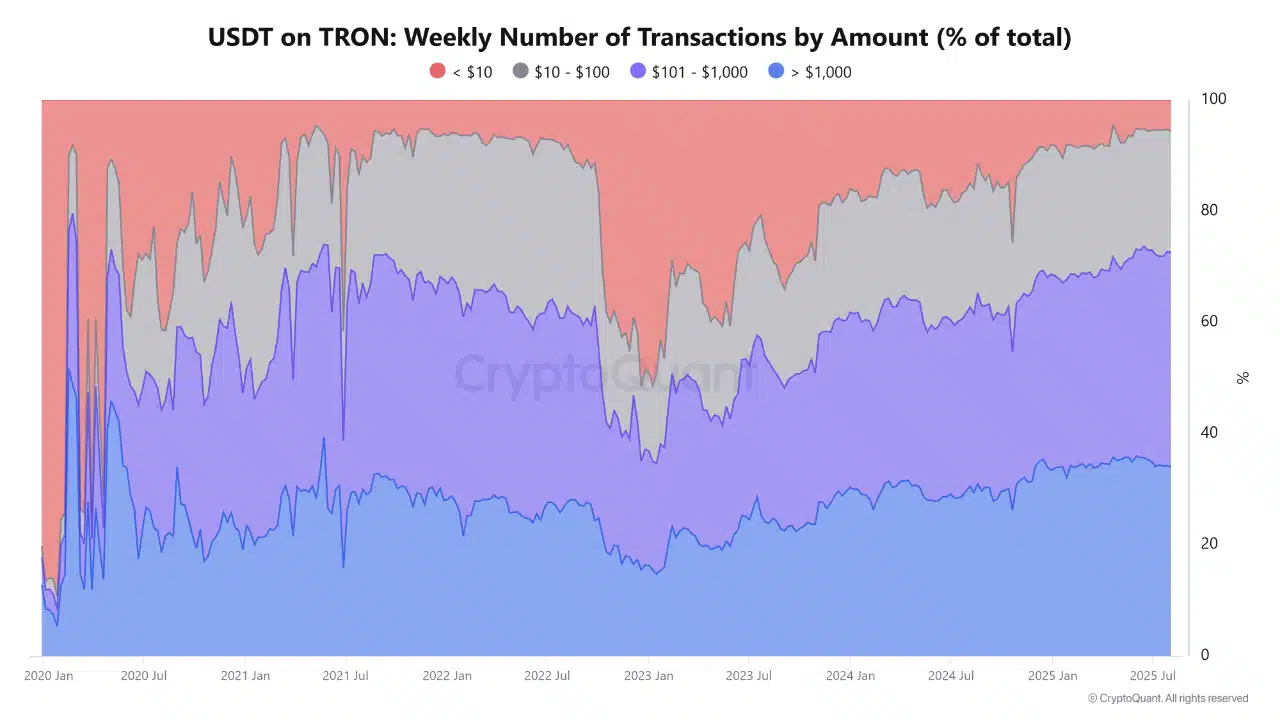

Immediate effect:, raising its share to 51% of all USDT in circulation, or 83 billion dollars. Justin Sun, founder of TRON, praised this performance in a post highlighting the speed and low cost of his network.

Usage changes: 38.66% of transactions on TRON are between 101 and 1,000 dollars. Freelancers, merchants, and SMEs adopt these fast, secure transfers. Micropayments (

USDT on Tron: Weekly number of transactions by amount – Source: CryptoQuant

USDT on Tron: Weekly number of transactions by amount – Source: CryptoQuant

This new regulatory environment transforms stablecoins into real treasury tools, able to attract both Wall Street and emerging markets.

Boiling networks: Tron, Ethereum, and the volume war

In this technological battle,but complementary paths. TRON, with its 8.29 million weekly USDT transactions, establishes itself as the global hub for fast payments. Its formula: low fees, speed, and reliability.

Ethereum remains the stronghold of USDC and DeFi. Its TVL reaches 137.33 billion dollars, with a peak at 179 billion this year, supported by liquid staking and ETH flirting with 4,000 $. USDC volumes on ethereum dominate the DeFi market, capturing most transactions.

ETHUSDC chart by TradingViewBehind these two giants,, offering alternative issuance grounds. Newcomers like USDe (+79.47% supply in one month) or USDf (+100%) shake the established order.

Some key numeric benchmarks:

- 270.303 Bn $ stablecoin “float” in 2025;

- 2.7 trillion $ exchanged in 30 days;

- 51% of USDT circulates on TRON;

- 42.8 million active addresses in one month;

- USDC = 40 to 48% of DeFi transactions.

These data show that the battle no longer plays only on capitalization, but also on usage, speed, and network diversity.

The United States sees in this stablecoin wave a lever to regain control of global digital finance. China, on the other hand, chooses a cautious and soft-step approach, reflecting a desire to master the digital monetary transition without rush. A strategy that could well redefine the global balance in the long term.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.