BNB Smashes All-Time High: The Crypto Juggernaut Rewrites Global Finance Rules

BNB isn't just breaking records—it's bulldozing through them like a DeFi wrecking ball. The token just hit an eye-watering ATH, leaving traditional finance clutching its pearls.

How high did it go? High enough to make Wall Street's 'safe' 5% yields look like pocket change. The charts aren't just climbing—they're doing a vertical moonshot that would give acrophobic traders vertigo.

Market Domination in Real-Time

Binance's native token isn't playing nice with competitors. While altcoins wobble, BNB's liquidity depth could swallow smaller cap tokens whole—no fork required. Exchange reserves? Stacked higher than a crypto bro's NFT portfolio.

The Aftermath: Finance Will Never Be the Same

Legacy banks are scrambling to explain why their 'blockchain initiatives' still can't match a five-year-old crypto project's transaction throughput. Meanwhile, BNB holders are too busy counting gains to care about the SEC's latest regulatory tantrum. (Funny how profits silence even the loudest compliance officers.)

One thing's clear: when history books write about 2025's financial revolution, this surge won't be a footnote—it'll be the headline. Unless of course the suits finally 'discover' blockchain and try to take credit.

In brief

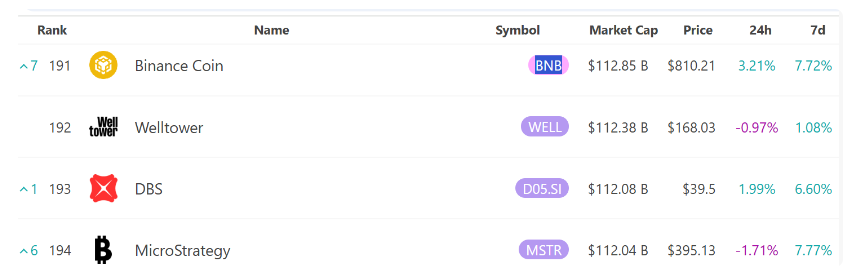

- BNB reaches 112.85 billion USD in market cap, surpassing DBS Bank and MicroStrategy in the ranking.

- The token rose 7.72% over one week, showing strong bullish momentum.

- Massive buys by Nano Labs and Windtree support institutional demand for BNB.

- BNB Chain leads Ethereum in DEX volumes and daily application revenues.

BNB, the rise of an altcoin that challenges banks

In one week,, reaching. This figure propels it to the, ahead of DBS Bank and MicroStrategy. On July 28, the altcoin had already surpassed the 119 billion USD mark, overtaking Nike.

Markets are watching. Some applaud, others grit their teeth. Changpeng Zhao, founder of Binance, recently publicly expressed his appreciation to. This symbolic gesture was seen as a sign of cohesion and confidence, strengthening the image of a solid and mobilized network.

Behind this rise, several catalysts:, massive institutional buys like those from Nano Labs (50 million USD), and public support from CZ. Even intraday volatility – from 790 to 808 USD – did not dampen enthusiasm.

BNBUSD chart by TradingViewWhen Binance’s crypto takes on a macroeconomic dimension

BNB is no longer just a utility token. It has become ain the crypto world. By surpassing multinational companies, it forces analysts to rethink the comparison scales between digital and traditional assets.

On July 25, Windtree Therapeutics announced a. A clear signal: companies outside the crypto ecosystem now consider this altcoin a strategic asset. When publicly traded companies buy a token for their treasury, it is no longer a simple speculative bet.

Key takeaways to remember

- 112.85 billion USD: market cap reached in early August;

- 191st rank among global assets;

- 64% of circulating supply controlled by CZ;

- 5.06 billion USD DEX volume on BNB Chain, ahead of Ethereum.

This dominance is not just technical: it reflects growing confidence, supported by network solidity and the vision of its founder.

BNB is now among the few cryptos considered a true institutional asset. Its progress shows a marked convergence between traditional finance and blockchain innovations, making this token an anchor point for investors seeking solidity and potential.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.