Bitcoin Crushes Q2 2025: CoinGecko Reports 24% Crypto Market Surge as King Coin Reigns

Bitcoin just flexed its dominance—again. According to CoinGecko's latest quarterly report, the crypto market roared back with a 24% gain in Q2 2025, and BTC led the charge like a bull in a china shop.

The Alpha Coin Stays Alpha

No surprises here: Bitcoin ate the competition's lunch. While altcoins flailed, BTC stacked gains and reminded everyone why it’s the only crypto your uncle remembers the name of.

Market Waves, Not Ripples

The 24% surge wasn’t just a blip—it was a full-throttle rebound. Traders piled in, institutions stopped pretending to ignore it, and even Wall Street’s ‘blockchain, not Bitcoin’ crowd got uncomfortably quiet.

Cynical Finance Bonus

Let’s be real—half this growth came from hedge funds overleveraging ‘the new gold’ while shorting it on the side. Some things never change.

In Brief

- The crypto market jumps 24% in Q2 2025, driven by Bitcoin with 62.1% dominance.

- Bitcoin and Ethereum ETFs attract record capital, strengthening institutional confidence.

- DeFi, memecoins, and AI boost the ecosystem despite declining trading volumes.

This in-depth analysis of the CoinGecko Q2 2025 report breaks down the major trends that shaped the quarter, from Bitcoin’s reinforced dominance to new ETF approvals, through the meteoric rise of memecoins and the evolution of decentralized finance.

The Market Recovers: $663 Billion Growth

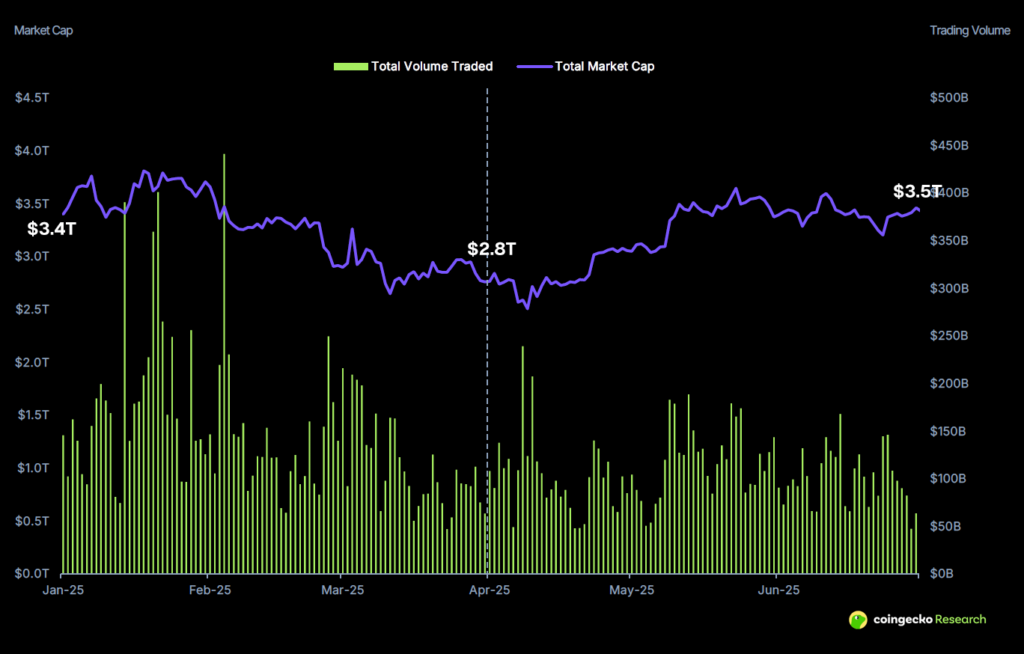

The figure summarizing the quarter is impressive: the total cryptocurrency market capitalization jumped from, a phenomenal increase ofrepresentinggrowth. This spectacular rebound follows the sharp April crash caused by the escalation of tensions between Iran and Israel that sowed panic across all financial markets.

Paradoxically, this valuation explosion is accompanied by a significant drop in trading volumes, falling to(compared to the previous quarter). This phenomenon reflects a fundamental behavior change: investors now prefer to hold their crypto assets rather than engage in frequent speculative trading. A sign of market maturity approaching traditional finance standards.

This evolution is accompanied by growing convergence with traditional stock markets. The correlation between cryptocurrencies and thenow reaches, reflecting the progressive integration of digital assets into the global financial ecosystem. Cryptos are no longer a separate market but an integral part of the modern investment landscape.

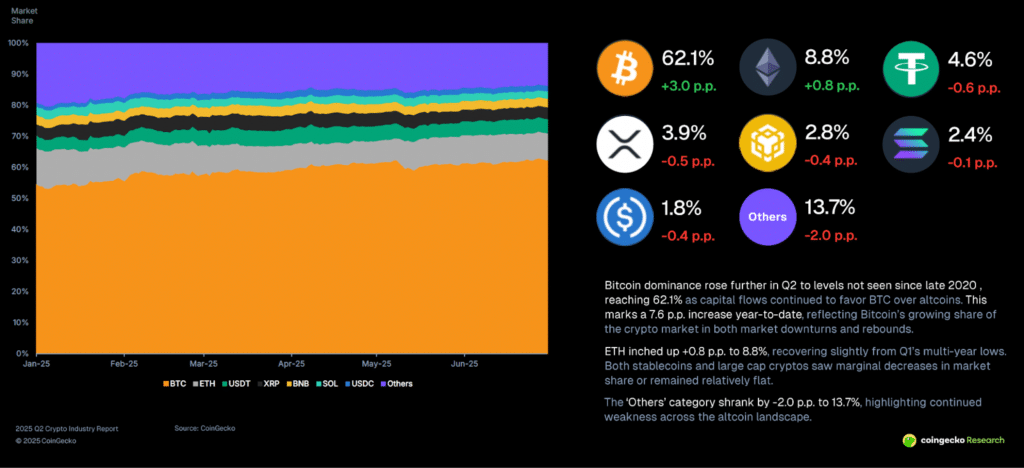

Bitcoin Strengthens Dominant Position with 62.1% Market Share

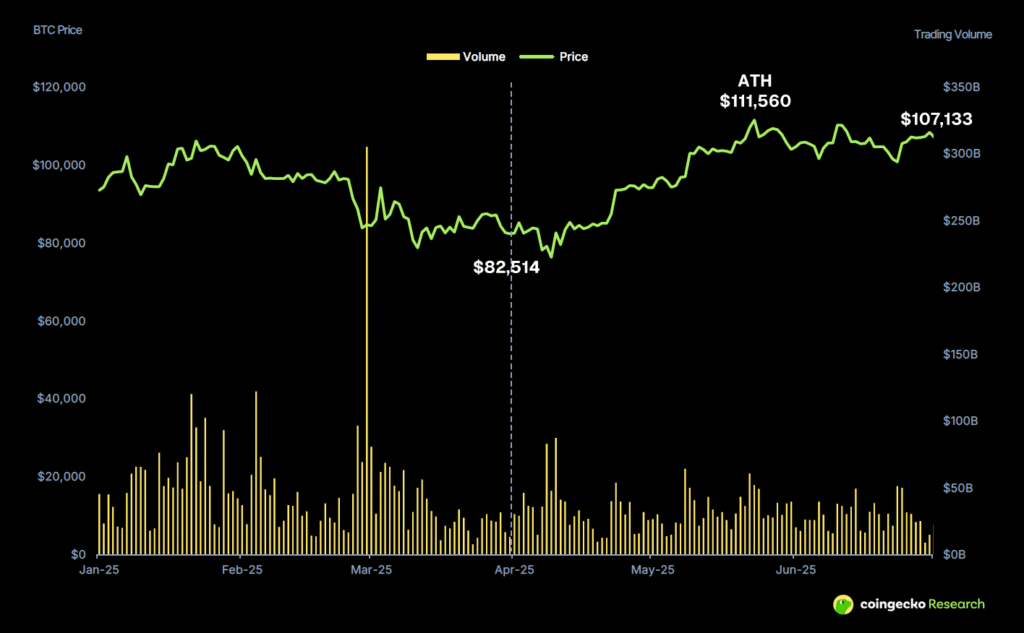

was the big winner this quarter, consolidating its status as “digital gold” with remarkable performance. Its market share now reaches(percentage points), its highest level since the end of 2020. This dominance is explained by a price increase ofduring the quarter, the cryptocurrency recovering from a low ofin April toat the end of June.

The peak was reached on May 23 with a historic high at, driven by the overall improvement of market sentiment and massive inflows of institutional capital. Bitcoin ETFs played a key role, attractingversus onlyin Q1. This 14x increase in capital inflows illustrates renewed appetite from professional investors forexposure.

confirms its undisputed leadership with its IBIT ETF now controllingof bitcoin ETF market share. This concentration reflects investors’ trust in traditional asset managers for their crypto exposure.

Technically, thenetwork reached a historic milestone by surpassingof computing power for the first time, confirming the network’s increasing security. Meanwhile, annual volatility fell tofromin Q1, signaling gradual price stabilization.

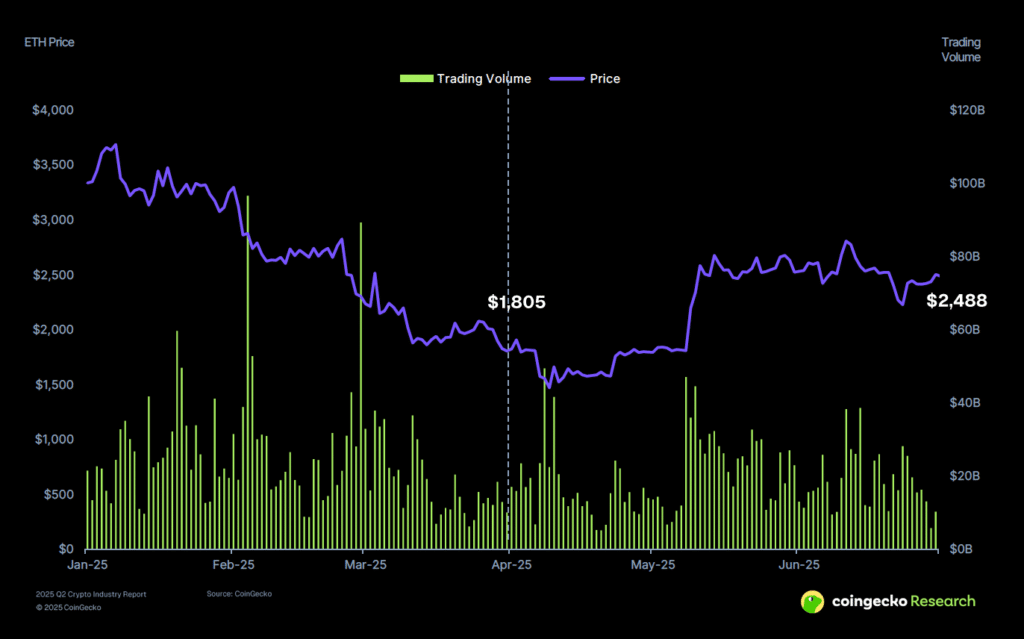

Ethereum Recovers Despite Increased Competition

delivered the best performance among the top five cryptocurrencies with a gain ofin Q2, pushing its price from. However, this remarkable rebound is not enough to erase early-year losses, withstill below its 2025 opening price of.

The success ofETFs is one of the quarter’s standouts. These funds raised, bringing total assets under management to(compared to Q1).reiterates its dominance with its ETHA ETF becoming the segment leader withassets.

Despite fierce competition from alternative blockchains,maintains its dominant position in decentralized finance withof total value locked. This resilience relies notably on technical improvements brought by theupdate, which enhances the network’s perception among developers and users.

Network optimization pays off with a significant reduction in transaction fees, averagingdown fromin Q1. This improvement, combined with a stable daily activity volume of abouttransactions, boosts’s attractiveness for decentralized applications.

Solana and the Historic Approval of the First ETF

experienced a rollercoaster quarter with a final performance of, but marked by significant fluctuations. After reaching a peak at, the cryptocurrency ended the quarter at, illustrating the persistent volatility of this rapidly growing ecosystem.

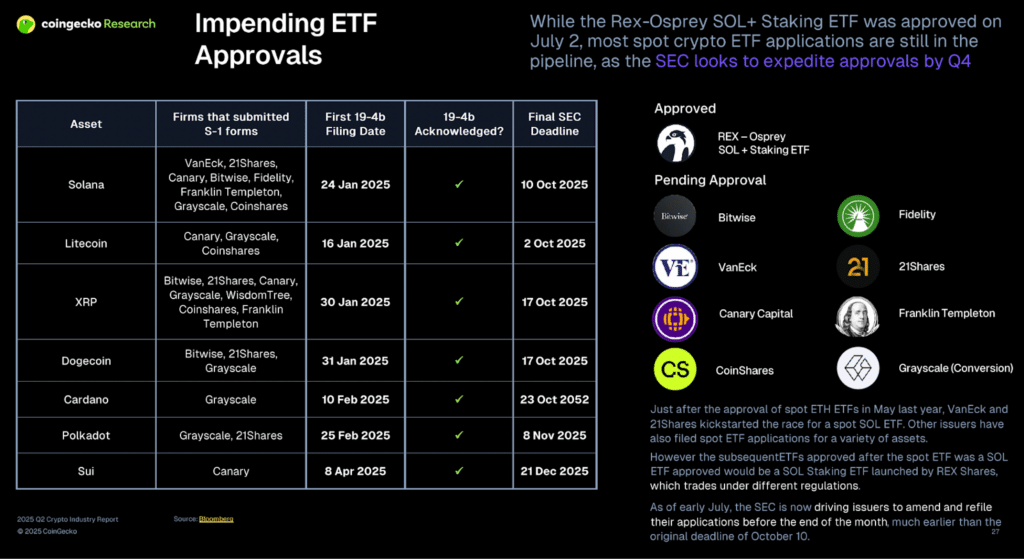

The quarter’s historic event forwas the approval, on June 30, of the first ETF dedicated to this blockchain: the. This first approval paves the way for a series of expected approvals, with,,, andin the pipeline.

network activity continues to grow with aincrease in active addresses, making this blockchain the most dynamic in the sector. This vitality is also reflected in decentralized finance, whereconsolidates its second place withof total value locked.

Thememecoin ecosystem remains particularly attractive, capturingof global investor interest, demonstrating this blockchain’s ability to attract creative communities and viral projects.

Decentralized Finance Regains Momentum

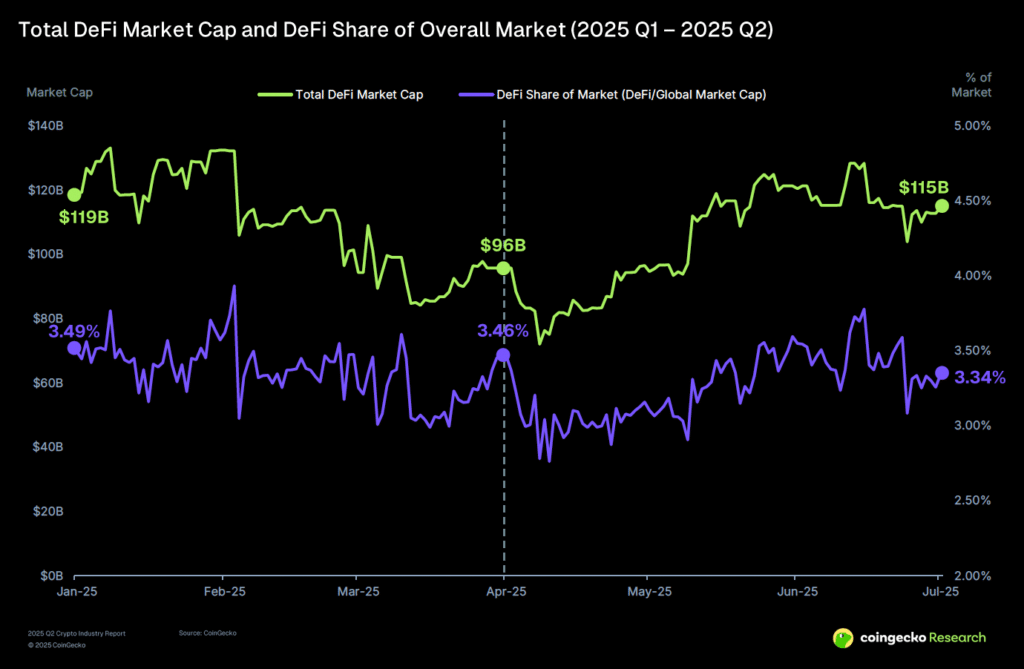

Thesector is experiencing a revival, with capitalization increasing from(). Although its relative market share slightly decreases tofromin Q1, this stabilization despite competition reflects the robustness of fundamentals.

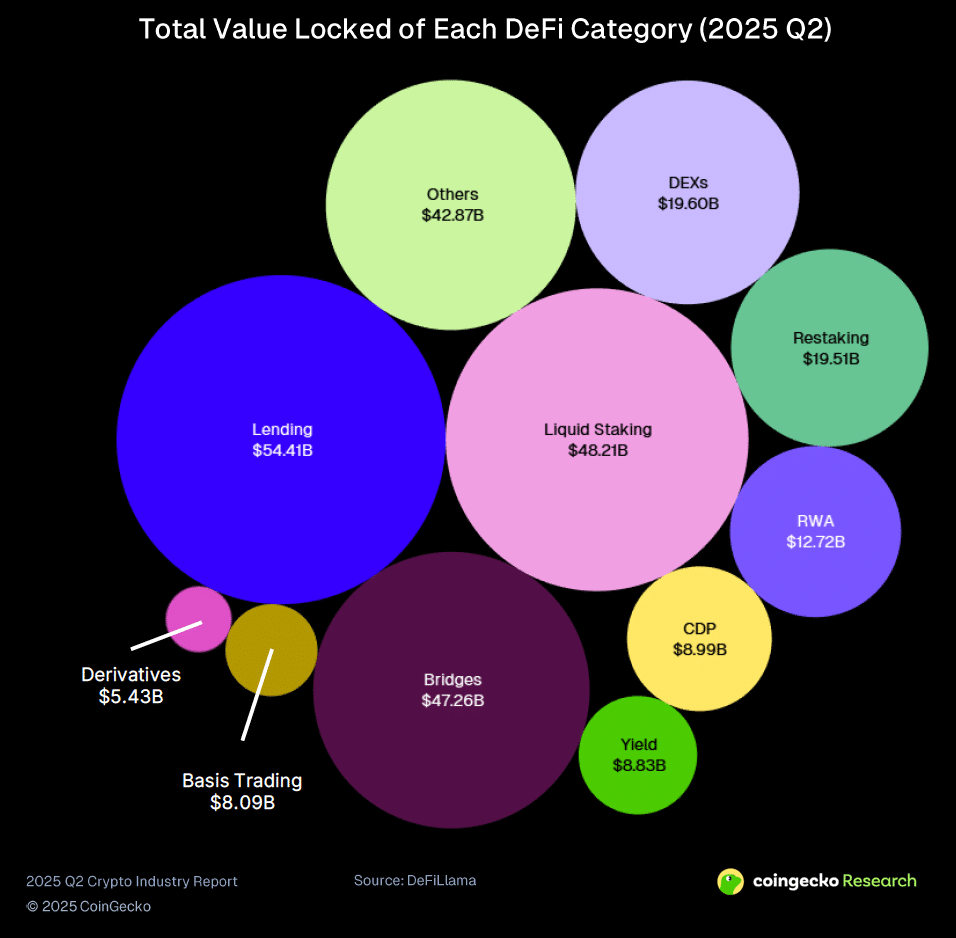

Several segments stand out with exceptional growth. Bridges between blockchains explode withgrowth, meeting increasing demand for interoperability in a multi-chain ecosystem. Lending protocols follow with, driven by players likeand. Liquid staking, a key narrative post-Shanghai, shows growth of.

is the most spectacular phenomenon this quarter. This decentralized trading protocol multiplied its value bysince Q1 to reach, illustrating the disruptive potential of decentralized platforms against traditional exchanges.

Real-world assets (RWA) maintain their momentum withgrowth despite still modest market share of. This emerging category symbolizes’s evolution toward concrete use cases and tangible economic utility.

Memecoins and AI: Trends Captivating Investors

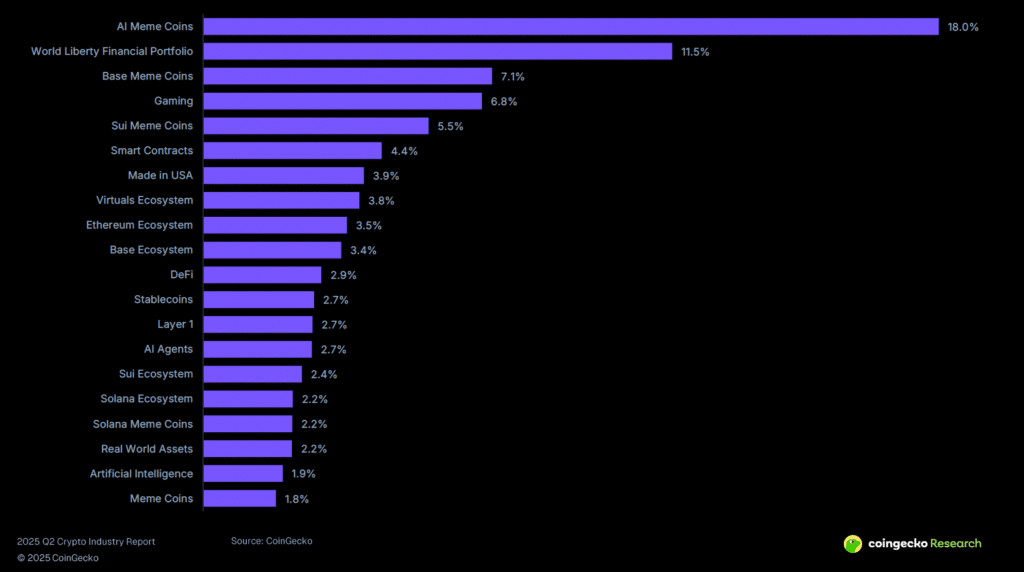

Enthusiasm for memecoins and artificial intelligence dominates this quarter’s crypto news, these two themes together capturingof investor interest. This predominance illustrates retail market appetite for simple and viral concepts.

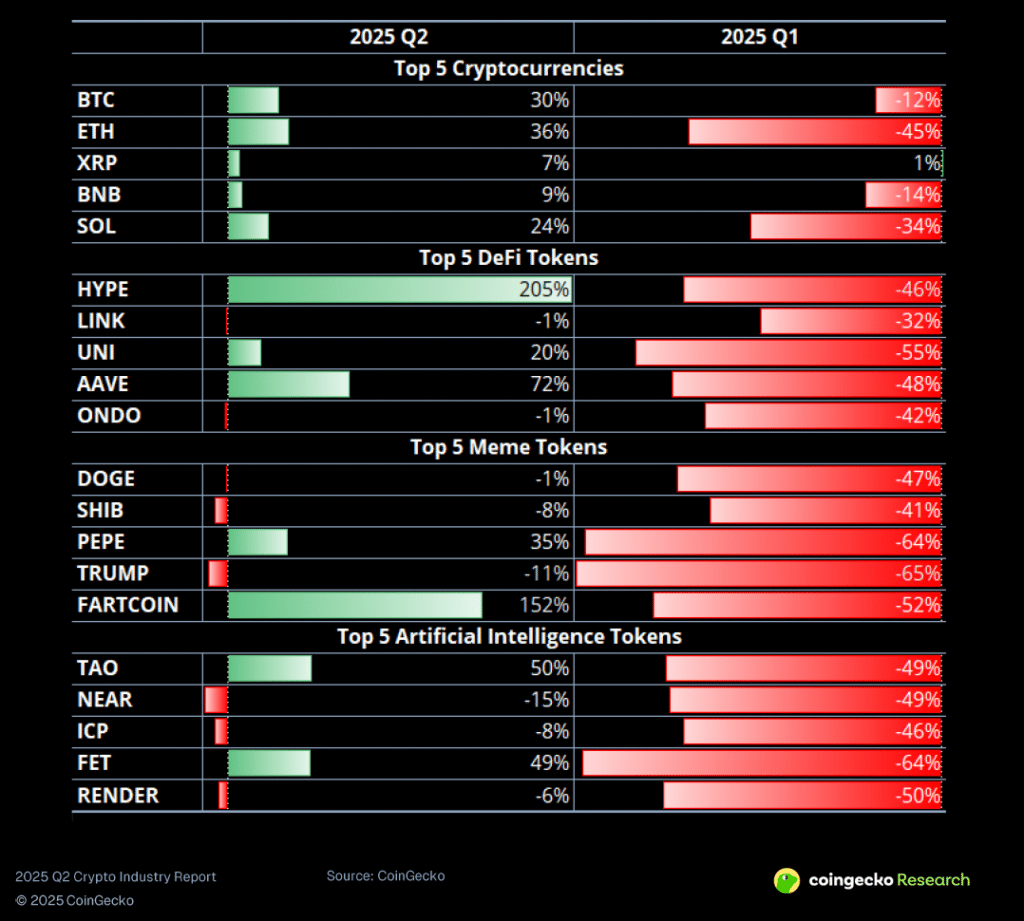

The performances are spectacular:leads with, followed bywith a remarkable comeback atafter adrop in Q1.consolidates gains with, confirming the relative maturity of some meme projects.

The political effect materializes through thewhich drawsinterest, demonstrating the growing influence of public figures on crypto capital movements. This politicization opens new perspectives but also new regulatory risks.

Geographic diversification of memecoins accelerates with() and(), reflecting the democratization of token creation on different blockchains. Overall, enthusiasm for AI representsof combined interest, confirming the attractiveness of this future-oriented theme.

Decentralized vs Centralized Exchanges: A Shifting Balance of Power

The quiet revolution of the quarter concerns the changing power balance between centralized and decentralized exchanges. The DEX/CEX ratio reaches a historic record ofversusin Q1, reflecting growing adoption of decentralized platforms.

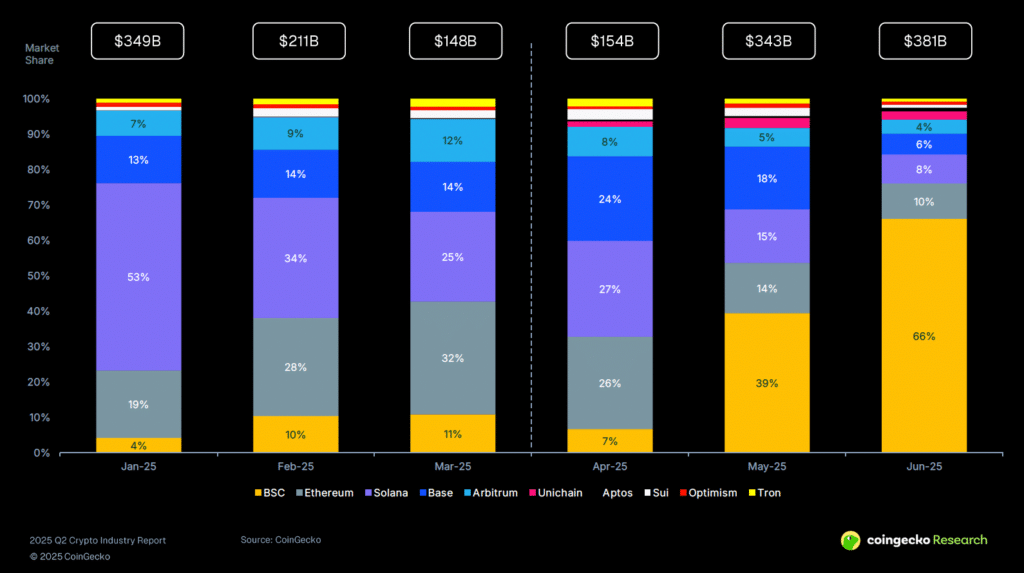

This transformation heavily relies on the dominance of(Binance Smart Chain) representingof decentralized exchange volumes in June 2025, up fromin January., the main DEX of theecosystem, explodes withvolume to reach, benefiting notably from theprogram which redirects traffic to the decentralized platform.

Conversely, centralized exchanges face a difficult period, with volume droppingover the quarter.suffers the steepest decline with, illustrating the challenge some players face maintaining attractiveness against decentralized competition.

confirms its rise by controllingof decentralized perpetual contracts market share, demonstrating it is possible to compete with centralized giants by offering an equivalent user experience without compromising decentralization.

Future Outlook: A Closely Watched Q3 2025

The second quarter of 2025 unmistakably marks the return of institutional confidence in the crypto ecosystem, evidenced by record ETF inflows and valuation stabilization. Retail enthusiasm for new trends (memecoins, AI) coexists harmoniously with the growing sophistication of theinfrastructure.

The third quarter promises to be decisive with a pipeline of pending ETF approvals, notably for,and. The approach of the U.S. elections could also influence regulatory directions and institutional adoption. Ongoing developments in, particularly around real-world assets and interoperability, shape an ever more mature and diversified ecosystem.

Cryptocurrency investments carry capital loss risks. This content is produced for general information purposes only and does not constitute investment advice. Please consult the complete CoinGecko Q2 2025 report for detailed analysis.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.