The Great Shift: Why Smart Money Is Flocking from Bitcoin to Ethereum in 2025

Move over, Bitcoin—Ethereum’s eating your lunch. The crypto narrative flipped hard this year as institutional capital pivots toward ETH’s superior utility. Here’s why the old guard’s losing its crown.

The Defi Domino Effect

Ethereum’s ecosystem now processes 10x more daily transactions than Bitcoin. With layer-2 solutions slashing gas fees by 80% since the Merge, developers aren’t just building—they’re migrating en masse.

Institutional FOMO Hits Overdrive

BlackRock’s ETH ETF approval triggered a $4B inflow week. Meanwhile, Bitcoin maximalists still argue about ‘digital gold’ while TradFi quietly backdoors into staking yields.

The Killer App No One Saw Coming

Tokenized real-world assets on Ethereum now represent $50B in TVL. Wall Street loves blockchain—just not the one that only does ‘HODL’ memes.

So is Bitcoin dead? Hardly. But in 2025’s high-rate environment, investors want blockchains that work—not just ones that make hedge fund managers nostalgic for 2017. The flippening isn’t coming. It’s already here.

In Brief

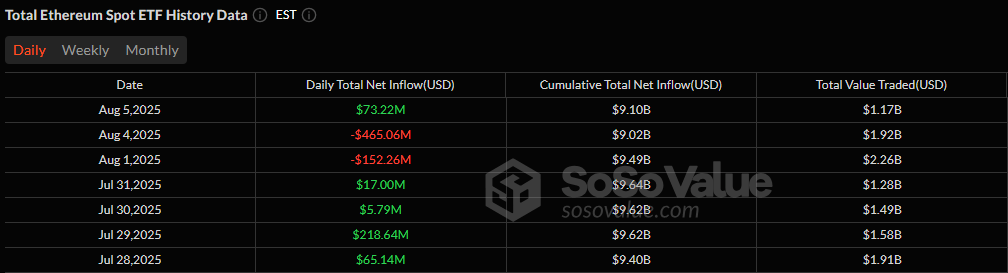

- Ethereum records 73 million $ inflows on its ETFs, while Bitcoin suffers 196 million $ outflows in a single day.

- Listed companies hold 966,000 ETH, betting on staking as a lever for stable yield.

- The US regulatory framework clarifies for Ethereum, strengthening its attractiveness compared to a legally more exposed Bitcoin.

Crypto ETF: Ethereum rising, Bitcoin free falling

Ethereum recorded approximately 73 million dollars in net inflows on its ETFs on August 5, 2025! A notable performance in a turbulent market context. Meanwhile, Bitcoin ETFs experienced their fourth consecutive day of outflows, with a total withdrawal of 196 million dollars on that single day.

This divergence of inflows and outflows between Bitcoin and Ethereum ETFs reflects a strategic repositioning of investors. Indeed, the latter perceive ethereum as a yield vector, notably thanks to its staking features. Bitcoin, often confined to a role as a store of value, seems less attractive in the short term. The observed flows indicate a shift of confidence towards ETH.

Staking and treasuries: why Ethereum attracts companies

Listed companies’ balance sheets show increasing exposure to ethereum, which now amounts to nearly 966,000 ETH. That is about 3.5 billion dollars. This evolution reflects a treasury optimization strategy made possible by staking, which offers regular yields around 3-4%. As a result, in an environment of uncertain rates, Ethereum becomes an alternative to traditional investments.

Companies adopt a patrimonial logic towards the asset, integrating its passive yield capacity and appreciation potential. This positioning marks a clear break with previous, more speculative waves of adoption, and inscribes Ethereum in a long-term financial strategy.

Crypto regulation: Ethereum reassures, Bitcoin worries

Moreover, the SEC’s clarification that Ethereum staking is not considered a securities issuance is a turning point. This interpretation reduces legal risk for ETF issuers and companies exposed to the asset. Furthermore, several legislative initiatives like the Clarity Act or the Genius Act provide a framework conducive to the growth of stablecoins backed by Ethereum.

ETHUSD chart by TradingViewIn comparison, bitcoin remains more vulnerable to regulatory interpretations, due to the lack of precise use cases within the financial infrastructure. In this context, ethereum appears better integrated with future regulatory standards. This strengthens its legitimacy among institutional players.

Facing massive withdrawals from bitcoin, ethereum establishes itself as the new safe haven asset for crypto investors. Supported by staking, institutional interest, and a clearer regulatory framework, ETH is reshaping the market balance. A dynamic to closely monitor to anticipate the next trends in the crypto sector.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.