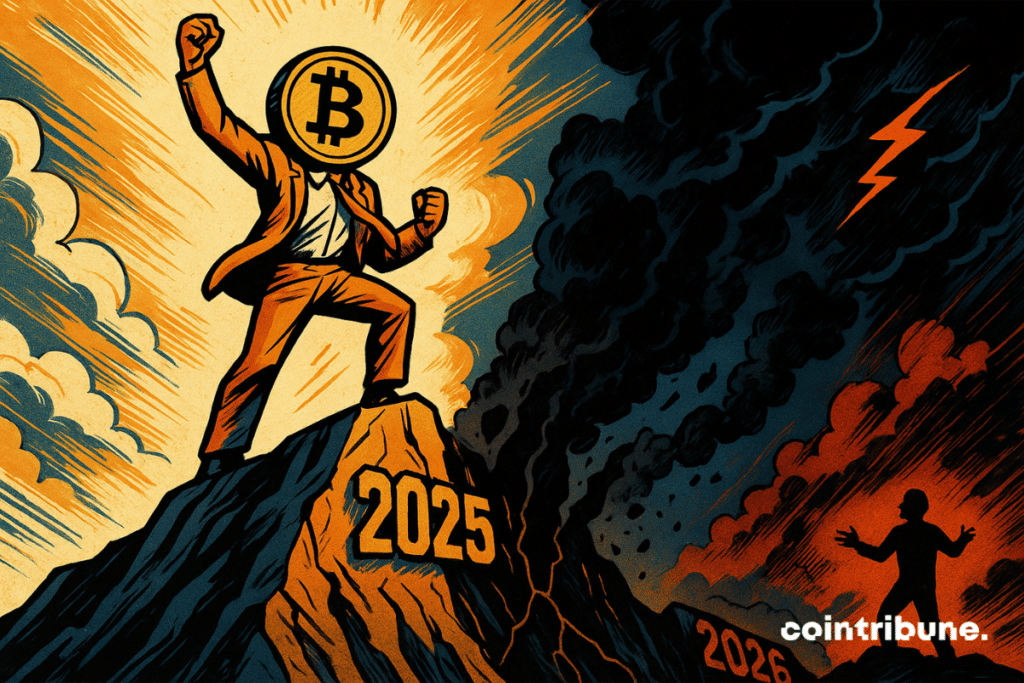

Bitcoin Poised to Skyrocket to $140K Before 2026 Market Shift—Here’s Why

Brace for impact—Bitcoin’s next bull run could send prices soaring to $140K before the market flips bearish in 2026. Analysts are doubling down on the forecast, citing halving cycles, institutional FOMO, and that classic crypto volatility.

Why $140K? It’s not just hopium. Historical patterns suggest Bitcoin’s post-halving rallies tend to overshoot even the most aggressive targets. This time, Wall Street’s playing along—golden handcuffs and all.

Timing the top? Good luck. The ‘26 pivot might be the exit signal for smart money, leaving retail holding the bag (again). Meanwhile, traditional finance will still be arguing about ‘store of value’ while Bitcoin eats their lunch.

In Brief

- Bitcoin continues its rise and trades above 114,000 dollars, an unprecedented level for several weeks.

- According to an Elliott Wave analysis expert, the market is engaged in the fifth and final bullish wave of the cycle.

- The technical target of 140,000 dollars by the end of 2025 remains plausible if the current momentum continues.

- However, the same analyst warns of a major reversal in 2026, signaling a probable entry into a bear market.

A Bullish Target Maintained Despite Uncertainties

In an analysis, John Glover, Chief Investment Officer at Ledn and former trader on interest rate markets and specialist in the Elliott Wave approach, confirmed that Bitcoin remains on an upward trajectory towards 140,000 dollars by the end of the year.

At a time when BTC trades around 114,000 dollars, this projection fits into a still largely optimistic market context. “We are still on a structural path pointing to a peak around 140,000 dollars by the end of the year“, he stated.

This statement comes at a key moment, as major resistance levels could be tested in the coming weeks.

BTCUSDT chart by TradingViewSuch a projection is based on Elliott Wave theory, which structures markets in behavioral cycles. The expert identifies the current market as being in the fifth and final bullish wave of the cycle, a phase historically associated with a major peak. Here are the key points made :

- The current BTC price is around 114,000 dollars ;

- The technical target is set at 140,000 dollars for this year, supported by cyclical Elliott Wave analysis ;

- The current configuration would be the fifth wave, the last bullish phase before a structural reversal ;

- This final wave is characterized, according to the theory, by a surge of euphoria and strong market participation before correction ;

- John Glover highlights the consistency with previous cycles, which have often seen peaks precede significant drops.

All these elements suggest that the bullish momentum could continue in the coming months, but technical analysis calls for caution. The 140,000 dollar target, if reached, could thus mark a peak, not a new stable base.

2026, The Year of Reversal ? A Worrying End of Cycle

Beyond apparent optimism, the expert warns of a significantly less favorable scenario for the following year. According to him, once the peak is reached, 2026 could mark the beginning of a DEEP bear market, linked to the typical behavior of Elliott cycles.

“The greatest danger does not lie in the coming months, but in what awaits us after the peak“, he warns. This statement reverses the perspective of many players, urging caution post-euphoria rather than the anticipated celebration of a new historic peak for bitcoin.

The Elliott Wave theory, on which this analysis is based, predicts that after the fifth bullish wave comes a major corrective phase, usually called wave A of a retracement cycle.

The extent of this correction is not specified, but the cyclical nature of the approach implies a structural market retreat. This hypothesis differs from purely fundamental or macroeconomic classic analyses, relying on crowd psychology and behavioral regularities of investors over time.

From this perspective, the potential consequences are multiple. If the 140,000 dollar target is reached, the risk of a sharp reversal could surprise some institutional players who have entered the market, and revive the extreme volatility that bitcoin has experienced during previous cycles, even if the asset is becoming more stable than stocks. Caution is therefore advised not because of an unfavorable macroeconomic context, but because the very technical conditions of the market would indicate the end of a cycle.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.