Bitcoin Miners Rake in $1.66B in July—Smashing Post-Halving Records

Talk about a comeback. Bitcoin miners just pocketed a staggering $1.66 billion in July—their highest haul since the last halving event. Proof that pickaxes (well, ASICs) still print money when the network tightens its belt.

Who needs Wall Street margins when you’ve got cryptographic lottery tickets? The hash rate may fluctuate, but miners keep cashing checks—even as traditional finance bros clutch their pearls over 'volatility.'

One thing’s clear: while bankers debate yield curves, crypto’s dirtiest hands are quietly stacking sats. Again.

In Brief

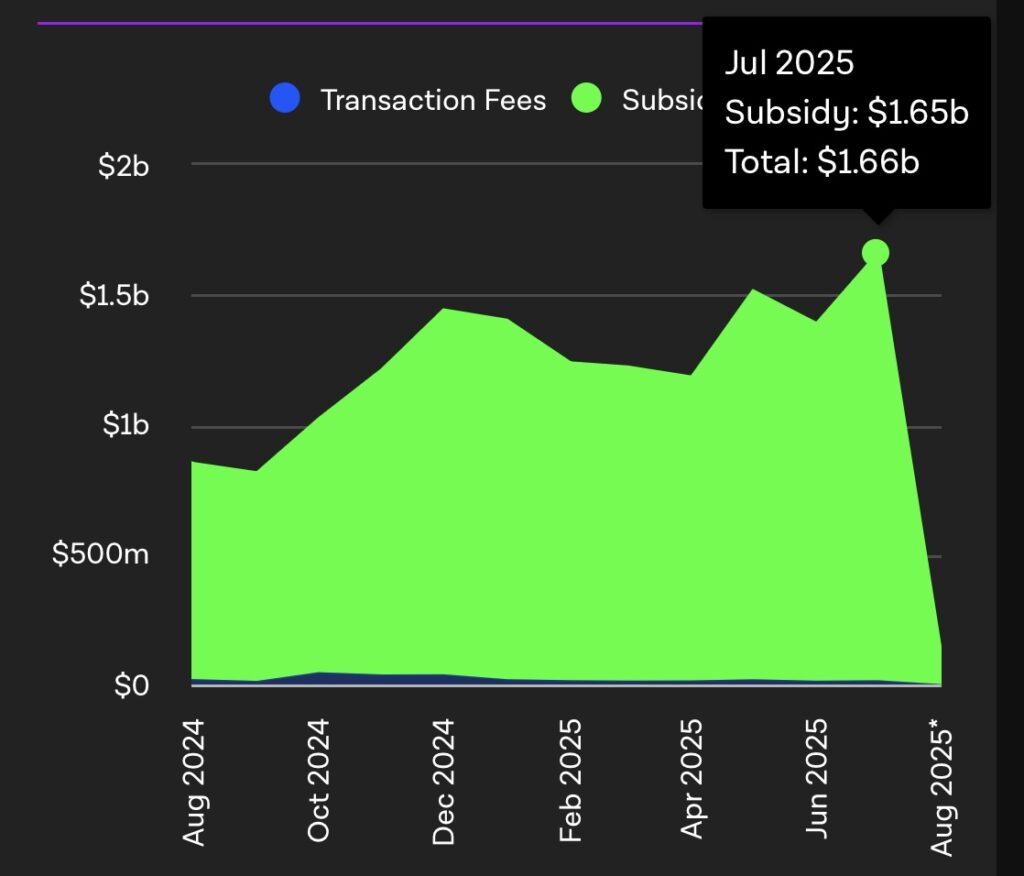

- Bitcoin miners’ revenues reached $1.66 billion in July, a record since the 2024 halving.

- Despite this rebound, profitability remains 43 to 50% lower than pre-halving levels.

- August will be decisive with an expected difficulty adjustment and geopolitical uncertainties in the background.

Bitcoin miners hit a historic record in July

In July 2025, bitcoin miners’ total revenue reached $1.66 billion, combining block rewards and transaction fees. This is the highest amount since the 2024 Bitcoin halving. The recovery comes amid rising difficulty and intense competition across the network.

The average daily income per exahash per second (EH/s) was $57,400, 4% higher than in June. However, these revenues remain 43% lower than those observed before the 2024 halving, when daily income was around $100,700 per EH/s. Gross margins remain 50% lower compared to levels before April 2024.

Mining under pressure: how players adapt to survive

To remain competitive, many Bitcoin miners have adjusted their operational model. This includes searching for low-energy-cost areas, automating operations, and pooling computational power in mining pools.

Profitability now depends on a trio of variables:

- BTC price;

- Difficulty level;

- Regulatory environment.

In addition to the $1.66 billion Bitcoin miners’ revenue in July, the average hashrate increased by 4% to 899 EH/s, while difficulty jumped 9% over the month, further pressuring less efficient miners.

Decisive August for Bitcoin mining: between hopes and uncertainties

A negative difficulty adjustment is expected early August, with a correction estimated around –3%. This readjustment is part of Bitcoin’s automatic mechanism, which balances difficulty based on the average observed computing power. This potential relief, combined with a BTC price stable around $113,000 at the end of July, could temporarily improve margins.

BTCUSD chart by TradingViewHowever, geopolitical uncertainty, energy volatility, and tax constraints in certain jurisdictions could quickly reshuffle the cards.

The resurgence of Bitcoin miners’ revenues in July hides a more nuanced reality: profitability remains under pressure. Between difficulty adjustment and macroeconomic uncertainties, August promises to be decisive. Is the current BTC mining model sustainable in the long term?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.