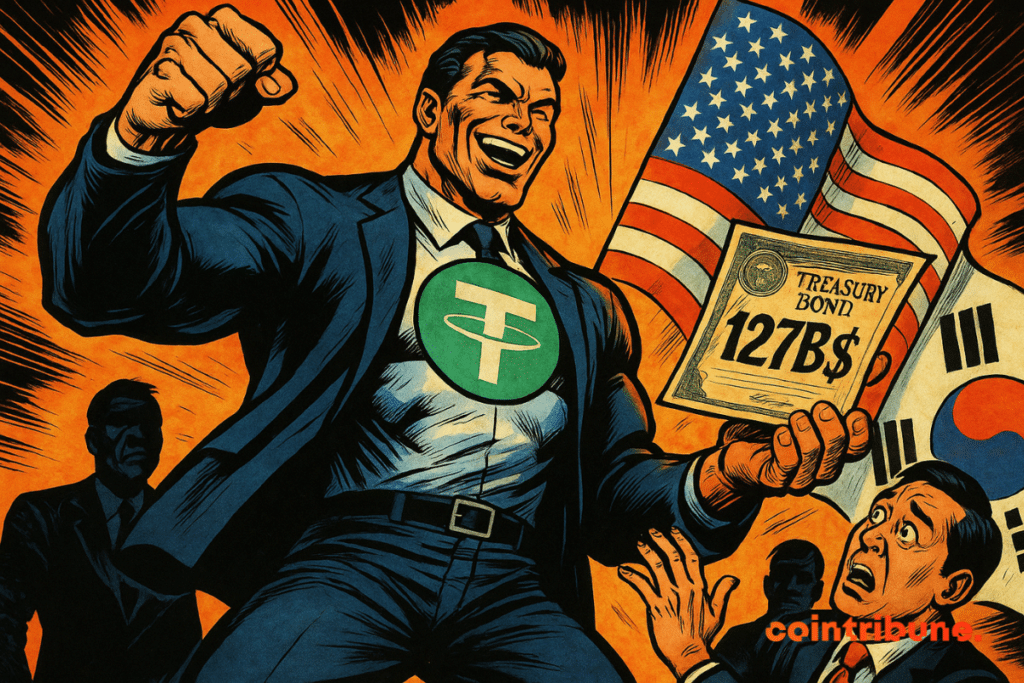

Tether Now Holds More U.S. Treasuries Than South Korea—$127B and Counting

Tether just flexed harder than most sovereign nations—its $127 billion U.S. Treasury stash now dwarfs South Korea’s holdings. Who needs a central bank when you’ve got a stablecoin printer?

The crypto shadow economy bites back

While regulators wring their hands over ‘unbacked’ stablecoins, Tether’s vaults overflow with more Treasuries than the GDP of Hungary. The irony? Traditional finance still calls crypto ‘niche.’

BlackRock’s worst nightmare

A single crypto company now commands enough clout to move bond markets—take that, Wall Street dinosaurs. Next stop: out-holding the Bank of England?

Funny how the ‘wild west’ of finance keeps building Fort Knox while banks play catch-up with blockchain ledgers. Maybe Jamie Dimon should try mining some Bitcoin between rate hikes.

In Brief

- Tether holds $127 billion in US Treasury bonds, ahead of South Korea.

- The USDT stablecoin explodes with $26 billion issued in 2025.

- Crypto becomes a key player in global finance.

A sovereign portfolio for a crypto company

In its attestation report for the second quarter of 2025, Tether positions itself to claim the top spot in the race to mining by unveiling an impressive progression: $127 billion in Treasury bonds, including $105.5 billion in direct exposure and $21.3 billion via indirect instruments. In three months, that is a net increase of $7 billion, confirming the group’s constant growth momentum.

Already in May, Tether had surpassed Germany, grabbing 19th place globally. Today, its holdings in US Treasury bonds reach $127 billion, allowing it to outperform South Korea and approach Saudi Arabia. More than an economic signal, it is a symbolic shock: an entity from crypto becomes a major player in US public debt, ahead of several sovereign states.

This is no accident. This strategy aims to lend credibility to USDT by backing it with solid, liquid, and universally recognized assets. Fully assumed.

USDT in full expansion, confidence rising

Tether’s surge in the bond market reflects the organic growth of its flagship stablecoin. Since January, USDT capitalization has risen from $137 billion to $163.6 billion, a 19% increase.

Twenty-six billion new tokens have been issued, proof of growing interest in stable digital payment methods. The boom is explained by monetary uncertainty, local devaluation, and the global need for a reliable digital dollar equivalent.

BTCUSDT chart by TradingViewPaolo Ardoino, CEO of Tether, does not hide his satisfaction. In the attestation report, he states that confidence in Tether keeps growing. And on X (formerly Twitter), he even added a touch of irony by sharing a viral meme with a simple comment: “I told you so.”

Tether enters the big leagues. With $127 billion in US Treasury bonds, the USDT issuer surpasses states like South Korea and confirms its role as a pillar between crypto and global finance. It is no longer just a crypto company; it is now a heavyweight with sovereign ambitions, whose influence exceeds that of some G20 member states G20.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.