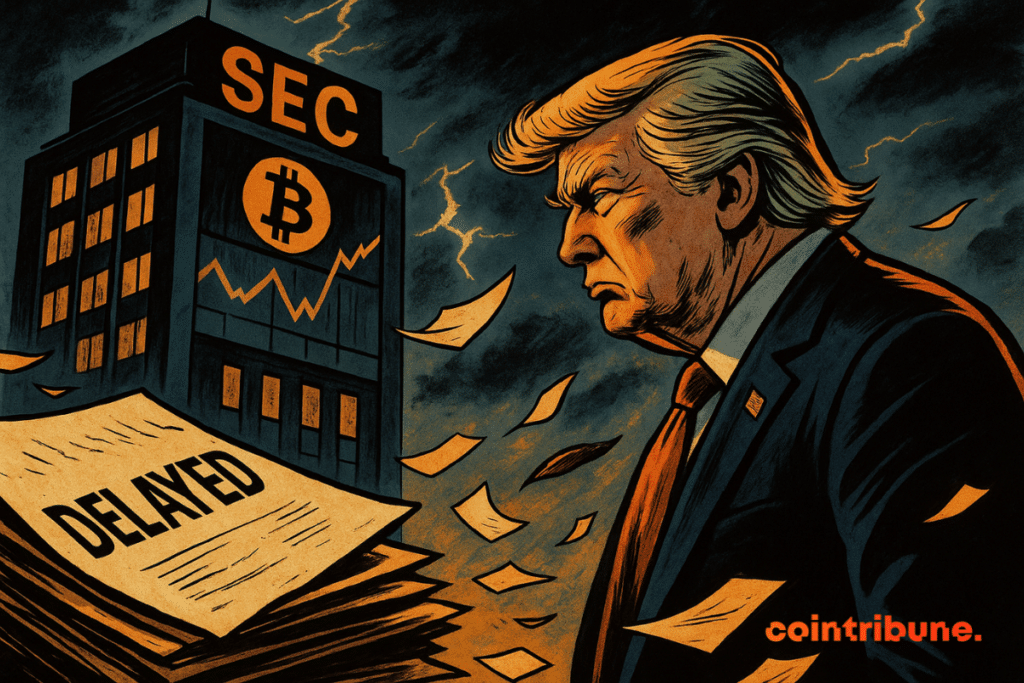

Breaking: SEC Drops Bombshell Decision on Trump Group’s Bitcoin ETF – Here’s What You Need to Know

The Securities and Exchange Commission just shook crypto markets with its long-awaited verdict on the Trump Organization's controversial Bitcoin ETF proposal.

Wall Street's favorite regulatory speed bump finally made its move—and the fallout could redefine institutional crypto adoption.

While details remain scarce, insiders suggest the decision reflects the SEC's trademark caution. Because nothing says 'investor protection' like delaying innovation until incumbent banks can copy the technology.

Market watchers are bracing for volatility as traders digest the implications. Will this finally be the green light crypto's been waiting for? Or just another case of 'regulation by procrastination'?

One thing's certain: in the high-stakes poker game between regulators and disruptors, we all just got dealt a wild card.

En bref

Trump, Bitcoin, and the Rules of the Game He Is Rewriting

At the beginning of June,through NYSE Arca. So far, a standard procedure. But when the fund’s initiator is a former president with still burning business interests, everything changes. On July 28,to review the proposal,.

The Commission writes:

Additional time will allow examination of the implications of the proposed change as well as the issues it raises.

This maneuver sparked waves. Several Democratic senators, including Elizabeth Warren, are alarmed. Jeff Merkley goes further: “Allowing Trump to create a bitcoin ETF is opening the door to abuse of power. He can influence the regulation and then profit from it.”

Behind the SEC’s delay, one question hangs: can it really review this project without political pressure?

Regulation on Pause, Ambitions in Turbo Mode

The SEC likes to take its time. Generally,. But with Paul Atkins at its helm, a former TRUMP associate, the tone has changed. Officially, Atkins requests clarifications on staking and redemption mechanisms. Unofficially, several analysts see a delayed green light.

The year 2025 is busy. The SEC is also delaying requests from Grayscale (Solana) and Canary (Litecoin). Yet, since the opening to Bitcoin ETFs in January 2024,.

Meanwhile, Trump continues his offensive. Truth Social has also filed requests for two other products: theand a mixed Bitcoin-Ethereum fund.

Commissioner Hester Peirce, nicknamed “Crypto Mom,” calls for patience:

We have to handle several disputes at the same time. Each crypto file demands particular attention.

While regulation hesitates, the former president is structuring his crypto empire with tokens, favorable laws, and filed dossiers.

Truth Social, the ETF, and the Disruptive Bitcoin Dynamic

This Trump-related Bitcoin ETF project arrives at the heart of. By linking a social platform and a speculative fund, Truth Social transforms its political visibility into a financial lever. And the numbers prove it.

The numbers that are dizzying

- The Truth Social ETF was filed on June 3, 2025, published in the official journal on June 20;

- The request targets a listing under the “Commodity-Based Trust Shares” framework of NYSE Arca;

- More than 50 new crypto ETF proposals are currently under SEC review;

- Since January 2024, U.S. crypto ETFs have generated $54.8 billion in inflows.

What shocks observers is the mixing of roles. For the first time, a crypto product directly linked to a sitting president is on the table. Especially since, likeand, reinforce suspicions of personal enrichment.

TRUMPUSDT chart by TradingViewSenator Warren points out that this is not just a financial product, it is a political and personal tool. This should worry any regulator.

Crypto here becomes a Trojan horse, masking a large-scale economic offensive.

Internet, crypto, derivatives: Trump has played, speculated, and doubled his fortune in one year. By taking advantage of the enthusiasm for digital assets, he secured billions and liquidity. While some debate, he cashes in. History seems to prove him right.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.