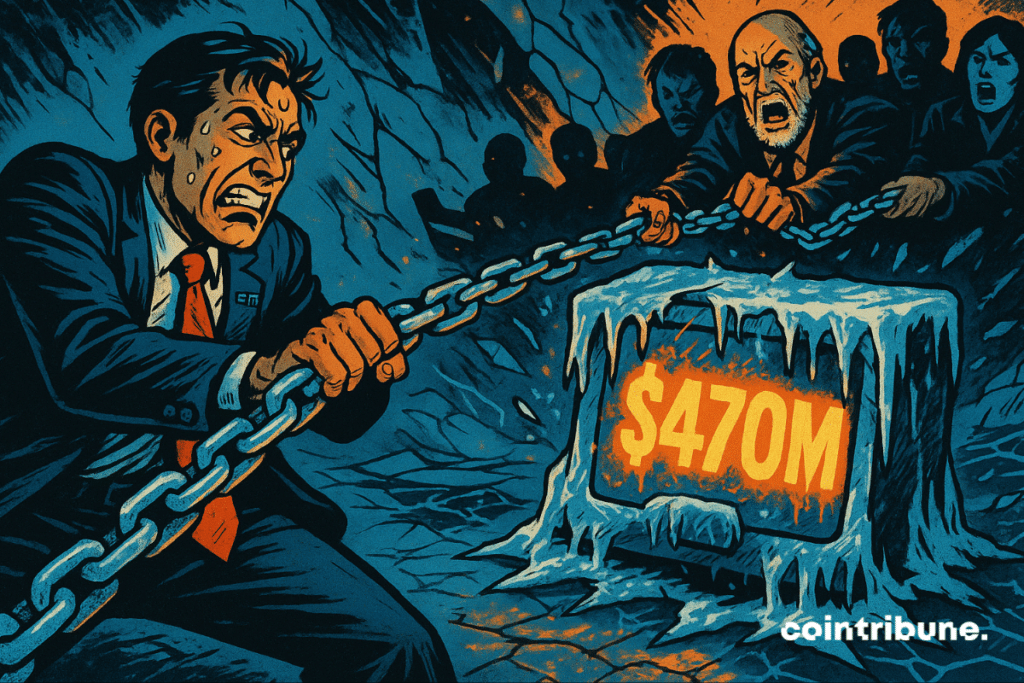

FTX in Hot Seat: Creditors Push Back Against $470M Freeze as Exchange Seeks Delay

FTX's legal drama escalates as creditors revolt against a proposed $470 million asset freeze—while the embattled exchange begs for more time. Who blinks first?

Behind the scenes: The crypto giant's 'restricted regions' maneuver sparks fury among those waiting to claw back funds. Classic case of 'your liquidity is their illiquidity.'

Meanwhile, the court docket grows thicker than a Bitcoin maximalist's scorn for altcoins. Will judges buy FTX's delay tactics? Place your bets—this circus accepts payments in SOL or jail time.

In Brief

- FTX seeks court delay to pause $470M creditor repayments amid 90+ objections.

- Repayment freeze targets creditors in restricted crypto jurisdictions like China, Russia, Egypt.

- Creditors express concern; some fear claims could drop to zero if delay approved.

FTX Cites Legal Risks in Bid to Pause Repayments

On Sunday, FTX submitted a “Motion for Leave,” requesting more time to address the objections. The delay WOULD give the estate a chance to prepare a thorough legal defense related to its request to suspend repayments to creditors in “restricted jurisdictions.” The estate argues that the volume and complexity of objections require careful and detailed responses.

The estate initially sought to pause payments to creditors in countries where cryptocurrency laws are ambiguous or particularly stringent. The estate cites potential legal repercussions as the main reason for the freeze.

Making payments to individuals in these countries could expose the estate’s directors and officers to significant risks, including fines, lawsuits, or even criminal prosecution. By suspending payments to these jurisdictions, the estate aims to shield its management from possible legal liability.

FTX Freezes Majority of Funds in China Amid Growing Creditor Concerns

The total amount involved in the freeze stands at around $470 million. China represents the vast majority of this sum, accounting for nearly $380 million, or roughly 82% of the total. Other countries included in the restricted list are Russia, Egypt, and Ukraine, among 49 nations flagged by the estate as high-risk for direct dollar payments.

Creditors have reacted with concern to the estate’s approach. One creditor, Zhetengji, shared that after carefully reviewing FTX’s comprehensive reply to objections, he has been working tirelessly to formulate his response and plans to consult with his lawyers.

Since this morning, I haven’t taken a single break after seeing FTX’s omnibus reply to our objections. I just finished reviewing everything and writing my response—still working on organizing it. I’ll send it to my lawyers once done, but they’re probably just waking up and may not have enough time to prepare. I hope if I can’t speak, they can speak for me.

Another creditor, known as Mr. Purple, cautioned that the situation may be more serious than many realize. He pointed out that if Judge Owens approves the estate’s motion, it could effectively cause many claims to lose all value. Mr. Purple also mentioned that selling claims might help some creditors avoid total losses but stressed this option is uncertain and not a guaranteed solution.

Repayments Underway, But Challenges Remain

FTX began distributing repayments in February 2025, more than two years after its collapse in late 2022. The amounts vary depending on the type and size of each claim. Smaller claims—that is, those under $50,000—are being paid at 120% of their approved value, offering a slight increase over what was owed.

Meanwhile, creditors with claims over $50,000 have received only 72.5% of their original claim value so far. The remaining 27.5% is expected to be paid out in the next distribution round, currently scheduled for the fourth quarter of 2025, between October and December.

However, FTX creditor activist Sunil noted that the repayment timeline could stretch further, possibly into 2026 or even 2027.

The estate is seeking a court-approved delay to give itself more time to strengthen its legal case and carefully respond to objections from international creditors. Without that extra time, the bankrupt exchange—responsible for billions in losses—may be forced to rethink its repayment plan or face fresh legal hurdles.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.