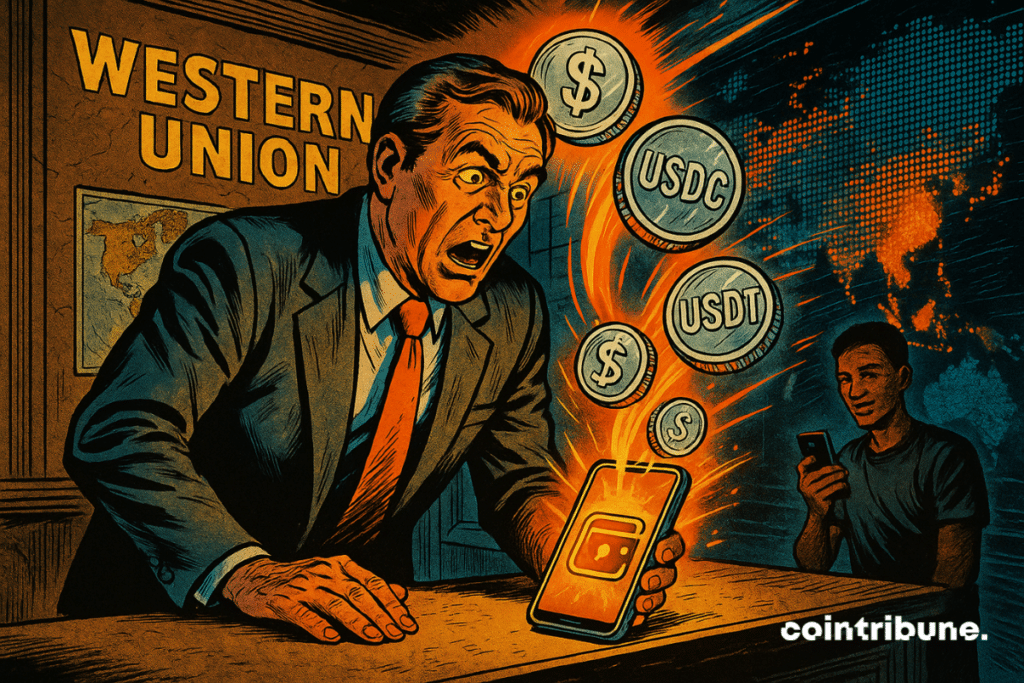

Western Union Embraces Stablecoins: The Future of Instant, Low-Cost Money Transfers?

Western Union—the 170-year-old money transfer giant—is finally dipping its toes into crypto waters. Their latest experiment? Stablecoins for cross-border payments.

Why now? Legacy systems are creaking. Transaction speeds lag behind blockchain alternatives. Fees stack up like stale paperwork in a bank vault. Stablecoins offer a tantalizing fix: near-instant settlements at a fraction of the cost.

The test could signal a seismic shift. If a regulated dinosaur like WU adopts stablecoins, will competitors follow—or get left in the dust? One thing's certain: the 'we've always done it this way' brigade just got served a wake-up call.

Bonus jab: Meanwhile, traditional banks are still charging $30 for 'express' transfers that take three business days—because nothing says 'innovation' like a fax machine and a wire fee.

In Brief

- Western Union adopts stablecoins to modernize its money transfers and attract users from the crypto market.

- The GENIUS law creates a favorable regulatory framework, prompting Western Union to accelerate its crypto strategy.

Western Union bets on crypto to modernize its transfers

Western Union CEO, Devin McGranahan, confirmed to Bloomberg: the company is actively exploring.

As explained during the interview, the company is working on on-ramp and off-ramp solutions which allow customers to buy and sell crypto-assets directly from their digital wallet.

This initiative targets three objectives:

- accelerate cross-border transfers;

- offer an alternative to the digital dollar in unstable economies;

- facilitate conversion between crypto and fiat currency.

This MOVE occurs in. Reference is made to the GENIUS Act, recently signed by Donald Trump. It imposes a clear framework for stablecoins, including annual audits for issuers exceeding 50 billion dollars in capitalization.

With 175 years of history, Western Union thus intends to avoid the uberization of its sector by decentralized blockchains. The company even plans to ally with specialized partners. The goal:, especially in countries where digital wallets are replacing banks.

The strategic bet of a giant facing the rise of stablecoins

The integration of stablecoins by Western Union is no accident. Indeed, these dollar-backed tokens are increasingly used due to their stability and speed. In areas where inflation is skyrocketing, they constitute.

Western Union therefore wants to capitalize on this trend by offering its users a credible crypto alternative. But that’s not all! With more than 70 million active customers, the firm could also become a major player in the stablecoin market.

By opening up to crypto, Western Union proves that even the dinosaurs of finance can evolve. A silent revolution, but one that could reshape the landscape of global payments!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.