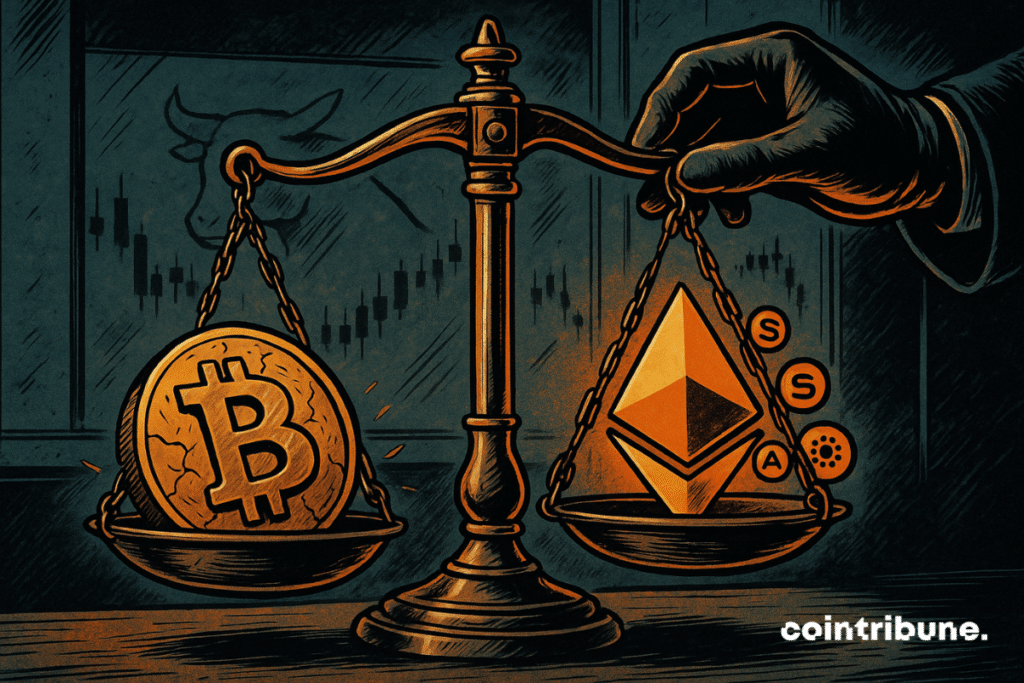

🚀 Altcoins Soar While Bitcoin Stumbles: The Next Crypto Bull Market Ignites?

Blood in the streets for BTC holders as altcoins stage a coup. Ethereum, Solana, and Cardano lead the charge—while Bitcoin maximalists cope with sub-50% dominance.

The Flippening Lite?

DeFi blue chips post double-digit gains as traders rotate out of 'digital gold' into higher-beta plays. Memecoins—because nothing says 'mature asset class' like dog-themed gambling tokens—outperform the S&P 500 for the seventh straight week.

Institutional Whiplash

Hedge funds that spent Q2 loading up on Bitcoin ETFs are now panic-bidding altcoin OTC deals. Meanwhile, crypto VCs quietly dump their locked-up tokens on retail through 'community airdrops' (read: regulated pump-and-dumps).

The cycle continues—just don't tell the SEC.

In Brief

- Bitcoin hits a new record, but its dominance index drops from 66% to 64.5% as altcoins outperform.

- Ethereum rallies 17% in a week, pushing the ETH/BTC ratio up by over 8%, boosting altseason momentum.

- Stablecoin reserves on exchanges surpass $31B, signaling traders are ready to deploy fresh capital into altcoins.

- Analysts predict a strong altseason as Bitcoin outflows rise and low/mid-cap coins show independent growth trends.

Altcoins Surge as Bitcoin Dominance Slips

The Bitcoin Dominance Index (BTC.D) has dropped from 66% to 64.5%, with 27 altcoins outpacing the first-born token in the past 90 days. Data from TradingView also shows that the altcoin market cap (TOTAL2) has bounced back by over 10% since the start of the month.

Commenting on this recent trend, Hyland noted that “Alts are ripping,” even with the relatively stable bitcoin dominance. The market analysts speculated that if the OG asset’s dominance were to decline from its current level to around 45%, the altcoin market could see even greater inflows.

Over time, the Bitcoin Dominance has been used as a benchmark to measure the altcoin season. A decline in dominance is generally interpreted as the beginning of an “altseason,” where the altcoin market percentage gains. However, the current divergence of altcoins from the BTC dominance could signal a fresh liquidity injection into the crypto market.

BTCUSDT chart by TradingViewEthereum Rally Fuels Altcoin Season Momentum

Ethereum, which is second only to BTC in market valuation, has rallied over 17% week-to-date. During this period, the ETH/BTC ratio, which is used to analyze Ether’s performance against Bitcoin, has climbed by 8.39%.

Analysts like Michael van de Poppe believe that the market is set to enter the “final easy and biggest bull ever on Altcoins.”

Trading Altcoins is difficult, that’s why the downwards corrections are extremely challenging and the upwards returns enormous.

Michael van de PoppeSantiment also aligned with this view, stating that the altcoin season has started based on their analysis. The crypto research platform added that as long as the OG coin stays above the $110,000 psychological support level, traders will likely shift gains into altcoins, further driving the sector.

Stablecoin Surge and Bitcoin Outflows Hint at Altseason

Another key trend underpinning this phenomenon is the high amount of exchange-held stablecoins. Often called “dry powder,” these assets are kept in reserve for the right market opening:

According to CryptoQuant analyst oinonen_t, there’s a clear pattern happening on Binance. Stablecoin reserves, such as USDT and USDC, remain high, with more than $31 billion in total value. On the flip side, BTC reserves on exchanges are declining.

Here’s what’s behind it:

- Many investors are moving their Bitcoin off exchanges into private wallets to keep it safe for the long term.

- At the same time, stablecoin reserves keep growing because traders hold these funds on exchanges as “dry powder” — capital waiting to be used.

- This shows that while investors are locking away their Bitcoin, they’re also keeping large amounts of stablecoins ready to deploy when the right market opportunity appears.

Crypto commentator under the pseudonym Master of Crypto maintained that altcoins can still chart upward courses with the BTC price falling. He explained that if the first-born asset’s price moves sideways as its influence wanes, it could set the perfect stage for an altseason, particularly for low- and mid-cap coins.

He also clarified that the strength of the altcoin season is contingent on the depth of the BTC.D decline from the EMA50 and EMA200 levels.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.